Diving into the world of Retirement age statistics, get ready to explore the fascinating trends and insights that shape our understanding of retirement age across the globe. From gender disparities to the impact on social security systems, this topic is a goldmine of information waiting to be uncovered.

Overview of Retirement Age Statistics

Retirement age statistics provide valuable insights into the trends and patterns of when individuals are choosing to retire. By understanding these statistics, we can better prepare for the future and make informed decisions regarding retirement planning.

It is essential to grasp the retirement age trends as they can impact various aspects of society, such as workforce participation, social security programs, and overall economic stability. By analyzing these statistics, policymakers, employers, and individuals can anticipate changes and adapt accordingly.

Sources of Retirement Age Data

- The Social Security Administration: The SSA provides data on the average retirement age in the United States, offering valuable insights into when individuals are choosing to claim their benefits.

- Bureau of Labor Statistics: The BLS offers information on labor force participation rates among older workers, shedding light on trends in retirement age and employment patterns.

- Research Studies: Various research studies and surveys conducted by academic institutions and organizations also contribute to the pool of retirement age data, providing a comprehensive view of the landscape.

Global Retirement Age Trends

In recent years, there has been a noticeable shift in retirement age trends across different countries. Let’s take a closer look at the variations in retirement age, comparing developed and developing nations, as well as any recent changes in retirement age policies globally.

Variations in Retirement Age Across Different Countries

- Japan has one of the highest retirement ages at 65, while countries like France and Germany have retirement ages as low as 62.

- In the United States, the full retirement age for Social Security benefits is gradually increasing to 67 for those born in 1960 or later.

- Some countries have different retirement ages for men and women, with women often being allowed to retire earlier.

Comparison Between Developed and Developing Nations

- Developed nations tend to have higher retirement ages due to longer life expectancies and the need to sustain social security systems.

- Developing nations often have lower retirement ages, reflecting different economic and social structures.

- There is a growing trend towards increasing retirement ages globally to address the challenges of an aging population and increasing life expectancies.

Recent Changes in Retirement Age Policies Globally

- Countries like the United Kingdom and Australia have been gradually increasing their retirement ages to account for demographic changes.

- Some countries are exploring flexible retirement options, allowing individuals to work beyond the traditional retirement age if they choose to do so.

- The COVID-19 pandemic has also prompted some countries to reevaluate their retirement age policies in light of economic challenges and shifting workforce dynamics.

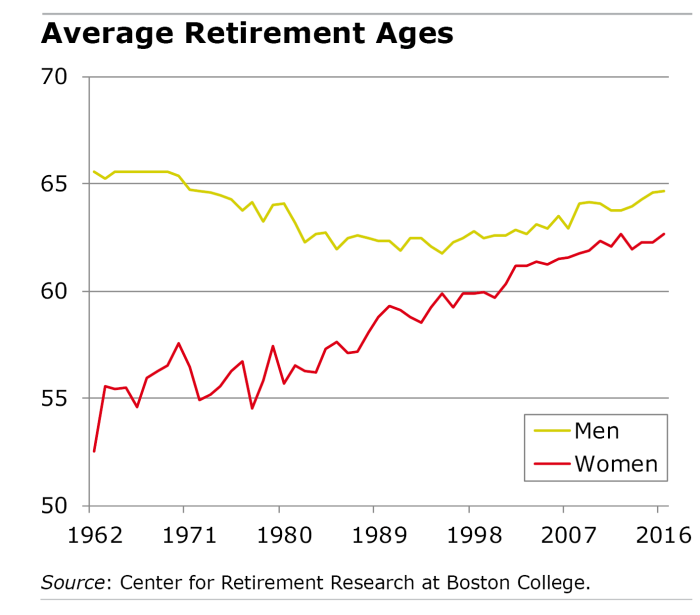

Gender Disparities in Retirement Age

Gender disparities in retirement age are a common issue that affects many individuals around the world. While retirement age is often determined by factors such as government policies and individual choices, there are noticeable differences between genders in terms of when they retire.

One of the main factors contributing to gender disparities in retirement age is the gender pay gap. Women, on average, earn less than men for the same work, which can result in lower retirement savings. As a result, women may need to work longer before being able to afford retirement compared to men.

Another factor is the impact of caregiving responsibilities. Women are more likely to take on caregiving roles for children, elderly parents, or other family members. This can lead to interruptions in their careers, making it harder to save for retirement and ultimately influencing the age at which they can retire.

To address these gender inequalities in retirement age, there have been initiatives aimed at promoting equal pay for equal work. Additionally, some countries have implemented policies to support caregivers, such as paid family leave and flexible work arrangements. By addressing these underlying factors, it is hoped that gender disparities in retirement age can be minimized.

Government Policies

- Government policies promoting equal pay for equal work can help reduce the gender pay gap and enable women to save more for retirement.

- Implementing caregiver support programs, such as paid family leave and flexible work arrangements, can help women balance work and caregiving responsibilities.

Financial Literacy Programs

- Providing financial literacy programs targeted at women can help improve their understanding of retirement planning and savings strategies.

- Offering retirement planning resources and tools that are accessible and tailored to women’s needs can empower them to make informed decisions about their retirement age.

Retirement Age Statistics by Occupation

When it comes to retirement age, different professions have varying trends that dictate when individuals typically retire. Let’s explore how retirement age varies based on occupation and the reasons behind these variations.

Healthcare Professionals

In the healthcare industry, professions such as doctors and nurses tend to have higher retirement ages compared to other occupations. The demanding nature of the job and the need for specialized skills often lead healthcare professionals to work longer before retiring.

Construction Workers

On the other hand, occupations like construction workers often have lower retirement ages due to the physical demands of the job. The strenuous nature of the work can take a toll on the body, prompting individuals in these professions to retire earlier.

Corporate Executives

Corporate executives and professionals in managerial roles may have higher retirement ages compared to other white-collar occupations. The competitive and fast-paced nature of the corporate world can drive individuals to work longer before retiring to secure their financial future.

Artists and Creatives

Professions in the arts and creative industries may see a mix of retirement ages, with some individuals retiring earlier while others continue working well into their later years. The passion-driven nature of these occupations often influences the decision to retire.

Impact of Retirement Age on Social Security Systems

Retirement age statistics play a crucial role in shaping social security programs around the world. As retirement age trends shift, it directly impacts the financial sustainability and effectiveness of social security systems. Let’s delve deeper into how retirement age statistics affect social security programs and their implications.

Financial Implications of Changing Retirement Age Requirements

Changing retirement age requirements can have significant financial implications on social security systems. When the retirement age is increased, it means that individuals will contribute to the system for a longer period before becoming eligible for benefits. This can help balance the system by increasing the pool of contributors and reducing the strain on resources. However, it may also lead to concerns about older workers being unable to find employment and the potential need for higher benefit payouts as people live longer.

Sustainability of Social Security Systems in Relation to Retirement Age Trends

The sustainability of social security systems is closely tied to retirement age trends. As the retirement age increases, it can help mitigate the challenges posed by an aging population and longer life expectancies. By adjusting retirement age requirements to reflect demographic shifts, social security systems can better adapt to changing economic conditions and ensure long-term viability. However, striking a balance between maintaining financial stability and meeting the needs of retirees remains a key challenge for policymakers.