Hey there future investors, ready to dive into the world of stocks? In this guide, we’ll break down everything you need to know about buying stocks, from understanding the market to choosing the right brokerage account. Let’s get started!

So, you wanna make some money in the stock market? Well, buckle up because we’re about to drop some knowledge bombs on how to make those stocks work for you.

Understanding the Stock Market

Investing in the stock market can be a great way to grow your money over time, but it’s important to understand the basics before diving in. Stocks represent ownership in a company, and when you buy shares of stock, you essentially own a piece of that company.

Difference between Common and Preferred Stocks

- Common Stocks: Common stocks are the most typical type of stock that investors buy. They give shareholders voting rights and the opportunity to receive dividends.

- Preferred Stocks: Preferred stocks typically do not come with voting rights, but they do have a higher claim on assets and earnings. Shareholders of preferred stocks are usually guaranteed a fixed dividend payment.

Key Stock Market Terminologies

- Dividends: Dividends are a portion of a company’s profits that are distributed to shareholders. They can be paid out in cash or additional shares of stock.

- Market Cap: Market capitalization is the total value of a company’s outstanding shares of stock. It is calculated by multiplying the stock price by the number of shares outstanding.

- P/E Ratio: The price-to-earnings ratio is a measure of a company’s valuation. It is calculated by dividing the current price per share by the earnings per share.

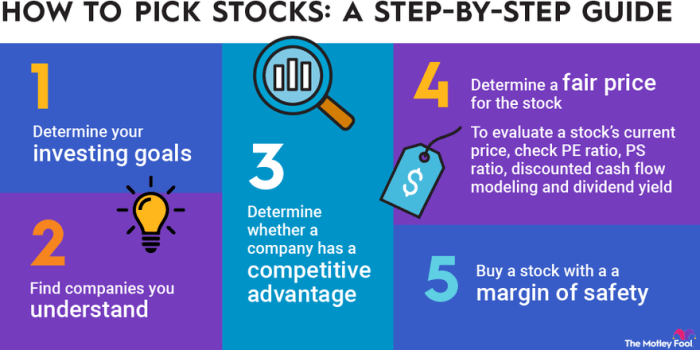

Researching Stocks

Before investing in stocks, it’s crucial to conduct thorough research and analysis to make informed decisions. This involves looking into the company’s financial health, performance, and future prospects.

Reading Financial Statements and Annual Reports

- Financial statements provide valuable insights into a company’s revenue, expenses, assets, and liabilities. Analyzing these can help determine the company’s profitability and financial stability.

- Annual reports offer a comprehensive overview of the company’s operations, goals, and strategies. They also include management discussions and analysis, giving investors a deeper understanding of the company’s performance.

- Pay attention to key financial ratios like P/E ratio, debt to equity ratio, and return on equity to assess the company’s financial health and profitability.

Using Stock Screeners

- Stock screeners are powerful tools that allow investors to filter stocks based on specific criteria such as market cap, industry, and financial ratios.

- By using stock screeners, investors can identify potential investment opportunities that match their investment goals and risk tolerance.

- Consider factors like earnings growth, dividend yield, and price trends when using stock screeners to narrow down your investment choices.

Diversification and Risk Management

Diversification and risk management are crucial aspects of successful stock investing. Diversification involves spreading your investments across different assets to reduce the overall risk of your portfolio. By not putting all your eggs in one basket, you can minimize the impact of a single investment’s poor performance on your entire portfolio.

Importance of Diversification

- Diversification helps to protect your investments from the volatility of specific industries or sectors.

- It allows you to capture the growth potential of different sectors, balancing out potential losses.

- By diversifying, you can reduce the overall risk of your portfolio without sacrificing potential returns.

Strategies for Managing Risk

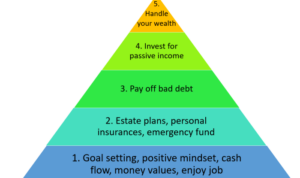

- Set clear investment goals and risk tolerance levels before building your portfolio.

- Regularly review and rebalance your portfolio to ensure it aligns with your goals and risk tolerance.

- Consider investing in index funds or exchange-traded funds (ETFs) to gain exposure to a broad range of assets.

- Use stop-loss orders to limit potential losses on individual investments.

Diversifying Across Different Industries

Diversifying across different industries can protect your portfolio from sector-specific risks. For example, if you heavily invest in the technology sector and it experiences a downturn, having investments in healthcare or consumer goods can help offset those losses. By spreading your investments across various industries, you reduce the impact of any single sector’s performance on your overall portfolio.

Setting Investment Goals and Strategies

Setting realistic financial goals when buying stocks is crucial for a successful investment journey. It’s important to consider factors such as your risk tolerance, time horizon, and overall financial objectives. By having clear goals in mind, you can make informed decisions and stay focused on your investment strategy.

Different Investment Strategies

- Value Investing: This strategy involves identifying undervalued stocks that have the potential to increase in value over time. Investors using this approach focus on buying stocks at a discount to their intrinsic value.

- Growth Investing: Growth investors look for companies with strong potential for future growth. They typically invest in stocks of companies that are expected to outperform the market in terms of revenue and earnings growth.

- Dividend Investing: Dividend investors prioritize stocks that pay regular dividends. These investors seek to generate a steady stream of income from their investments in addition to potential capital appreciation.

Having a long-term investment approach is key to achieving your financial goals. By focusing on the long term, you can ride out market fluctuations and benefit from the power of compounding. It also allows you to take advantage of the growth potential of your investments over an extended period.

Brokerage Accounts and Platforms

When it comes to buying stocks, having the right brokerage account and platform is crucial. Your choice can impact your investment experience and success. Let’s dive into some key points to consider when selecting a brokerage account.

Comparing Brokerage Account Options

- Take a look at the different brokerage options available and compare their features, fees, and customer service.

- Consider whether you want a traditional full-service brokerage or a more cost-effective online platform.

- Look into the reputation and track record of each brokerage to ensure they are reliable and trustworthy.

Choosing a Reliable and Cost-Effective Platform

- Research and compare the fees and commissions charged by each platform to find one that aligns with your budget and trading frequency.

- Check for any account minimums required to open an account and maintain it, as these can vary between different platforms.

- Read reviews and seek recommendations from other investors to gauge the platform’s performance and customer satisfaction.

Understanding Fees, Commissions, and Account Minimums

- Be aware of any trading fees, account maintenance fees, and other charges that may apply when using a brokerage platform.

- Understand how commissions are structured and how they can impact your overall returns on investments.

- Take note of account minimums, as failing to meet these requirements could result in additional fees or penalties.

Timing the Market and Dollar-Cost Averaging

When it comes to investing in the stock market, timing can be a tricky game. Many investors try to predict when the market will go up or down to maximize their returns. However, this strategy comes with a high level of risk. Market timing relies heavily on luck and speculation, making it difficult to consistently predict market movements. Investors who try to time the market may end up missing out on potential gains or selling at a loss if their predictions are incorrect.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy where investors regularly buy a fixed dollar amount of a particular investment, regardless of the share price. This approach helps to reduce the impact of market volatility on investment returns. When prices are high, investors buy fewer shares, and when prices are low, they buy more shares. Over time, this can result in a lower average cost per share and a more stable investment portfolio.

- By consistently investing a fixed amount over time, investors can benefit from market fluctuations without trying to time the market.

- Dollar-cost averaging can help reduce the emotional aspect of investing, as it takes the focus away from short-term market movements.

- It allows investors to build a diversified portfolio gradually and benefit from compounding returns over time.

Monitoring and Rebalancing Portfolio

Monitoring and rebalancing your investment portfolio is crucial to ensure that your assets are aligned with your financial goals and risk tolerance. By regularly checking on your stock investments, you can make informed decisions to optimize your portfolio performance.

The Importance of Monitoring

- Regular monitoring allows you to track the performance of your stocks and assess whether they are meeting your expectations.

- Monitoring helps you identify any potential red flags or changes in market conditions that may require adjustments to your investment strategy.

- By staying informed and vigilant, you can take timely actions to capitalize on opportunities or mitigate risks in your portfolio.

Rebalancing Your Portfolio

- Rebalancing involves adjusting the allocation of assets in your portfolio to maintain the desired mix of investments.

- When certain stocks outperform or underperform, rebalancing helps you realign your portfolio to ensure diversification and risk management.

- Set a schedule for rebalancing, such as quarterly or annually, to stay disciplined and avoid emotional decision-making based on short-term market fluctuations.

Selling or Holding Stocks

- Consider selling stocks that no longer fit your investment strategy or have reached your target price to realize gains.

- Hold onto stocks that still have growth potential or align with your long-term financial goals, even during market volatility.

- Use fundamental and technical analysis to evaluate whether to sell or hold onto stocks based on their performance and market conditions.