Ready to take charge of your financial future? Dive into the world of financial goal setting and discover how it can transform your money mindset. From short-term splurges to long-term investments, we’ve got you covered with tips and tricks to help you reach your financial goals with style.

Whether you’re a budgeting novice or a seasoned saver, understanding the importance of financial goal setting is key to securing your financial well-being. Let’s break it down and get you on the path to financial success.

Importance of Financial Goal Setting

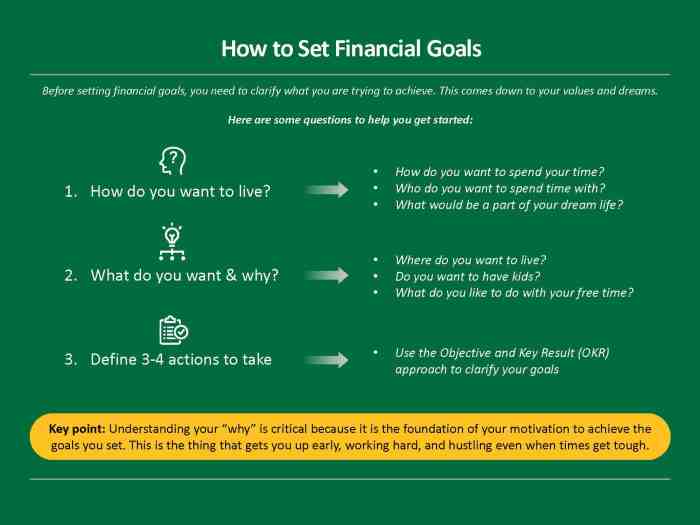

Setting financial goals is crucial for personal financial planning as it provides individuals with a roadmap to achieve their desired financial outcomes. Without clear goals, it can be challenging to make informed decisions about saving, spending, and investing.

Examples of Financial Goals

- Short-term financial goals: Saving up for a vacation, paying off credit card debt, building an emergency fund.

- Long-term financial goals: Buying a home, saving for retirement, investing in a child’s education.

How Financial Goal Setting Helps Prioritize Spending and Saving

Setting financial goals helps individuals prioritize their spending by identifying what is truly important to them. By having specific goals in place, individuals can allocate their money towards achieving those goals rather than spending impulsively on things that may not align with their long-term objectives.

Strategies for Setting Effective Financial Goals

Setting financial goals is crucial for achieving financial success. Here are some strategies to help you set effective financial goals:

SMART Financial Goals

- Specific: Clearly define your financial goal, such as saving a specific amount for a down payment on a house.

- Measurable: Set a quantifiable target, like saving $10,000 in a year.

- Achievable: Ensure your goal is realistic based on your income and expenses.

- Relevant: Align your financial goal with your overall financial plan and priorities.

- Time-bound: Set a deadline for achieving your goal, such as saving the down payment in three years.

Regular Review and Adjustment

It’s important to regularly review and adjust your financial goals to stay on track. Life circumstances and financial situations can change, so it’s essential to adapt your goals as needed. Schedule regular check-ins to evaluate your progress and make any necessary adjustments to ensure you are still working towards your financial objectives.

Tools and Apps for Tracking Progress

There are various tools and apps available to help individuals track their progress towards their financial goals. Some popular options include:

- Mint: A budgeting app that allows you to set financial goals, track expenses, and monitor your overall financial health.

- You Need a Budget (YNAB): An app that focuses on budgeting and helps you allocate funds towards specific goals.

- Personal Capital: An app that offers tools for tracking investments, retirement accounts, and overall financial goals.

Overcoming Challenges in Achieving Financial Goals

Achieving financial goals can be a challenging journey filled with obstacles that can deter even the most determined individuals. However, by understanding common challenges and implementing effective strategies, you can stay motivated and focused on reaching your long-term financial objectives.

Identifying Common Obstacles

- Procrastination: Delaying financial decisions and actions can hinder progress towards your goals.

- Unexpected Expenses: Emergencies or unforeseen costs can derail your financial plans.

- Lack of Financial Literacy: Not understanding basic financial concepts can lead to poor decision-making.

- Impulse Spending: Giving in to instant gratification can sabotage your savings and investment goals.

Staying Motivated and Focused

- Set Milestones: Break down your long-term goals into smaller, achievable milestones to track progress.

- Reward Yourself: Celebrate small victories along the way to stay motivated and maintain focus.

- Visualize Success: Create a vision board or mental image of achieving your financial goals to stay inspired.

Role of Discipline and Perseverance

- Stick to a Budget: Establish a budget and adhere to it consistently to avoid overspending.

- Develop Good Habits: Cultivate disciplined financial habits such as saving regularly and avoiding debt.

- Stay Resilient: Understand that setbacks may occur, but staying resilient and persistent is key to achieving financial success.

Impact of Financial Goal Setting on Financial Well-being

Setting and achieving financial goals can have a significant impact on one’s overall financial well-being. By having clear objectives and a plan in place, individuals can make better financial decisions, manage their money more effectively, and ultimately improve their financial situation.

Psychological Benefits of Setting and Achieving Financial Goals

- Increased motivation and focus: Setting financial goals gives individuals a sense of purpose and direction, motivating them to take action and stay focused on their objectives.

- Reduced stress and anxiety: Knowing what you are working towards and having a plan in place can help alleviate financial stress and anxiety, leading to better mental health.

- Improved self-discipline: Setting and achieving financial goals requires self-discipline and perseverance, which can translate to other areas of life and lead to personal growth.

Success Stories of Individuals Improving Financial Situation Through Goal Setting

“I started setting monthly savings goals and tracking my expenses diligently. Within a year, I was able to pay off my credit card debt and start building an emergency fund. Setting those goals changed my financial life for the better.” – Sarah

“After setting a goal to increase my income, I invested in a skills development course that allowed me to get a better-paying job. Achieving that goal not only boosted my financial situation but also my confidence and career prospects.” – John