Dive into the world of angel investing, where visionary individuals fuel the dreams of startups and pave the way for innovation. From high-risk ventures to potential high returns, this financial landscape is as thrilling as it is rewarding.

As we unravel the intricacies of angel investing, get ready to explore the key aspects that make this form of investment both unique and impactful.

What is Angel Investing?

Angel investing involves high-net-worth individuals providing financial backing for small startups or entrepreneurs. These angel investors typically offer capital in exchange for ownership equity in the company.

Examples of Successful Angel Investments

- One notable example is Peter Thiel, who provided early funding for Facebook in 2004. His $500,000 investment turned into billions when the company went public.

- Another successful angel investment is in Uber, where investors like Chris Sacca and Jason Calacanis saw massive returns after the company’s IPO.

Role of Angel Investors in Funding Startups

Angel investors play a crucial role in funding startups that may not have access to traditional sources of financing. They often provide not just capital, but also mentorship, advice, and valuable connections to help the startup grow and succeed.

Characteristics of Angel Investors

Angel investors are individuals who provide financial backing to startups or small businesses in exchange for ownership equity. They play a crucial role in funding early-stage companies and helping them grow. Here are some common traits of angel investors:

Risk Tolerance

Angel investors are known for their high risk tolerance compared to other investors. They are willing to take a chance on new and unproven businesses, understanding that not all investments will be successful. This risk-taking attitude sets them apart from more conservative investors who prefer safer, established companies.

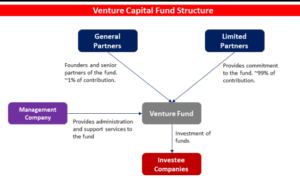

Differences from Venture Capitalists

Angel investors differ from venture capitalists in several ways. While both provide funding to startups, angel investors typically invest their own money, whereas venture capitalists manage pooled funds from multiple investors. Angel investors are also more hands-on in their approach, offering mentorship and guidance to the companies they invest in, whereas venture capitalists often take a more passive role.

Benefits of Angel Investing

Angel investing offers several advantages for startups, going beyond just providing funding. Angel investors can bring valuable expertise, industry connections, and mentorship to the table, helping startups navigate challenges and make strategic decisions. Additionally, angel investors often invest their own money, showing a strong belief in the potential of the startup.

Potential for High Returns

Angel investing presents the potential for high returns, as startups have the opportunity to grow rapidly and become successful. While there are risks involved in angel investing, the possibility of significant returns is an attractive proposition for many investors. Successful startups can provide angel investors with substantial profits, making angel investing a lucrative investment option.

How to Become an Angel Investor

Becoming an angel investor requires careful consideration and strategic planning. Here are the key steps involved in entering the world of angel investing:

Networking in the Angel Investing Community

Building a strong network within the angel investing community is crucial for success. Here are some insights on the importance of networking:

- Attend industry events, conferences, and workshops to meet like-minded individuals and expand your network.

- Join angel investor groups or online platforms to connect with seasoned investors and learn from their experiences.

- Participate in pitch events and demo days to discover potential investment opportunities and build relationships with entrepreneurs.

Networking not only helps you access deal flow but also provides valuable insights and support from other investors.

Evaluating Potential Investment Opportunities

When evaluating potential investment opportunities as an angel investor, it’s essential to conduct thorough due diligence. Here are some tips on how to assess investment opportunities:

- Research the market and industry trends to understand the growth potential of the startup.

- Evaluate the team behind the startup, focusing on their experience, skills, and commitment to the business.

- Assess the product or service being offered, looking for uniqueness and market fit.

- Analyze the financials of the startup, including revenue projections, expenses, and funding needs.

- Seek advice from industry experts and mentors to gain additional perspectives on the investment opportunity.

By carefully evaluating potential investment opportunities, you can make informed decisions that increase your chances of success as an angel investor.

Risks and Challenges in Angel Investing

Angel investing can be a lucrative opportunity, but it also comes with its fair share of risks and challenges that investors need to navigate. Let’s dive into some of the key factors to consider:

Risks Associated with Angel Investing

- High Failure Rate: Startups have a high failure rate, and angel investors may lose their entire investment if the company does not succeed.

- Illiquidity: Investments in startups are illiquid and may take years to see a return, tying up capital for an extended period.

- Lack of Diversification: Angel investors often make concentrated investments in a few startups, increasing the risk if one or more of them fail.

- Market Risks: External market factors can impact the success of a startup, making it difficult to predict outcomes.

How Angel Investors Can Mitigate Risks

- Due Diligence: Conduct thorough research on the startup, its market, team, and competition before making an investment.

- Portfolio Diversification: Spread investments across multiple startups to reduce the impact of any single failure.

- Investment Terms: Negotiate favorable terms such as convertible notes or equity to protect your investment.

- Stay Informed: Stay involved with the startup post-investment to monitor progress and provide guidance when needed.

Challenges in the Startup Ecosystem

- Deal Flow: Finding high-quality startups to invest in can be challenging, requiring a strong network and deal sourcing abilities.

- Valuation: Determining the right valuation for a startup can be tricky, as early-stage companies often lack clear revenue and profit metrics.

- Exit Strategy: Planning for a successful exit strategy can be complex, as it may involve acquisition, IPO, or other avenues that are uncertain.

- Managing Risks: Balancing risk and reward in a startup portfolio requires strategic decision-making and continuous evaluation.