Budgeting for Families dives into the world of managing finances as a family unit, offering insightful tips and strategies to ensure a prosperous future. From setting up a budget to teaching children about money management, this guide covers it all in a cool, relatable manner that resonates with the modern family.

Importance of Budgeting for Families

Budgeting is crucial for families as it helps them manage their finances effectively and plan for the future. By creating a budget, families can track their income and expenses, identify areas where they can save money, and set financial goals.

Financial Goals Achievement

Budgeting helps families achieve their financial goals by providing a clear roadmap for how they will reach them. By setting specific targets for saving, investing, and spending, families can work towards milestones such as buying a house, saving for education, or planning for retirement.

Impact on Family Relationships, Budgeting for Families

Effective budgeting can have a positive impact on family relationships by reducing financial stress and promoting open communication about money matters. When families work together to create and stick to a budget, they can avoid conflicts over spending, build trust, and strengthen their bond.

Setting Up a Family Budget: Budgeting For Families

Creating a family budget is crucial for financial stability and achieving goals. It involves careful planning and tracking of income and expenses to ensure that all family members are on the same page when it comes to managing finances.

Steps to Create a Comprehensive Family Budget

- List all sources of income, including salaries, bonuses, and any other earnings.

- Track all expenses, such as bills, groceries, and other regular payments.

- Differentiate between needs and wants to prioritize essential expenses.

- Set specific financial goals, like saving for education or a family vacation.

- Create a detailed budget plan with categories for each expense and savings goals.

- Review and adjust the budget regularly to accommodate any changes in income or expenses.

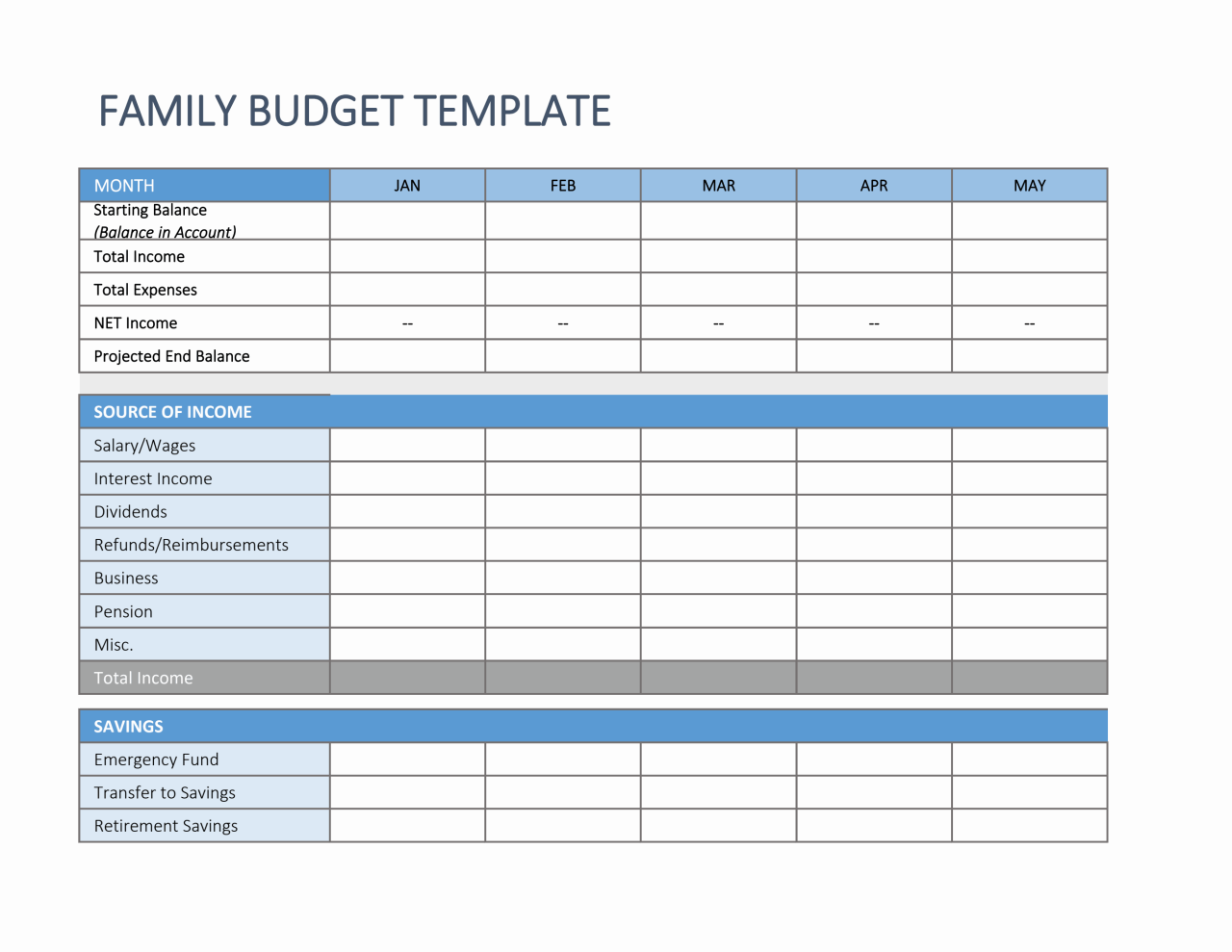

Tools and Software Available for Family Budgeting

- Utilize budgeting apps like Mint, YNAB, or EveryDollar to track expenses and set financial goals.

- Consider using spreadsheet software like Microsoft Excel or Google Sheets for customizable budget templates.

- Explore online banking tools that offer budgeting features and automatic categorization of expenses.

- Use envelope budgeting systems to allocate cash for different spending categories and avoid overspending.

The Importance of Involving All Family Members in the Budgeting Process

Involving all family members in the budgeting process promotes transparency, accountability, and shared financial responsibility. It allows everyone to understand the family’s financial situation, contribute to decision-making, and work together towards common financial goals. When each member has a voice in the budgeting process, it fosters a sense of unity and cooperation, strengthening the family’s overall financial well-being.

Managing Family Expenses

Managing family expenses is crucial to maintaining financial stability and achieving your financial goals. By tracking and categorizing expenses, cutting down on unnecessary costs, and prioritizing spending based on family needs, you can effectively manage your budget.

Tracking and Categorizing Family Expenses

Tracking and categorizing family expenses is essential to understand where your money is going. Utilize budgeting apps or spreadsheets to record all expenses, including bills, groceries, entertainment, and other purchases. Categorize expenses into fixed (mortgage, utilities) and variable (dining out, shopping) to identify areas where you can potentially cut costs.

Cutting Down on Unnecessary Expenses

To reduce unnecessary expenses, evaluate your spending habits and identify areas where you can make cuts. Consider cutting back on dining out, subscription services, or impulse purchases. Set a budget for discretionary spending and stick to it to avoid overspending.

Prioritizing Expenses Based on Family Needs

When prioritizing expenses, focus on essential needs such as housing, utilities, groceries, and healthcare. Allocate a portion of your budget for savings and emergency funds to prepare for unexpected expenses. Consider your long-term financial goals when making spending decisions to ensure financial security for your family.

Saving and Investing as a Family

Saving and investing as a family is crucial for building a secure financial future and achieving long-term financial goals together. By working as a team, families can maximize their resources and create a strong financial foundation for the future.

Importance of Saving and Investing for Families

One of the key reasons for families to save and invest is to provide financial security and stability. By setting aside money for emergencies, future expenses, and retirement, families can ensure that they are prepared for any unexpected financial challenges that may arise.

- Opening a high-yield savings account: This can help families earn more interest on their savings compared to traditional savings accounts.

- Investing in a 529 college savings plan: This is a tax-advantaged investment account specifically designed to help families save for their children’s education expenses.

- Investing in a diversified portfolio: Families can consider investing in a mix of stocks, bonds, and mutual funds to grow their wealth over time.

Benefits of Teaching Children about Saving and Investing Early On

It is never too early to start teaching children about the importance of saving and investing. By instilling good financial habits at a young age, children can develop a strong foundation for managing money responsibly and making informed financial decisions in the future.

- Learning the value of money: Teaching children about saving and investing helps them understand the importance of budgeting, setting financial goals, and delayed gratification.

- Building financial literacy: Educating children about financial concepts such as compound interest, risk, and diversification can help them become financially savvy adults.

- Fostering a sense of responsibility: By involving children in family financial discussions and decisions, parents can help them develop a sense of ownership and responsibility towards their financial future.

Dealing with Financial Challenges as a Family

Facing financial setbacks as a family can be tough, but with the right strategies and mindset, it’s possible to overcome them. Building resilience and preparedness are key in navigating unexpected financial difficulties.

Importance of Emergency Funds

Having an emergency fund is crucial for families to handle unexpected expenses without compromising their financial stability. This fund serves as a safety net during challenging times.

- Establish a separate savings account specifically for emergency funds.

- Strive to save at least 3-6 months’ worth of living expenses in this fund.

- Only use the emergency fund for true emergencies, not for regular expenses.

Adjusting the Family Budget

In times of financial difficulty, it’s important to reevaluate and adjust the family budget to make ends meet without sacrificing essential needs.

- Identify non-essential expenses that can be temporarily cut or reduced.

- Explore ways to increase income through part-time work or selling unused items.

- Communicate openly with family members about the situation and involve them in finding solutions.

Teaching Children about Budgeting

Teaching children about budgeting is crucial for their financial literacy and future success. By instilling good money management habits at a young age, children can develop a better understanding of the value of money and how to make wise financial decisions.

Importance of Educating Children about Budgeting

Introducing budgeting concepts to children at an early age can help them develop essential skills that will benefit them throughout their lives. Teaching children about budgeting can help them understand the importance of saving, setting financial goals, and making responsible spending choices.

Age-Appropriate Ways to Introduce Budgeting Concepts

- Start with simple concepts like saving money in a piggy bank or setting aside a portion of their allowance for a specific goal.

- Use everyday situations to teach children about budgeting, such as comparing prices at the grocery store or discussing the difference between needs and wants.

- Introduce the concept of budgeting through games or activities that make learning about money fun and engaging.

Activities or Games for Teaching Money Management

- Play “Grocery Store” where children can practice budgeting by “shopping” for items within a set budget.

- Create a savings challenge where children can set goals and track their progress towards saving for something they want.

- Use online resources or apps designed for children to learn about budgeting and money management in an interactive way.