With Managing expenses effectively at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

When it comes to handling your finances like a boss, managing expenses effectively is key. From budgeting like a pro to cutting costs like a savvy shopper, this topic is all about helping you navigate the money game with style and smarts.

Importance of Managing Expenses Effectively

Effective management of expenses is crucial for both individuals and businesses to ensure financial stability and success. By keeping track of where money is being spent and making informed decisions about expenditures, one can avoid falling into debt and ensure a healthy financial future.

Improper expense management can lead to various financial difficulties. For individuals, overspending on unnecessary items or failing to budget properly can result in mounting credit card debt, late bill payments, and ultimately, a lower credit score. Businesses that do not monitor expenses closely may face cash flow problems, inability to invest in growth opportunities, and even bankruptcy.

On the other hand, effectively managing expenses offers several benefits. It allows individuals to increase their savings, build an emergency fund, and achieve financial goals such as buying a home or retiring comfortably. For businesses, proper expense management can lead to higher profits, better financial health, and the ability to invest in new projects or expand operations.

Strategies for Effective Expense Management

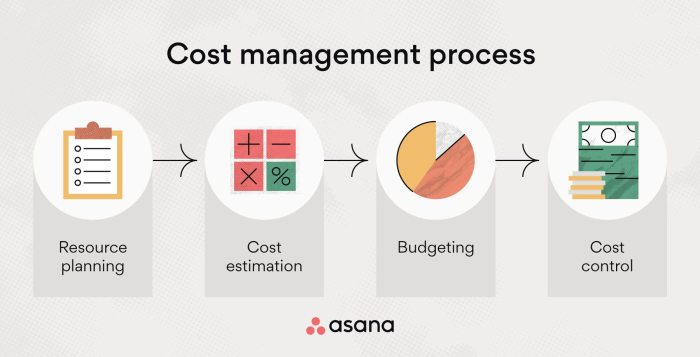

Effective expense management involves various strategies to track spending, budget effectively, and set financial goals to achieve financial stability.

Tracking Expenses

- Utilize budgeting apps or software to monitor and categorize expenses in real-time.

- Create and maintain a detailed spreadsheet to track daily expenses and identify spending patterns.

Budgeting

Budgeting plays a crucial role in managing expenses effectively by setting limits on spending in different categories. It helps individuals prioritize their needs, control impulse purchases, and allocate funds towards savings and investments.

Setting Financial Goals

- Establish short-term and long-term financial goals, such as saving for a vacation, buying a house, or retiring comfortably.

- Break down these goals into actionable steps and allocate a portion of income towards achieving them each month.

- Regularly review and adjust financial goals based on changing circumstances or priorities.

Cutting Costs and Saving Money

In order to effectively manage expenses, it is crucial to find ways to cut costs and save money in daily life. By reducing unnecessary expenses and creating a contingency fund for unexpected situations, individuals can secure their financial well-being and work towards achieving their long-term financial goals.

Reducing Unnecessary Expenses

- Avoid impulse purchases by creating a shopping list and sticking to it while grocery shopping.

- Cancel unused subscriptions or memberships to save money each month.

- Opt for DIY solutions instead of hiring professionals for tasks you can do yourself.

Creating a Contingency Fund

- Set aside a portion of your income each month into a separate savings account for emergency expenses.

- Consider opening a high-yield savings account to maximize the growth of your contingency fund.

- Regularly review and adjust your emergency savings goals based on changes in your financial situation.

Strategies for Saving Money

- Automate your savings by setting up automatic transfers from your checking account to your savings account.

- Invest in long-term assets such as stocks, bonds, or real estate to grow your wealth over time.

- Take advantage of employer-sponsored retirement accounts like 401(k) plans to save for your future.

Monitoring and Analyzing Expenses

Monitoring expenses regularly is crucial to identify spending patterns and trends that can help in making informed financial decisions.

Importance of Analyzing Expenses

Analyzing expenses is essential as it allows individuals and businesses to gain insights into their financial health and identify areas where cost-saving measures can be implemented.

- It helps in tracking where the money is being spent and if there are any unnecessary expenses that can be eliminated.

- By analyzing expenses, one can prioritize spending on essential items and cut back on non-essential purchases.

- Understanding spending patterns can also help in setting realistic budgets and financial goals.

Tools and Techniques for Effective Expense Analysis

There are various tools and techniques available that can aid in analyzing expenses effectively:

- Expense Tracking Apps: Utilizing apps like Mint, YNAB, or PocketGuard can help in automatically categorizing expenses and providing detailed reports.

- Spreadsheets: Creating a detailed spreadsheet to track expenses manually can also be effective in analyzing spending habits and patterns.

- Comparative Analysis: Comparing expenses over different time periods or against industry benchmarks can provide valuable insights for cost-saving opportunities.