Get ready to dive into the world of debt repayment strategies, where we break down the ins and outs of managing your debts like a boss. From the snowball method to debt consolidation, we’ve got you covered with all the tips and tricks you need to take control of your finances.

In this guide, we’ll explore the different strategies you can use to tackle your debts head-on and pave the way to a debt-free future.

Overview of Debt Repayment Strategies

Debt repayment strategies are essential for individuals looking to take control of their finances and work towards achieving financial freedom. Having a structured plan in place can help individuals prioritize their debts, reduce interest payments, and ultimately become debt-free.

Types of Debts in Repayment Strategy

- Credit Card Debt: High-interest debt that can quickly accumulate if not managed properly.

- Student Loans: Long-term debts that often require a consistent repayment plan.

- Personal Loans: Unsecured loans that may have varying interest rates.

- Mortgage Loans: Secured loans used to finance a home purchase, typically with a long repayment period.

Benefits of Debt Repayment Strategies

- Reduce Stress: By having a plan in place, individuals can feel more in control of their financial situation.

- Save Money: By prioritizing high-interest debts, individuals can save money on interest payments over time.

- Improve Credit Score: Timely debt repayment can help improve credit scores, leading to better financial opportunities in the future.

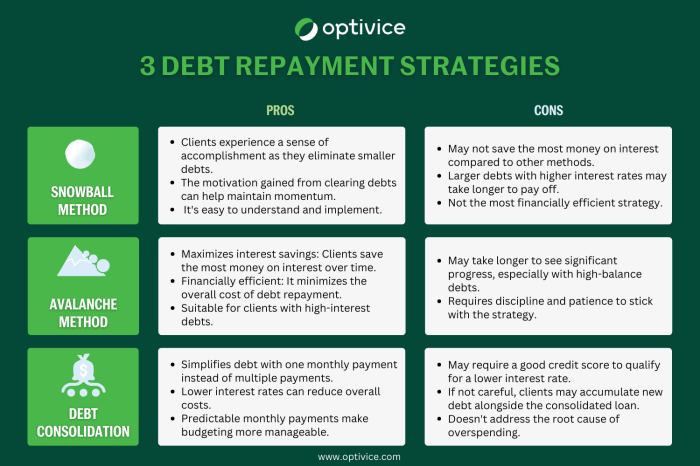

Snowball Method

The snowball method is a debt repayment strategy where you focus on paying off your smallest debts first while making minimum payments on larger debts. Once the smallest debt is paid off, you roll that payment into the next smallest debt, creating a snowball effect that helps you tackle larger debts more aggressively.

This method works by providing a sense of accomplishment and motivation as you see progress quickly on your debts. It allows you to build momentum and stay motivated to continue paying off your debts.

Prioritizing Smaller Debts

When you prioritize smaller debts using the snowball method, you can see results faster, which can help boost your confidence and keep you motivated. For example, if you have a credit card with a $500 balance and a personal loan with a $5,000 balance, focusing on paying off the credit card first can give you a quick win and encourage you to keep going.

Psychological Benefits

The snowball method provides psychological benefits by allowing you to experience small victories along the way. As you pay off each debt, you feel a sense of accomplishment and progress, which can boost your confidence and motivation to continue tackling your debts. This positive reinforcement can help you stay committed to your debt repayment journey and ultimately become debt-free.

Avalanche Method

When it comes to tackling debt, the avalanche method is another popular strategy that focuses on saving you money in the long run. This method involves paying off your debts starting with the one that has the highest interest rate first, while continuing to make minimum payments on the others. Once the debt with the highest interest rate is paid off, you move on to the next highest and so on, creating a snowball effect that accelerates your debt repayment.

Comparison with Snowball Method

The avalanche method differs from the snowball method in that it prioritizes debts based on interest rates rather than balances. While the snowball method focuses on paying off the smallest debts first to build momentum, the avalanche method saves you more money in the long term by tackling high-interest debts first.

Scenarios for Avalanche Method

One scenario where the avalanche method may be more beneficial than the snowball method is if you have debts with significantly high interest rates. By targeting these high-interest debts first, you can save money on interest payments over time, ultimately paying off your debts faster and more efficiently.

Debt Consolidation

Debt consolidation is a financial strategy where multiple debts are combined into a single loan or payment. This can help simplify debt repayment by streamlining the process and potentially lowering the overall interest rate.

Pros and Cons of Debt Consolidation

- Pros:

- Single Monthly Payment: Debt consolidation combines multiple payments into one, making it easier to manage finances.

- Potential Lower Interest Rate: Consolidating debt may result in a lower overall interest rate, saving money in the long run.

- Improved Credit Score: By paying off multiple debts with a consolidation loan, you can improve your credit score over time.

- Cons:

- Extended Repayment Period: Consolidating debt may extend the repayment period, resulting in paying more interest over time.

- Requires Good Credit: To qualify for a lower interest rate, you typically need a good credit score, which may be a barrier for some individuals.

- Additional Fees: Some debt consolidation methods come with fees or costs that should be considered before making a decision.

Choosing the Right Debt Consolidation Method

- Assess Your Financial Situation: Understand your current debts, interest rates, and credit score to determine the best consolidation method.

- Compare Interest Rates: Research different consolidation options to find the lowest interest rate that will save you money in the long term.

- Consider Fees and Terms: Look into any fees associated with the consolidation method and make sure the terms align with your financial goals.

- Seek Professional Advice: Consult with a financial advisor or credit counselor to get personalized recommendations based on your individual circumstances.

Budgeting Techniques

Budgeting is a crucial aspect when it comes to managing your finances and working towards paying off your debts. By creating a budget that prioritizes debt repayment, you can stay on track and make meaningful progress towards your financial goals.

Track Your Expenses

One of the first steps in creating a budget to support debt repayment is to track your expenses. This involves keeping a record of everything you spend money on, from your monthly bills to your daily coffee. By understanding where your money is going, you can identify areas where you can cut back and allocate more funds towards paying off your debts.

Set Realistic Goals

When budgeting for debt repayment, it’s important to set realistic goals. Determine how much you can afford to put towards your debts each month while still covering your essential expenses. Setting achievable goals will help you stay motivated and focused on your repayment journey.

Use the 50/30/20 Rule

The 50/30/20 rule is a popular budgeting technique that suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. By following this rule, you can ensure that you are prioritizing your debt repayment while still allowing yourself some room for discretionary spending.

Automate Your Savings

Automating your savings and debt payments can help you stay on track with your budgeting goals. Set up automatic transfers from your checking account to your savings account or towards your debts to ensure that you are consistently putting money towards your financial goals.

Monitor Your Progress

Regularly monitoring your budget and tracking your progress towards debt repayment is essential. Make adjustments as needed to ensure that you are staying on track and making steady progress towards becoming debt-free.