Yo, diving into home loan refinancing, this intro is here to grab your attention and give you the lowdown on how to save that cash money. Get ready to learn all about this money move that could change your financial game!

Get ready to level up your knowledge on home loan refinancing and make some smart financial decisions. Let’s do this!

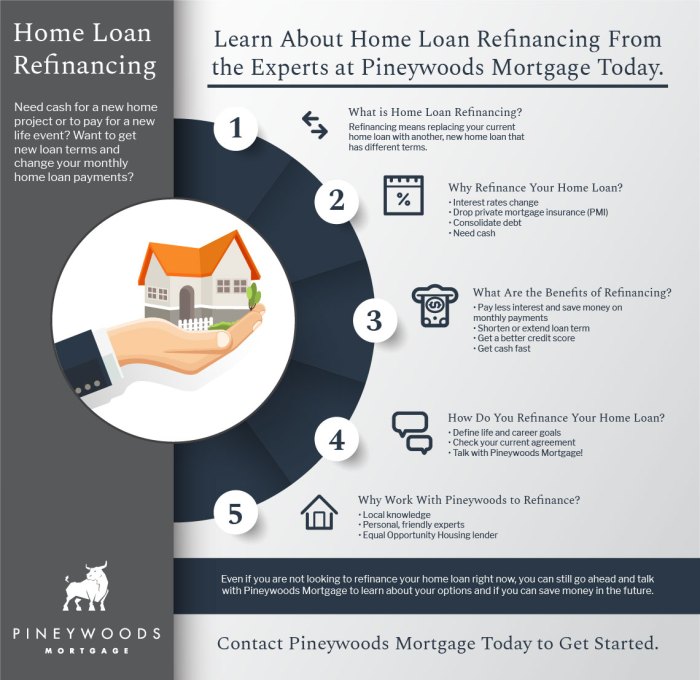

What is Home Loan Refinancing?

When it comes to home loan refinancing, it’s all about getting a fresh start on your mortgage game. Basically, refinancing means swapping out your current home loan for a new one, usually with better terms and conditions. It’s like hitting the reset button on your mortgage, giving you the chance to save some cash or make your payments more manageable.

Benefits of Refinancing a Home Loan

- Lower Interest Rates: By refinancing your home loan, you might be able to snag a lower interest rate, which can lead to significant savings over time.

- Lower Monthly Payments: If you’re struggling to make your current mortgage payments, refinancing could help you secure a lower monthly payment that fits better into your budget.

- Access Equity: Refinancing allows you to tap into the equity you’ve built in your home, giving you access to cash for renovations, debt consolidation, or other expenses.

- Change Loan Terms: You can switch from an adjustable-rate mortgage to a fixed-rate mortgage or vice versa, depending on what works best for your financial situation.

Common Reasons for Refinancing Home Loans

- To Secure a Lower Interest Rate: Many homeowners refinance to take advantage of lower interest rates, reducing the overall cost of their mortgage.

- To Shorten the Loan Term: Some choose to refinance to shorten the term of their loan, paying off their mortgage faster and saving on interest in the long run.

- To Convert Equity into Cash: Homeowners may refinance to access the equity in their homes, using the cash for home improvements, debt consolidation, or other financial needs.

- To Remove Private Mortgage Insurance (PMI): If the value of your home has increased significantly since you purchased it, refinancing can help you eliminate the need for PMI.

Types of Home Loan Refinancing

When it comes to refinancing your home loan, there are various options to consider based on your financial goals and circumstances.

Fixed-Rate Refinancing vs. Adjustable-Rate Refinancing

Fixed-rate refinancing involves locking in a set interest rate for the duration of the loan, providing stability in monthly payments. On the other hand, adjustable-rate refinancing offers an initial lower interest rate that can fluctuate over time based on market conditions.

Cash-Out Refinancing

Cash-out refinancing allows you to borrow more than your current loan balance and receive the difference in cash. This option is ideal for homeowners looking to access their home equity for major expenses like home renovations or debt consolidation.

Rate-and-Term Refinancing

Rate-and-term refinancing involves refinancing your existing loan to secure more favorable terms, such as a lower interest rate or shorter loan term. This option can help you save money on interest over the life of the loan or pay off your mortgage sooner.

Eligibility and Requirements

To be eligible for home loan refinancing, borrowers typically need to meet certain criteria set by lenders. These criteria may vary depending on the lender and the type of loan being refinanced.

Eligibility Criteria

- Stable Income: Lenders usually require borrowers to have a stable source of income to ensure they can make the loan payments.

- Equity in Home: Borrowers should have built up enough equity in their home to qualify for refinancing. Lenders may require a certain amount of equity to be eligible.

- Good Credit Score: A good credit score is often necessary to qualify for refinancing. Lenders may have minimum credit score requirements that borrowers must meet.

- Debt-to-Income Ratio: Lenders may also consider the borrower’s debt-to-income ratio to ensure they can afford the new loan payments.

Credit Score Requirements

- Most lenders require a minimum credit score of around 620 to 680 to qualify for home loan refinancing. However, a higher credit score may result in better refinancing terms and lower interest rates.

- Having a higher credit score can also help borrowers qualify for other types of refinancing, such as cash-out refinancing, which allows them to borrow against their home equity.

Documents Needed

- Income Verification: Borrowers typically need to provide documents such as pay stubs, W-2 forms, or tax returns to verify their income.

- Property Information: Documents related to the property, such as the deed, property tax statements, and homeowners insurance information, may be required.

- Credit Report: Lenders will pull the borrower’s credit report to assess their creditworthiness and determine their eligibility for refinancing.

- Other Financial Documents: Additional documents, such as bank statements, investment account statements, and proof of assets, may be needed to complete the refinancing application.

Process of Home Loan Refinancing

When it comes to refinancing your home loan, the process can seem daunting at first. However, understanding the step-by-step process, the role of an appraisal, and how to choose the right lender can help make the process smoother and more manageable.

Step-by-step Process of Refinancing a Home Loan

- Review your current loan: Take a look at your current loan terms, interest rate, and monthly payments to understand what you’re working with.

- Check your credit score: A good credit score can help you qualify for better rates, so make sure your credit is in good shape.

- Shop around for lenders: Compare offers from different lenders to find the best deal for your refinancing needs.

- Submit your application: Once you’ve chosen a lender, submit your application and provide any required documentation.

- Appraisal and underwriting: The lender will appraise your home to determine its value and assess your financial situation before approving your refinance.

- Closing: If your refinance is approved, you’ll review and sign the new loan documents before closing on your new loan.

Role of Appraisal in the Refinancing Process

An appraisal is a crucial step in the refinancing process as it helps the lender determine the current value of your home. This valuation is essential for establishing the loan-to-value ratio, which can impact the terms of your refinance, including the interest rate and loan amount. A higher appraisal value can result in better refinancing terms, so it’s important to maintain your home and address any issues that could affect its value.

Choosing the Right Lender for Refinancing

- Research lenders: Look for reputable lenders with positive reviews and a history of successful refinancing transactions.

- Compare rates and fees: Consider the interest rates, closing costs, and fees offered by different lenders to find the most competitive option.

- Ask questions: Don’t be afraid to ask lenders about their experience with refinancing, the timeline for the process, and any potential fees or penalties.

- Read the fine print: Before committing to a lender, carefully review the loan terms, conditions, and any potential risks associated with the refinance.

Pros and Cons of Home Loan Refinancing

When considering refinancing a home loan, it’s important to weigh the advantages and disadvantages to make an informed decision.

Advantages of Refinancing a Home Loan

- Lower Interest Rates: Refinancing can help you secure a lower interest rate, potentially saving you money on monthly payments and overall interest costs.

- Consolidating Debt: Refinancing allows you to consolidate high-interest debt into your mortgage, reducing your overall interest payments.

- Access to Equity: By refinancing, you can tap into your home’s equity for major expenses like home improvements or education costs.

- Change in Loan Term: Refinancing gives you the opportunity to change the term of your loan, potentially shortening it and paying off your mortgage sooner.

Potential Drawbacks of Refinancing

- Closing Costs: Refinancing typically involves closing costs, which can add up and offset the savings from a lower interest rate.

- Extended Loan Term: If you refinance to a longer loan term, you may end up paying more in interest over the life of the loan.

- Risk of Foreclosure: If you struggle to make payments after refinancing, you risk losing your home to foreclosure.

Factors to Consider Before Refinancing

- Current Interest Rates: Compare your current interest rate with market rates to determine if refinancing will result in significant savings.

- Loan Term: Consider how changing the term of your loan will impact your monthly payments and overall financial goals.

- Financial Stability: Ensure you have a stable income and emergency savings to handle any unexpected expenses after refinancing.

Calculating Savings and Costs

When considering refinancing your home loan, it’s important to calculate the potential savings and costs involved to determine if it’s a financially sound decision.

Calculating Potential Savings

- Start by comparing your current interest rate with the new rate offered for refinancing. The larger the difference, the more you could potentially save.

- Calculate the total interest you would pay over the life of your current loan versus the refinanced loan. This can give you an idea of the long-term savings.

- Consider any fees associated with the refinancing process and factor them into your calculations to get a more accurate picture of potential savings.

Costs Involved in Refinancing

- Refinancing typically involves closing costs, which can include application fees, appraisal fees, and title insurance. These costs can add up and should be taken into consideration.

- There may be prepayment penalties for paying off your current loan early. Make sure to find out if this applies to you and factor it into your decision-making process.

- Additional costs such as points, which are fees paid to the lender to reduce the interest rate, should also be considered when calculating the overall cost of refinancing.

When It Makes Financial Sense to Refinance

- It makes financial sense to refinance when the potential savings outweigh the costs involved in the process. Ideally, you want to recoup the costs of refinancing within a reasonable timeframe.

- If you plan to stay in your home for a long period, the savings from a lower interest rate can accumulate over time and make refinancing a wise choice.

- When your credit score has improved since you initially got your home loan, you may qualify for a better interest rate, making refinancing beneficial in the long run.

Tips for a Successful Home Loan Refinancing

When it comes to home loan refinancing, there are several key tips that can help you navigate the process smoothly and save money in the long run. From improving your credit score to negotiating better terms, here are some essential tips to consider.

Improving Credit Score Before Refinancing

If you’re planning to refinance your home loan, it’s crucial to work on improving your credit score beforehand. A higher credit score can help you qualify for better interest rates and terms, ultimately saving you money over the life of your loan.

- Check your credit report for any errors and dispute inaccuracies.

- Paying off outstanding debts can help boost your credit score.

- Avoid opening new credit accounts before refinancing.

Negotiating Strategies for Better Refinancing Terms

When refinancing your home loan, don’t be afraid to negotiate for better terms. With the right approach, you may be able to secure a lower interest rate or reduced fees, resulting in significant savings over time.

- Shop around and compare offers from different lenders to leverage better deals.

- Highlight your positive financial history and stability to lenders during negotiations.

- Consider working with a mortgage broker who can help you find the best refinancing options.

Timing the Market for Optimal Refinancing Opportunities

Timing is crucial when it comes to refinancing your home loan. By keeping an eye on market trends and interest rate movements, you can identify the optimal time to refinance and secure the most favorable terms for your new loan.

- Monitor interest rates regularly and be ready to act when rates are at a low point.

- Consider seasonal trends in the housing market that may impact refinance rates.

- Consult with a financial advisor to determine the best timing based on your individual financial goals.