Best ways to invest in the stock market sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

When it comes to navigating the stock market, knowing the best strategies for investing can make all the difference in your financial success. Let’s dive into the key tips and techniques to help you make informed investment decisions.

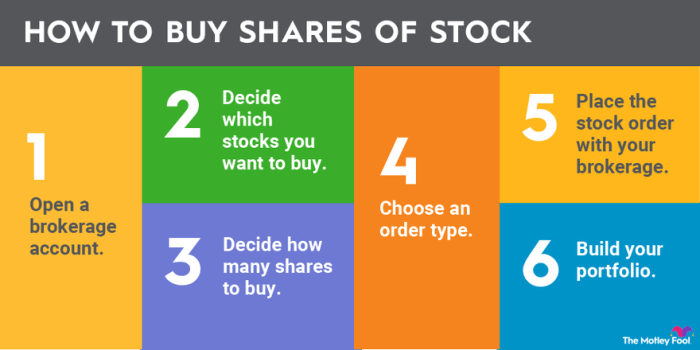

Ways to Start Investing in Stocks

Investing in stocks can be a great way to grow your wealth over time, but it’s essential to approach it with the right strategy. Here are some key ways to begin your stock market journey:

Buying Individual Stocks vs. Investing in ETFs or Mutual Funds

When starting to invest in stocks, one decision to make is whether to buy individual stocks or invest in ETFs (Exchange-Traded Funds) or mutual funds.

- Individual Stocks: Buying individual stocks means purchasing shares of a single company. This approach requires more research and monitoring, as the success of your investment depends on the performance of that specific company.

- ETFs or Mutual Funds: Investing in ETFs or mutual funds allows you to diversify your portfolio by owning a basket of different stocks. This can help reduce risk compared to investing in a single company.

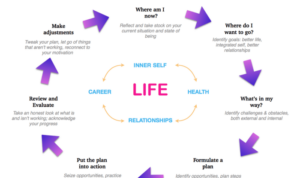

The Importance of Setting Investment Goals

Before jumping into the stock market, it’s crucial to set clear investment goals.

- Define your financial objectives, whether it’s saving for retirement, buying a house, or funding your child’s education.

- Determine your risk tolerance to align your investment strategy with your comfort level.

Tips on Researching and Choosing the Right Stocks

Research is key when selecting stocks to invest in to increase your chances of success.

- Look into the company’s financial health, growth prospects, and competitive advantage in the market.

- Consider the industry trends and economic conditions that could impact the company’s performance.

- Review analysts’ recommendations and historical stock performance to make informed decisions.

Understanding Risk and Return in Stock Market Investments: Best Ways To Invest In The Stock Market

Investing in the stock market involves a delicate balance between risk and return. The relationship between the two is crucial for investors to understand in order to make informed decisions and maximize their profits.When it comes to stock market investments, risk refers to the uncertainty of achieving expected returns. On the other hand, return is the profit or loss generated from an investment over a specific period of time.

Generally, the higher the risk, the higher the potential return, but this also means a greater chance of losing money.

Types of Risks in Stock Market Investments

- Market Risk: This type of risk is associated with overall market movements and cannot be diversified away. Factors like economic conditions, political events, and natural disasters can impact the entire market.

- Company-Specific Risk: Also known as unsystematic risk, this type of risk is specific to individual companies and can be reduced through diversification. Factors like management changes, product recalls, or lawsuits can affect a company’s stock price.

- Interest Rate Risk: Changes in interest rates can affect stock prices, especially for companies that rely heavily on debt financing. When interest rates rise, the cost of borrowing increases, impacting profitability.

Strategies to Manage Risk and Maximize Returns

- Diversification: By investing in a variety of stocks across different industries, investors can reduce company-specific risk and mitigate the impact of market fluctuations on their overall portfolio.

- Asset Allocation: Allocating investments across different asset classes, such as stocks, bonds, and real estate, can help balance risk and return based on individual financial goals and risk tolerance.

- Stop-Loss Orders: Setting predetermined price levels at which to sell a stock can help limit losses and protect investment capital in case of sudden price declines.

Long-Term vs. Short-Term Stock Market Investment Strategies

When it comes to investing in the stock market, one of the key decisions investors need to make is whether to adopt a long-term or short-term investment strategy. Each approach has its own set of benefits and drawbacks, and understanding the differences between them is crucial for making informed investment decisions.Long-term investment strategies involve buying and holding onto stocks for an extended period, typically five years or more.

This approach focuses on the overall growth potential of a company and aims to ride out market fluctuations over time. On the other hand, short-term trading approaches involve buying and selling stocks within a shorter time frame, often days, weeks, or months. This strategy relies on taking advantage of short-term price movements to generate quick profits.

Benefits and Drawbacks of Long-Term Investment Strategies

- Benefits:

- Reduced volatility risk: Long-term investors are less affected by short-term market fluctuations.

- Compound interest: Over time, reinvested dividends and capital appreciation can lead to significant wealth accumulation.

- Less time-intensive: Long-term investing requires less active management compared to short-term trading.

- Drawbacks:

- Lack of liquidity: Long-term investments may tie up capital for extended periods, limiting flexibility.

- Potential missed opportunities: Holding onto investments for too long can result in missing out on better opportunities.

Benefits and Drawbacks of Short-Term Trading Approaches

- Benefits:

- Potential for quick profits: Short-term traders can capitalize on immediate price movements to generate returns.

- Flexibility: Short-term trading allows for more frequent buying and selling of stocks.

- Drawbacks:

- High volatility risk: Short-term trading is susceptible to market volatility and can result in significant losses.

- Higher transaction costs: Frequent buying and selling can lead to increased transaction fees.

Diversification Techniques in Stock Market Investments

Diversification is a risk management strategy that involves spreading your investments across different assets to reduce the impact of any single investment’s performance on your overall portfolio. By diversifying, investors can potentially lower the overall risk of their portfolio while still aiming for returns.

Benefits of Diversification

- Diversifying across industries: Investing in companies from different sectors can help mitigate sector-specific risks. For example, if one industry performs poorly, other sectors may offset those losses.

- Diversifying across asset classes: Allocating investments across stocks, bonds, and other assets can help balance risk and return. Bonds, for instance, are generally less volatile than stocks and can provide stability in a portfolio.

- Diversifying by company size: Investing in companies of varying sizes, from large-cap to small-cap, can help spread risk. Smaller companies may offer higher growth potential but also come with higher risk, while larger companies may provide stability.

Impact of Diversification, Best ways to invest in the stock market

-

Diversification can lower the overall risk of a portfolio by reducing exposure to any single asset or market sector.

-

While diversification may not eliminate all risks, it can help investors manage volatility and potentially improve long-term returns.

-

By spreading investments across different assets, investors can avoid putting all their eggs in one basket and increase the likelihood of achieving a more balanced and stable portfolio.