Understanding market cycles sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Dive into the intricate world of financial markets and discover the rhythm that drives the economy forward.

As we unravel the complexities of market cycles, you’ll gain insights that can shape your investment strategies and decision-making processes. Brace yourself for a journey that combines data-driven analysis with intuitive understanding, all in the context of dynamic market trends.

Introduction to Market Cycles

Market cycles are recurring patterns in financial markets that consist of phases of growth, peak, decline, and trough. Understanding these cycles is crucial for investors to make informed decisions and manage risk effectively.

Phases of a Market Cycle

- The Accumulation Phase: This is the period when smart money starts buying assets at low prices.

- The Markup Phase: Prices start to rise as more investors enter the market, driving up demand.

- The Distribution Phase: Smart money begins selling their assets to realize profits as prices peak.

- The Markdown Phase: Prices start declining as fear and panic set in, leading to a market downturn.

Factors Influencing Market Cycles

- Economic Indicators: Factors like GDP growth, inflation, and interest rates play a significant role in shaping market cycles.

- Market Sentiment: Investor emotions and perceptions can drive market cycles, leading to periods of irrational exuberance or fear.

- Government Policies: Fiscal and monetary policies implemented by governments can impact market cycles through regulation and stimulus measures.

- Global Events: Events like geopolitical tensions, natural disasters, or pandemics can disrupt market cycles and cause significant volatility.

Types of Market Cycles

Market cycles can be categorized into different types based on their duration and impact on the economy. Understanding these cycles is crucial for investors and analysts to make informed decisions.

Secular Market Cycles

Secular market cycles are long-term trends that can last for several years or even decades. These cycles are driven by structural changes in the economy, such as technological advancements, demographic shifts, or major policy changes. For example, the Great Depression of the 1930s marked a significant secular bear market cycle, while the period of economic expansion in the 1990s was a secular bull market cycle.

Primary Market Cycles

Primary market cycles are intermediate-term trends that typically last for a few months to a few years. These cycles are influenced by factors such as economic indicators, corporate earnings, and investor sentiment. Primary market cycles are often characterized by fluctuations in stock prices and trading volumes. For instance, the 2008 financial crisis led to a primary bear market cycle, followed by a primary bull market cycle during the economic recovery.

Secondary Market Cycles

Secondary market cycles are short-term fluctuations within primary cycles, lasting for weeks to several months. These cycles are often driven by market sentiment, news events, and trading patterns. Secondary market cycles can create opportunities for short-term traders to capitalize on price movements. An example of a secondary cycle is a market correction, where prices decline by 10% or more from recent highs before rebounding.

Overall, understanding the different types of market cycles and their characteristics can help investors navigate the financial markets and adjust their strategies accordingly.

Characteristics of Market Phases

In a market cycle, different phases exhibit unique characteristics that impact investor sentiment and behavior. Understanding these phases is crucial for making informed investment decisions.

1. Accumulation Phase

During this phase, smart money investors begin accumulating positions in undervalued assets. Market indicators such as increasing trading volumes and bullish reversal patterns may signal the start of this phase. Investor sentiment is generally pessimistic, but there is a sense of opportunity among savvy investors.

2. Markup Phase

The markup phase is characterized by a significant uptrend in prices as more investors jump on the bandwagon. Market indicators like moving averages crossing over and strong buying momentum confirm this phase. Investor sentiment shifts to optimism and excitement as prices steadily rise.

3. Distribution Phase

In the distribution phase, smart money investors start selling off their positions to less informed investors. This phase is marked by decreasing trading volumes and bearish reversal patterns. Investor sentiment turns cautious as prices reach unsustainable levels, leading to a potential market correction.

4. Markdown Phase

The markdown phase sees a sharp decline in prices as panic selling ensues. Market indicators such as strong downtrends and high volatility indicate this phase. Investor sentiment is fear-driven, with many investors liquidating their positions to avoid further losses.

5. Recovery Phase

After a market correction, the recovery phase begins with prices stabilizing and showing signs of an uptrend. Market indicators like bullish reversal patterns and increasing trading volumes signal the start of this phase. Investor sentiment slowly transitions from fear to cautious optimism as confidence in the market begins to return.

Economic Indicators and Market Cycles

The relationship between economic indicators and market cycles is crucial in understanding the overall health and direction of the economy. Economic indicators provide valuable insights into the current state of the economy, which in turn impacts market cycles.

Impact of Leading, Lagging, and Coincident Indicators

Leading indicators are signals that change before the economy as a whole changes. They can be used to predict potential changes in market cycles. Lagging indicators, on the other hand, change after the economy as a whole does. Coincident indicators move in conjunction with the economy, reflecting its current state.

- Leading Indicators: Leading indicators like consumer confidence, building permits, and stock market performance can help investors anticipate shifts in market cycles.

- Lagging Indicators: Lagging indicators such as unemployment rates and corporate profits provide confirmation of trends that have already occurred in the market cycles.

- Coincident Indicators: Coincident indicators like GDP growth, retail sales, and industrial production give a real-time snapshot of the current economic conditions.

Understanding how these different types of indicators interact can provide a more comprehensive analysis of market cycles.

Impact of Employment, Inflation, and GDP

Employment levels, inflation rates, and GDP are key economic indicators that significantly influence market cycles.

- Employment: High employment rates often indicate a healthy economy with increased consumer spending, positively impacting market cycles. Conversely, rising unemployment can signal economic downturns.

- Inflation: Inflation levels can impact market cycles by affecting consumer purchasing power and business costs. High inflation rates may lead to interest rate hikes, impacting market performance.

- GDP: GDP growth is a critical indicator of economic performance and can influence market cycles. Strong GDP growth typically correlates with bull markets, while declining GDP growth may signal a bearish market.

Investment Strategies for Different Market Cycles

Investment strategies need to be adjusted based on the phase of the market cycle to maximize returns and minimize risk. Here, we will discuss tailored approaches for bull, bear, and sideways markets, emphasizing the importance of diversification and risk management.

Bull Markets

In a bull market, where prices are rising, investors can capitalize on the positive momentum by adopting the following strategies:

- Focus on growth stocks and sectors expected to perform well in a growing economy.

- Utilize a buy-and-hold strategy to benefit from the upward trend over the long term.

- Consider leveraging your investments to amplify gains, but be cautious of increased risk.

Bear Markets

During a bear market, characterized by declining prices and negative sentiment, investors should consider the following strategies:

- Shift towards defensive stocks, such as utilities and consumer staples, which tend to be more resilient during economic downturns.

- Implement a hedging strategy, like buying put options, to protect your portfolio from further losses.

- Focus on income-generating assets, like bonds or dividend-paying stocks, to provide stability during turbulent times.

Sideways Markets

In sideways markets, where prices are range-bound with little overall movement, investors can explore the following strategies:

- Engage in swing trading to capitalize on short-term price fluctuations within the established range.

- Consider alternative investments, such as real estate or commodities, to diversify your portfolio and potentially generate returns independent of the stock market.

- Stay nimble and be prepared to adjust your strategy quickly as market conditions evolve.

Diversification and Risk Management

Regardless of the market cycle, diversification across asset classes, sectors, and geographic regions is crucial to mitigate risk and protect your investments. Risk management techniques, such as setting stop-loss orders and maintaining a balanced portfolio, can help limit potential losses and preserve capital during volatile market conditions.

Market Cycle Timing and Forecasting

Market cycle timing and forecasting are crucial aspects of investment strategies. Being able to predict market cycles can help investors make informed decisions and capitalize on opportunities for maximum profit. However, it is important to understand the methods used for timing market cycles and the challenges associated with forecasting accurately.

Methods for Timing Market Cycles

- Technical Analysis: This method involves analyzing historical price movements and volume data to identify patterns and trends that can help predict future market cycles.

- Sentiment Analysis: Monitoring market sentiment through surveys, social media, and news can provide insights into investor behavior and potential shifts in market cycles.

- Economic Indicators: Keeping track of key economic indicators such as GDP growth, inflation rates, and unemployment levels can help forecast market cycles based on the overall health of the economy.

Challenges and Limitations of Predicting Market Cycles

- Market Volatility: Sudden changes in market conditions can make it difficult to accurately predict market cycles, as external factors can influence investor behavior unpredictably.

- Black Swan Events: Unforeseen events like natural disasters or geopolitical crises can disrupt market cycles and render forecasting models ineffective.

- Data Accuracy: Inaccurate or incomplete data can lead to faulty predictions, highlighting the importance of reliable data sources and analysis.

Examples of Forecasting Success and Failure

Successful: In 2007, some analysts accurately predicted the housing market crash by analyzing subprime mortgage data and identifying unsustainable trends.

Unsuccessful: Many forecasters failed to predict the 2020 market crash caused by the COVID-19 pandemic due to the unprecedented nature of the crisis.

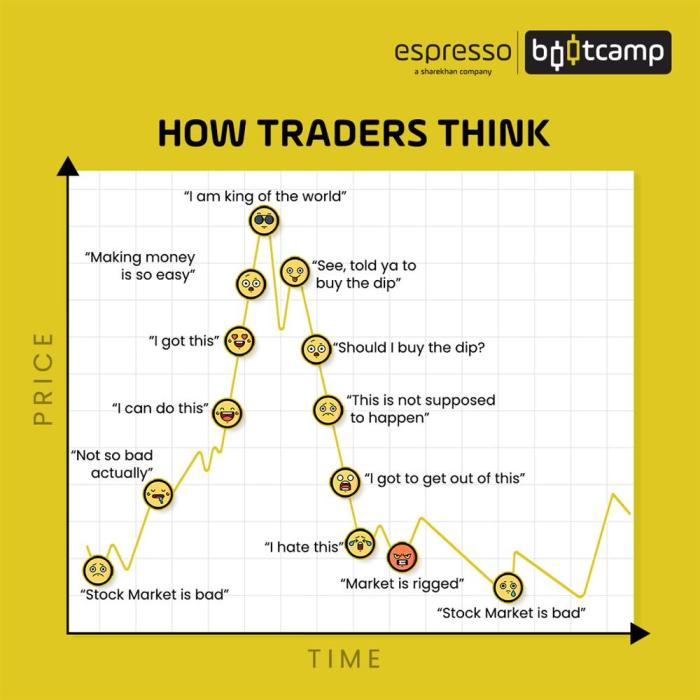

Behavioral Finance and Market Cycles

Behavioral finance plays a crucial role in influencing market cycles as it focuses on how psychological factors can impact financial decision-making. Understanding the impact of cognitive biases, herd behavior, and sentiment is essential in navigating different market phases.

Role of Cognitive Biases

- Cognitive biases, such as confirmation bias and loss aversion, can lead investors to make irrational decisions during market cycles.

- Investors may tend to seek information that confirms their existing beliefs, leading to a biased view of the market situation.

- Loss aversion can cause investors to hold onto losing positions for too long or sell winning positions prematurely, impacting their overall portfolio performance.

Herd Behavior and Sentiment

- Herd behavior refers to individuals following the actions of a larger group without necessarily analyzing the situation independently.

- During market cycles, herd behavior can lead to exaggerated price movements as investors rush to buy or sell based on the actions of others.

- Sentiment, or the overall feeling of market participants towards a particular asset or market, can also influence market cycles by creating trends based on emotions rather than fundamental analysis.

Real-world Applications of Understanding Market Cycles

Understanding market cycles can have significant real-world applications, especially when it comes to making successful investment decisions and optimizing strategies for companies and investors. Let’s explore some examples and insights into how this knowledge can be applied effectively.

Case Study: Market Cycle Analysis in Tech Stocks

In the tech industry, understanding market cycles is crucial for making informed investment decisions. For example, during the dot-com bubble in the late 1990s, investors who recognized the market cycle’s peak were able to sell their tech stocks before the crash, avoiding significant losses. On the other hand, those who understood the subsequent recovery phase were able to buy tech stocks at lower prices and benefit from the eventual upswing.

Optimizing Strategies with Market Cycle Analysis

Companies and investors can use market cycle analysis to adjust their strategies based on the current phase of the cycle. For instance, during an expansion phase, businesses may focus on growth and expansion, while during a contraction phase, they may prioritize cost-cutting and efficiency measures. By aligning their strategies with the market cycle, companies can better navigate the ups and downs of the market and position themselves for success.

Impact of Technological Advancements on Market Cycle Analysis

Technological advancements have revolutionized the study and application of market cycles. With the advent of big data analytics and machine learning algorithms, analysts can now analyze vast amounts of market data to identify patterns and trends more effectively. This allows for more accurate market cycle timing and forecasting, enabling companies and investors to make data-driven decisions with greater precision.