Diving into the world of reducing debt, this introduction will take you on a journey filled with tips, tricks, and strategies to help you achieve financial freedom. Get ready to unlock the secrets to a debt-free life with some American high school hip flair!

As we delve deeper into the topic, you’ll discover practical advice and expert insights that can pave the way for a brighter financial future.

Understanding Debt

Debt is money that you owe to a person, company, or financial institution. It can have a significant impact on your personal finances, affecting your ability to save, invest, and achieve financial goals.

Good debt is typically used to finance assets that have the potential to increase in value over time, such as a home mortgage or student loans. On the other hand, bad debt is used to purchase items that quickly lose value or do not generate long-term income, such as credit card debt or high-interest payday loans.

Common types of debt include:

Common Types of Debt

- Student loans

- Mortgages

- Auto loans

- Credit card debt

- Personal loans

Assessing Your Debt Situation

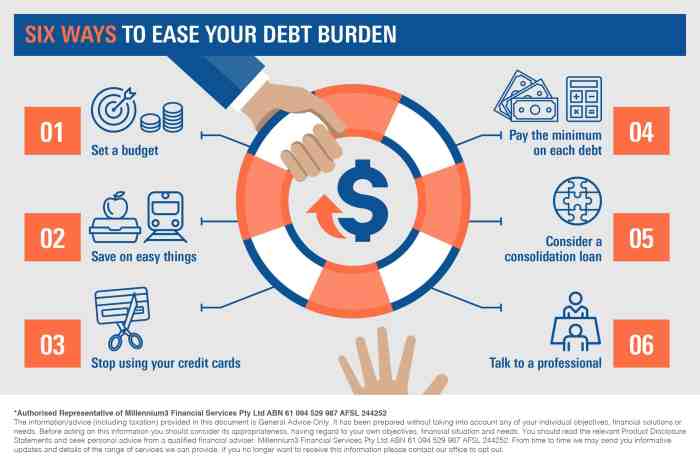

When it comes to reducing debt, the first step is to assess your current financial situation. This involves calculating your total debt, understanding your debt-to-income ratio, creating a budget, and gathering all necessary information related to your debts.

Calculating Total Debt

To calculate your total debt, make a list of all your outstanding debts, including credit card balances, student loans, mortgage payments, car loans, and any other debts you may have. Add up all these amounts to get your total debt.

Determining Debt-to-Income Ratio

Your debt-to-income ratio is a crucial metric that shows how much of your income goes towards paying off debt. To calculate this ratio, divide your total monthly debt payments by your gross monthly income. Multiply the result by 100 to get a percentage. A lower ratio indicates a healthier financial situation.

Creating a Budget

Creating a budget is essential to understand your financial standing and manage your debt effectively. List all your sources of income and expenses to see where your money is going each month. Allocate a portion of your income towards paying off debts to accelerate the debt reduction process.

Gathering Debt-Related Information

Gather all information related to your debts, including account balances, interest rates, minimum monthly payments, and due dates. Having a comprehensive overview of your debts will help you prioritize which debts to pay off first and develop a strategic repayment plan.

Creating a Debt Repayment Plan

When it comes to getting out of debt, having a solid repayment plan in place is key. By prioritizing your debts effectively, choosing the right repayment method, and negotiating with creditors, you can take control of your financial situation.

Prioritizing Debts

- Consider prioritizing debts based on interest rates. Start by paying off debts with the highest interest rates first, as they cost you the most money in the long run.

- Alternatively, you can prioritize debts based on balances. Some people prefer to pay off smaller debts first to gain motivation and momentum.

Snowball vs. Avalanche Method

- The snowball method involves paying off the smallest debts first, regardless of interest rates, to build momentum and motivation.

- The avalanche method, on the other hand, prioritizes debts with the highest interest rates first to save money on interest over time.

- Choose the method that aligns best with your financial goals and motivates you to stay on track.

Negotiating with Creditors

- Reach out to your creditors to discuss potential options for lowering interest rates or settling debts. They may be willing to work with you if you communicate your financial situation honestly.

- Consider enrolling in a debt management program or working with a credit counseling agency to help negotiate with creditors on your behalf.

- Remember to stay persistent and advocate for yourself to find a solution that works for both you and your creditors.

Increasing Income and Cutting Expenses

When looking to reduce debt, it’s essential to find ways to increase your income and cut down on unnecessary expenses. By taking on side hustles or part-time work, as well as budgeting wisely, you can make significant progress towards financial freedom.

Enhancing Income through Side Hustles or Part-time Work

One way to boost your income is by taking on side hustles or part-time work. This could include freelance gigs, tutoring, pet sitting, or even driving for a rideshare service. By diversifying your income streams, you can bring in extra money to put towards paying off your debt.

Reducing Expenses through Budgeting and Cutting Unnecessary Costs

To effectively reduce debt, it’s crucial to closely monitor your expenses and identify areas where you can cut back. Create a budget that Artikels your monthly income and expenses, then look for ways to trim unnecessary costs. This could involve meal planning, canceling subscriptions you don’t use, or negotiating lower bills.

Sticking to a Budget and Avoiding Impulse Purchases

Once you’ve created a budget, the key is to stick to it. Avoid impulse purchases by making a list before shopping and sticking to it. Consider implementing a 24-hour rule for non-essential purchases, giving yourself time to think before buying. By staying disciplined with your budget, you can make progress towards reducing your debt.

Seeking Professional Help

When dealing with overwhelming debt, it may be beneficial to seek help from a financial advisor or credit counselor. These professionals can offer expert advice and guidance to help you navigate your financial situation and make informed decisions.

Debt Consolidation and Debt Management Plans

- Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, making it easier to manage payments.

- Pros: Simplifies debt repayment, potentially lowers interest rates, and may reduce monthly payments.

- Cons: May require collateral, such as a home equity loan, and could extend the repayment period, resulting in more interest paid over time.

Finding Reputable Professionals

- Research and compare different financial advisors or credit counseling agencies to ensure they are reputable and accredited.

- Check reviews and testimonials from past clients to gauge the quality of services provided.

- Avoid organizations that charge high fees upfront or make unrealistic promises about eliminating debt quickly.