Diving into the world of Online financial courses, get ready to explore the key to financial literacy and success in today’s digital landscape. From budgeting to investing, the journey begins here.

Introduction to Online Financial Courses

In today’s digital age, online financial courses have become increasingly important as individuals seek to enhance their financial literacy and make informed decisions about their money. These courses offer a convenient and flexible way to learn about various financial topics, ranging from basic budgeting to complex investment strategies.

Benefits of Online Financial Courses

- Accessibility: Online financial courses can be accessed anytime, anywhere, allowing individuals to learn at their own pace.

- Cost-effective: Compared to traditional in-person courses, online financial courses are often more affordable or even free, making financial education more accessible to a wider audience.

- Wide range of topics: Online platforms offer a diverse range of financial courses, catering to beginners and experienced individuals alike.

Statistics on the Growth of Online Financial Education

According to a recent study, the online education market is expected to reach $350 billion by 2025, with financial education being one of the fastest-growing segments.

Furthermore, the number of individuals enrolling in online financial courses has been steadily increasing, reflecting the growing demand for accessible and quality financial education.

Types of Online Financial Courses

Online financial courses cover a wide range of topics to help individuals improve their financial literacy and skills. Here are some common types of online financial courses available:

Investing Courses

- Introduction to Stock Market Investing

- Real Estate Investment Strategies

- Options Trading Basics

Budgeting Courses

- Personal Finance Management

- Creating a Budget That Works

- Financial Planning for Young Adults

Retirement Planning Courses

- Retirement Savings Strategies

- Social Security and Medicare Planning

- Investing for Retirement Income

Comparing Self-Paced and Live Virtual Classes

Self-paced online financial courses offer flexibility in terms of scheduling and completion time, allowing students to learn at their own pace. On the other hand, live virtual classes provide real-time interaction with instructors and other students, offering a more engaging learning experience.

Specialized Courses for Different Skill Levels

- Beginner Courses: Covering basics like financial terminology and simple budgeting techniques.

- Intermediate Courses: Exploring more advanced topics such as investment strategies and retirement planning options.

- Advanced Courses: Delving into complex financial concepts like derivatives trading and estate planning.

Choosing the Right Online Financial Course

When it comes to selecting the best online financial course for your individual needs, there are a few key factors to consider. From accreditation to reviews and curriculum, here are some tips to help you make the right choice.

Accreditation and Reputation

- Look for courses offered by accredited institutions or recognized organizations in the financial industry.

- Check reviews and ratings from past students to get an idea of the course quality and effectiveness.

- Consider the reputation of the course provider in the financial education sector.

Curriculum and Content

- Review the course curriculum to ensure it covers topics that are relevant to your financial goals and interests.

- Make sure the course content is up-to-date and includes practical examples and case studies.

- Consider the teaching methods used, such as videos, interactive quizzes, or live webinars.

Cost and Value

- Compare the cost of the course with the value it provides in terms of knowledge and skills acquired.

- Avoid courses that seem too expensive for the content offered or that have hidden fees.

- Look for courses that offer a good return on investment in terms of career advancement or personal finance management.

Learning Experience in Online Financial Courses

In online financial courses, students can expect a structured learning experience that typically includes a mix of videos, quizzes, and assignments. These elements are designed to help students grasp key concepts, test their understanding, and apply their knowledge in practical scenarios.

Structure of Online Financial Courses

- Video Lectures: Online financial courses often include video lectures where instructors explain complex topics in a more engaging and visual manner.

- Quizzes: Quizzes are used to assess students’ comprehension of the material covered in the course and reinforce learning.

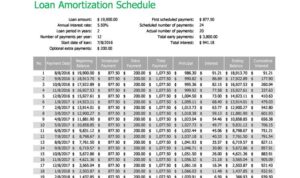

- Assignments: Assignments are given to students to apply what they have learned and demonstrate their ability to analyze financial data or make informed decisions.

Interaction on Online Platforms

Online platforms provide various tools to facilitate interaction between students and instructors, such as discussion forums, live webinars, and messaging systems. These features allow students to ask questions, participate in group discussions, and receive feedback from instructors in a timely manner.

Staying Motivated and Engaged

- Set Goals: Establish clear goals for what you want to achieve in the course to stay motivated throughout the learning process.

- Stay Organized: Create a study schedule and set aside dedicated time each day to engage with course materials and complete assignments.

- Engage with Peers: Participate in online discussions, group projects, or study groups to enhance your learning experience and stay connected with fellow students.

- Seek Help When Needed: Don’t hesitate to reach out to instructors or classmates if you have questions or need clarification on course content.

Advantages of Online Financial Courses

Online financial courses offer various advantages that can benefit both working professionals and students. These advantages include flexibility in scheduling, practical real-world knowledge, and the opportunity to enhance financial literacy.

Flexibility for Working Professionals and Students

- Online financial courses allow individuals to study at their own pace and convenience, fitting their learning around work schedules or other commitments.

- Students can access course materials and lectures at any time, enabling them to balance their academic studies with other responsibilities.

- Working professionals can continue their education without having to take time off from work, making it easier to advance their careers while gaining new financial skills.

Practical Real-World Knowledge

- Online financial courses often include case studies, simulations, and real-life examples to help students apply theoretical concepts to practical situations.

- By learning from industry experts and practitioners, individuals can gain insights into current trends and best practices in the financial sector.

- Hands-on projects and assignments can provide valuable experience in analyzing financial data, making forecasts, and developing investment strategies.

Financial Literacy and Better Decision-Making

- Online financial courses can help individuals improve their understanding of key financial concepts, such as budgeting, saving, investing, and managing debt.

- By acquiring financial literacy skills, students can make informed decisions about their personal finances, investments, and retirement planning.

- Access to online resources, tools, and forums can also empower individuals to seek advice, share knowledge, and collaborate with peers on financial matters.

Certification and Career Opportunities

Online financial course certifications hold significant importance in today’s job market. Employers value candidates who have completed relevant online financial courses as it demonstrates a commitment to professional development and a solid foundation of financial knowledge.

Enhanced Career Prospects

Completing online financial courses can greatly enhance career prospects by providing individuals with specialized skills and knowledge in various areas of finance. These courses help individuals stay updated on the latest trends and practices in the industry, making them more competitive in the job market.

- Online financial course certifications can lead to career advancement opportunities such as promotions and salary increases.

- Employers often prefer candidates with certifications as it validates their expertise and commitment to continuous learning.

- Individuals with online financial course certifications have a higher chance of standing out among other job applicants, especially in competitive industries.

Industries Valuing Online Financial Course Certifications

Online financial course certifications are highly valued in industries such as:

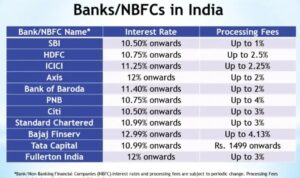

- Banking and Financial Services: Professionals in this industry benefit from certifications in areas like financial analysis, risk management, and investment banking.

- Accounting and Auditing: Certifications in areas like financial accounting, auditing, and taxation are essential for individuals pursuing careers in accounting firms.

- Consulting and Advisory Services: Professionals seeking roles in financial consulting and advisory services can benefit greatly from certifications in financial planning, wealth management, and business valuation.