Get ready to dive into the world of financial decision making, where every choice can make or break your future. From individuals to businesses, the impact is huge – think of it as the ultimate game of strategy and smarts.

As we explore the factors, strategies, and biases surrounding financial decision making, you’ll uncover the secrets to mastering this essential skill.

Importance of Financial Decision Making

Financial decision making plays a crucial role in the success of both individuals and businesses. It involves analyzing various options, weighing risks and rewards, and selecting the best course of action to achieve financial goals.

Effective financial decision making can lead to long-term success by helping individuals and businesses allocate resources wisely, maximize profits, and minimize losses. For example, a business that makes strategic investments in new technologies or expands into new markets based on thorough financial analysis is more likely to experience growth and profitability in the long run.

On the other hand, poor financial decision making can have serious consequences. It can result in financial losses, bankruptcy, and even closure of businesses. Individuals may face personal financial crises, debt accumulation, and inability to achieve their financial goals. For instance, overspending, taking on excessive debt, or making risky investments without proper evaluation can lead to financial ruin.

Benefits of Effective Financial Decision Making

- Optimal resource allocation: Making informed financial decisions helps individuals and businesses allocate resources efficiently, ensuring maximum returns on investments.

- Risk management: Effective financial decision making involves assessing and managing risks, reducing the likelihood of financial losses.

- Long-term financial stability: By making sound financial decisions, individuals and businesses can build a strong financial foundation for the future and achieve long-term stability.

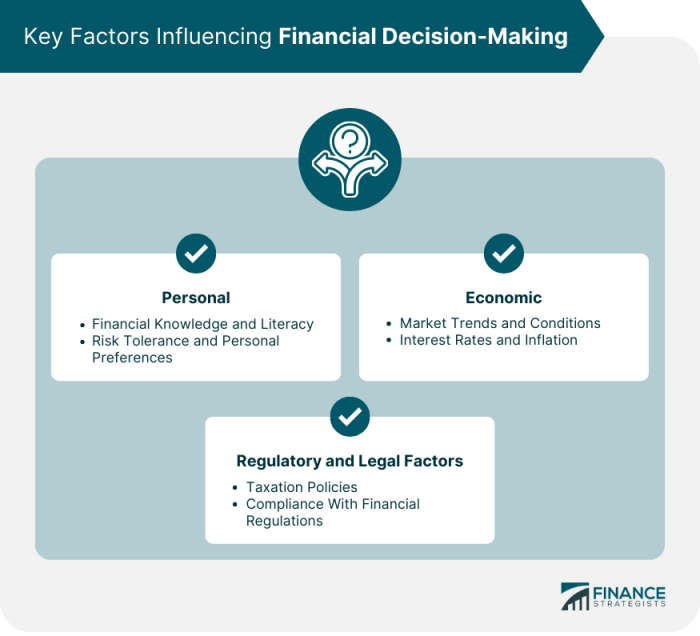

Factors Influencing Financial Decision Making

Understanding the various factors that influence financial decision making is crucial in making informed choices that align with our goals and values.

External Factors Impacting Financial Decision Making

External factors such as economic conditions, market trends, government policies, and industry regulations play a significant role in shaping our financial decisions. For example, a sudden recession may prompt individuals to prioritize saving and investment over spending, while favorable market conditions may encourage risk-taking and investment in stocks or real estate.

Personal Values and Beliefs in Financial Decision Making

Personal values and beliefs can greatly impact our financial decisions. For instance, someone who values financial security may choose to save more and avoid risky investments, while someone who prioritizes experiences and enjoyment may be more inclined to spend money on travel or entertainment. Understanding our values can help us make decisions that are in line with our long-term financial well-being.

Role of Emotions in Financial Decision Making

Emotions play a crucial role in financial decision making, often leading individuals to make irrational choices based on fear, greed, or anxiety. For example, fear of missing out (FOMO) may drive someone to invest in a trending stock without proper research, while greed may lead to excessive risk-taking for higher returns. Recognizing and managing our emotions can help us make more rational and objective financial decisions.

Strategies for Effective Financial Decision Making

Effective financial decision making involves different approaches to ensure sound outcomes. One key aspect is setting clear financial goals to guide your decisions and actions. Additionally, managing risks effectively is crucial to safeguard your financial well-being.

Setting Financial Goals

Setting financial goals helps provide a clear direction for your decision-making process. By defining specific objectives, such as saving for a house, retirement, or education, you can prioritize your financial decisions accordingly. This focus helps you allocate resources efficiently and stay motivated to achieve your goals.

Managing Risks

When making financial decisions, it’s important to assess and manage risks effectively. This involves identifying potential risks associated with each decision, such as market fluctuations, inflation, or unexpected expenses. By diversifying your investments, having an emergency fund, and obtaining insurance coverage, you can mitigate risks and protect your financial assets.

Behavioral Biases in Financial Decision Making

When it comes to making financial decisions, our behaviors and thought patterns can often lead us astray. These behavioral biases can impact our choices in ways that we may not even realize, ultimately affecting our financial well-being.

Overconfidence Bias

One common behavioral bias is the overconfidence bias, where individuals tend to overestimate their abilities and knowledge. This can lead to excessive trading in the stock market or taking on too much risk in investments, ultimately resulting in poor decision making.

Loss Aversion Bias

Loss aversion bias is another prevalent bias that affects financial decision making. This bias refers to the tendency for individuals to strongly prefer avoiding losses over acquiring gains. As a result, people may hold onto losing investments for too long, hoping for a rebound, instead of cutting their losses and moving on.

Anchoring Bias

Anchoring bias occurs when individuals rely too heavily on the first piece of information they receive when making decisions. In financial decision making, this bias can lead to sticking with an initial investment decision even when new information suggests otherwise.

Confirmation Bias

Confirmation bias is the tendency to search for, interpret, favor, and recall information in a way that confirms one’s preexisting beliefs or hypotheses. In the context of financial decision making, this bias can prevent individuals from objectively evaluating all available information, leading to potentially detrimental choices.

How to Overcome Behavioral Biases

To overcome these behavioral biases, individuals can take practical steps such as seeking advice from financial professionals, diversifying their investments, setting clear investment goals, and regularly reviewing their portfolio to ensure alignment with their objectives. Being aware of these biases and actively working to counteract them can lead to better financial decision making in the long run.