Customer Acquisition Cost sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with an American high school hip style and brimming with originality from the outset. The ins and outs of CAC, from its calculation to its impact on marketing strategies, will be explored in this exciting journey.

Definition of Customer Acquisition Cost

Customer Acquisition Cost (CAC) refers to the total amount of money a business spends on acquiring a new customer. It is a crucial metric for businesses as it helps in determining the effectiveness of their marketing and sales efforts.

Calculation and Significance of CAC

CAC is calculated by dividing the total costs associated with acquiring customers (such as marketing expenses and sales team salaries) by the number of customers acquired during a specific time period. This metric is significant in evaluating the return on investment (ROI) of marketing campaigns and helps businesses make informed decisions on allocating resources.

- Understanding CAC helps businesses optimize their marketing strategies by identifying which channels are most cost-effective in acquiring new customers.

- A high CAC may indicate inefficiencies in the sales and marketing processes, prompting businesses to reevaluate their approach and find ways to reduce costs.

- By comparing CAC to the customer lifetime value (CLV), businesses can determine the profitability of acquiring a customer and make adjustments to improve overall profitability.

Factors Affecting Customer Acquisition Cost

When it comes to Customer Acquisition Cost (CAC), several key factors influence how much a company needs to spend to acquire a new customer. Understanding these factors is crucial for businesses to optimize their marketing strategies and budgets effectively.

Industry Type and Target Market Demographics

The industry type plays a significant role in determining the CAC, as different industries have varying levels of competition and market saturation. For instance, industries with high competition may require more resources to stand out and attract new customers, leading to a higher CAC. On the other hand, niche industries with a specific target audience may have lower CAC due to the focused marketing efforts.

Moreover, target market demographics also impact CAC. Understanding the characteristics, behaviors, and preferences of the target audience can help businesses tailor their marketing campaigns more effectively. For example, reaching a younger demographic through social media platforms may result in a lower CAC compared to traditional advertising methods targeting an older demographic.

Marketing Channels and Strategies, Customer Acquisition Cost

The choice of marketing channels and strategies can significantly affect the CAC. Different channels, such as social media, search engine marketing, email marketing, or influencer partnerships, have varying costs associated with them. Businesses need to analyze the effectiveness of each channel in reaching their target audience and converting leads into customers to optimize CAC.

Furthermore, the marketing strategies employed, such as content marketing, paid advertising, referral programs, or discounts, can impact CAC. A well-planned and executed marketing strategy that resonates with the target audience can lower CAC by efficiently converting leads into customers.

In conclusion, businesses must consider industry type, target market demographics, marketing channels, and strategies when calculating and optimizing their Customer Acquisition Cost to ensure a cost-effective approach to acquiring new customers.

Strategies to Lower Customer Acquisition Cost

In order to reduce Customer Acquisition Cost (CAC) for businesses, it is crucial to implement effective methods that optimize marketing campaigns and focus on customer retention. By doing so, companies can streamline their efforts and resources, ultimately decreasing the overall cost of acquiring new customers.

Optimizing Marketing Campaigns

One key strategy to lower CAC is to optimize marketing campaigns to target the right audience effectively. By utilizing data analytics and market research, businesses can tailor their messaging and outreach to reach potential customers who are more likely to convert. This targeted approach can help increase conversion rates and reduce the overall cost of acquiring each new customer.

Utilizing Cost-Effective Channels

Another effective method to lower CAC is to identify and leverage cost-effective marketing channels. By focusing on channels that provide a high return on investment (ROI) and lower acquisition costs, businesses can maximize their marketing budget and reach a larger audience without overspending. This strategic allocation of resources can significantly impact the overall CAC for a company.

Enhancing Customer Retention

Customer retention plays a crucial role in decreasing CAC by fostering loyalty and repeat business. By providing exceptional customer service, personalized experiences, and incentives for returning customers, businesses can reduce the need to constantly acquire new customers. Retaining existing customers not only lowers CAC but also increases customer lifetime value, ultimately leading to long-term profitability for the business.

Calculating Customer Acquisition Cost

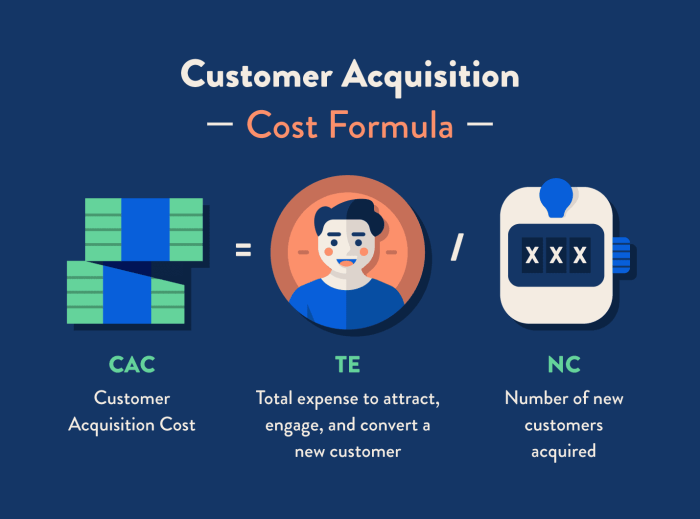

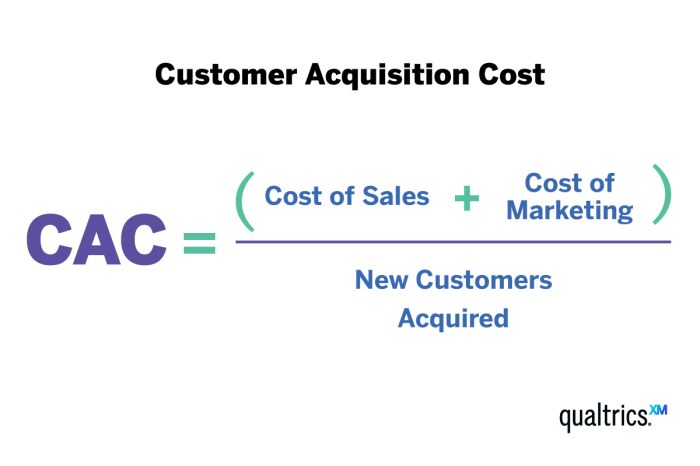

To calculate Customer Acquisition Cost (CAC), you need to follow a step-by-step guide and understand the different approaches or formulas used in determining CAC. Let’s dive into the details.

Step-by-Step Guide

- Calculate total marketing and sales expenses for a specific period.

- Identify the number of customers acquired during that period.

- Divide the total expenses by the number of customers acquired to get the CAC.

Different Approaches or Formulas

There are various formulas to calculate CAC, including dividing total marketing expenses by the number of customers acquired or considering sales and marketing costs separately.

Examples of CAC Calculations

| Period | Total Expenses | Customers Acquired | CAC |

|---|---|---|---|

| Q1 2021 | $50,000 | 100 | $500 |

| Q2 2021 | $70,000 | 150 | $466.67 |