With investing in healthcare stocks taking the spotlight, get ready for a deep dive into the world of lucrative investments. Strap in as we uncover the secrets and strategies behind healthcare stocks in a way that’s both informative and exciting.

Let’s explore the ins and outs of healthcare stocks, from understanding what they are to analyzing the risks and benefits, all while keeping it real with savvy investment tips.

Understanding Healthcare Stocks

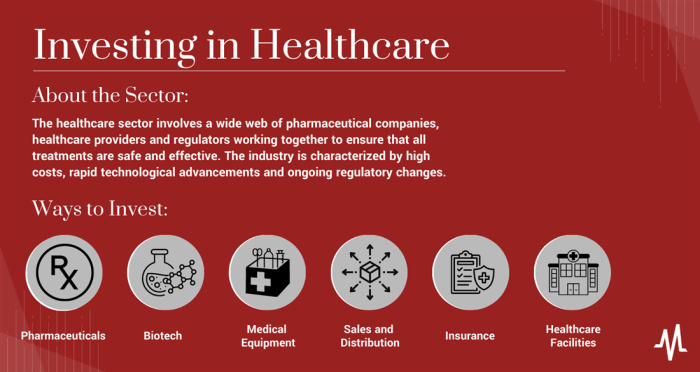

Investing in healthcare stocks can be a lucrative option for many investors due to the consistent demand for healthcare services regardless of economic conditions. Healthcare stocks encompass companies involved in pharmaceuticals, biotechnology, medical devices, hospitals, health insurance, and other healthcare-related services.

Types of Healthcare Stocks

- Pharmaceutical Companies: These companies focus on developing and producing drugs for various medical conditions.

- Biotechnology Companies: Involved in researching and developing innovative treatments using biological systems.

- Medical Device Companies: Manufacture and sell medical devices such as equipment, instruments, and diagnostic tools.

- Health Insurance Providers: Offer insurance coverage for medical expenses and services.

- Hospitals and Healthcare Facilities: Provide medical services to patients and generate revenue through patient care.

Investing in Healthcare Stocks vs. Other Sectors

Healthcare stocks are considered defensive investments as they are less affected by economic downturns compared to other sectors like technology or consumer goods. The demand for healthcare remains relatively stable, driven by factors such as an aging population, technological advancements, and increasing healthcare spending. Investors in healthcare stocks need to consider factors like regulatory changes, clinical trial results, and competition within the industry when making investment decisions.

Factors Influencing Healthcare Stocks

Healthcare stocks are influenced by a variety of factors that can impact their performance, including regulatory changes and technological advancements in the industry. These factors play a crucial role in determining the value and potential growth of healthcare stocks in the market.

Regulatory Changes

Regulatory changes, such as new healthcare legislation or policies, can have a significant impact on healthcare stocks. For example, changes in reimbursement rates for healthcare services or regulations surrounding drug approvals can directly affect the financial performance of healthcare companies. Investors need to closely monitor and analyze regulatory developments to assess the potential impact on healthcare stocks.

Technological Advancements in Healthcare

Technological advancements in healthcare, such as the development of new medical devices, treatments, or digital health solutions, can also influence stock prices. Companies that are at the forefront of innovation and are able to leverage technology to improve patient outcomes may see an increase in their stock value. Investors should pay attention to companies that are investing in research and development to capitalize on the latest healthcare technologies.

Risks and Benefits of Investing in Healthcare Stocks

Investing in healthcare stocks comes with its own set of risks and benefits that investors should carefully consider before making any decisions. Let’s dive into the potential advantages and disadvantages of adding healthcare stocks to your investment portfolio.

Risks Associated with Healthcare Stocks

When it comes to investing in healthcare stocks, there are several risks to be aware of. One major risk is regulatory uncertainty, as the healthcare industry is heavily regulated and changes in regulations can significantly impact stock prices. Another risk is the volatile nature of healthcare stocks, as they can be influenced by factors such as clinical trial results, drug approvals, and patent expirations. Additionally, healthcare stocks can be sensitive to changes in healthcare policies and government spending, leading to fluctuations in stock prices.

Benefits of Investing in Healthcare Stocks

Despite the risks, there are also potential benefits to investing in healthcare stocks. One major advantage is the long-term growth potential of the healthcare industry, driven by factors such as an aging population, technological advancements, and increasing demand for healthcare services. Healthcare stocks also tend to be defensive in nature, meaning they can provide stability to a portfolio during economic downturns. Furthermore, the healthcare sector has a history of outperforming other sectors during times of market volatility.

Volatility Comparison with Other Sectors

When comparing the volatility of healthcare stocks to other sectors, it’s important to note that healthcare stocks are generally considered to be less volatile than sectors such as technology or consumer discretionary. This is due to the essential nature of healthcare services, which tend to be in demand regardless of economic conditions. However, healthcare stocks can still experience significant fluctuations in stock prices, especially in response to regulatory changes, clinical trial results, or other industry-specific events.

Strategies for Investing in Healthcare Stocks

Investing in healthcare stocks can be a lucrative venture, but it is essential to have a solid strategy in place to maximize your returns and minimize risks. Here are some key strategies to consider when investing in healthcare stocks:

Tips for Researching and Selecting Healthcare Stocks to Invest In

When researching healthcare stocks, it is crucial to look beyond just the financial numbers. Consider factors such as the company’s pipeline of products, competitive positioning in the market, and regulatory environment. Look for companies with strong management teams and a history of innovation and success. Conduct thorough research and analysis before making any investment decisions.

The Importance of Diversification

Diversification is a critical component of any investment strategy, including when investing in healthcare stocks. By spreading your investments across different companies within the healthcare sector, you can reduce the impact of any single stock performing poorly. Diversification helps to mitigate risk and increase the potential for overall returns. Consider investing in a mix of large-cap, mid-cap, and small-cap healthcare stocks to achieve a balanced portfolio.

Long-Term Versus Short-Term Investment Strategies

When investing in healthcare stocks, it is essential to consider your investment goals and time horizon. Long-term investment strategies involve holding onto stocks for an extended period, allowing for potential growth and compounding returns over time. Short-term strategies, on the other hand, focus on taking advantage of short-term market fluctuations and trends. Determine whether you are looking for stable, long-term growth or quick profits when developing your investment strategy in the healthcare sector.