Diving into the world of loan amortization schedule, you’re about to embark on a journey that demystifies this financial concept in a way that’s both enlightening and engaging. Get ready to unravel the intricacies of loan repayments and discover how it impacts your financial future.

Exploring the depths of loan payments and balance changes, this guide will equip you with the knowledge needed to navigate the complex terrain of loan structures.

Loan Amortization Schedule Overview

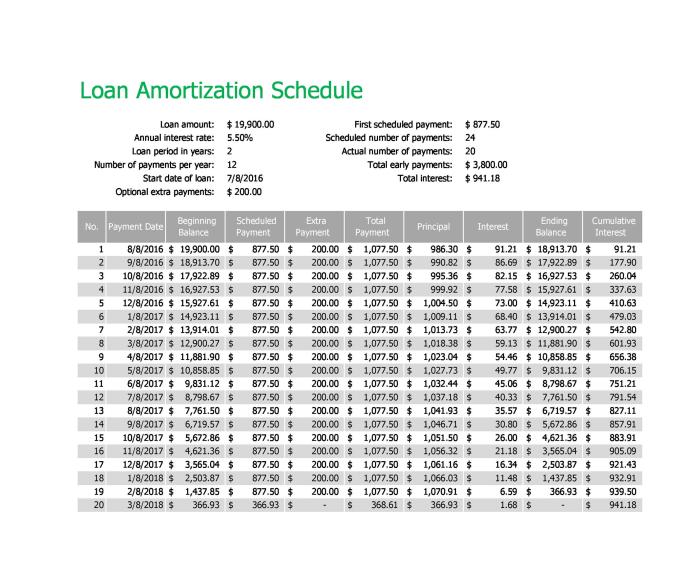

An amortization schedule is a table that shows the breakdown of periodic loan payments, detailing the amount allocated to interest and principal over time. It helps borrowers understand how their payments are distributed and how much they owe at any given point during the loan term.

Purpose of a Loan Amortization Schedule

- Helps borrowers visualize their repayment plan and track progress

- Illustrates the impact of different interest rates and loan terms

- Aids in financial planning by showing total interest paid over the loan term

Components of a Loan Amortization Schedule

The key components of a loan amortization schedule include:

- Loan Amount: Initial amount borrowed

- Interest Rate: Annual percentage charged on the loan balance

- Loan Term: Total duration over which the loan will be repaid

- Payment Amount: Regular installment comprising interest and principal

- Principal Paid: Portion of each payment used to reduce the loan balance

- Interest Paid: Amount of each payment allocated to interest charges

Calculating Loan Payments

To calculate loan payments based on an amortization schedule, you can use the formula for the monthly payment amount. This formula takes into account the loan amount, interest rate, and loan term to determine how much you need to pay each month.

Formula for Loan Payments

The formula for calculating loan payments is as follows:

Monthly Payment = P * (r * (1 + r)^n) / ((1 + r)^n – 1)

Where:

– P = Principal loan amount

– r = Monthly interest rate (annual interest rate divided by 12)

– n = Total number of payments (loan term in months)

Interest and Principal Payments Calculation

In a loan amortization schedule, each monthly payment is divided into interest and principal portions. Initially, a larger portion of the payment goes towards interest, but over time, more of the payment goes towards reducing the principal amount.

Example of Calculating Monthly Payments

Let’s consider a loan of $10,000 with an annual interest rate of 6% and a loan term of 3 years (36 months). Using the formula mentioned earlier, we can calculate the monthly payment as follows:

Monthly Payment = 10,000 * (0.06/12 * (1 + 0.06/12)^36) / ((1 + 0.06/12)^36 – 1) = $304.17

Therefore, the monthly payment for this loan would be $304.17.

Understanding Loan Balance

In an amortization schedule, the loan balance represents the remaining amount owed on the loan at any given time. Understanding how the loan balance changes over time is crucial for borrowers to manage their finances effectively.

When you make monthly payments on a loan, a portion of the payment goes towards paying off the principal amount borrowed, while the rest covers the interest accrued. As you continue to make payments, the proportion of each payment that goes towards the principal increases, reducing the loan balance over time.

Impact of Extra Payments

Making extra payments towards the principal amount can significantly reduce the loan balance and shorten the repayment period. By paying more than the required monthly installment, borrowers can save on interest costs and pay off the loan faster. This can have a positive impact on the overall financial health of the borrower.

- Extra payments directly reduce the outstanding loan balance.

- Reducing the loan balance leads to lower interest charges over the remaining term of the loan.

- Accelerated reduction of the loan balance shortens the loan term, saving the borrower money in the long run.

Effect on Future Payments

The loan balance plays a crucial role in determining future payments on the loan. As the loan balance decreases, the interest portion of each payment decreases, while the principal portion increases. This results in a faster repayment of the loan and reduces the total interest paid over the life of the loan.

Understanding how extra payments impact the loan balance and future payments can help borrowers save money and pay off their loans quicker.

Visualizing Amortization Schedule

When it comes to understanding the repayment of a loan, visualizing the loan amortization schedule can be incredibly helpful. By presenting the information in a visual format, it becomes easier to grasp the breakdown of each payment and see how the loan balance decreases over time.

Graphical Representation

- One common way to visualize an amortization schedule is through a line graph. The x-axis represents the payment number (month or year), while the y-axis shows the remaining loan balance. As payments are made, the line gradually decreases, showing the loan being paid off.

- Another format is a bar graph, where each bar represents a payment made. The height of the bar corresponds to the amount of the payment, and the bars decrease in size as the loan is paid down.

Tabular Representation

- Amortization schedules are often presented in a table format, detailing each payment, including the amount applied to interest and principal, as well as the remaining balance after each payment.

- Tables can also include a breakdown of the cumulative interest paid over time, helping borrowers understand the total cost of the loan.