Diving into the world of loan interest rates can be overwhelming, but fear not! In this guide, we’ll break down everything you need to know about lowering those rates like a pro. From understanding the factors at play to exploring effective financial management techniques, we’ve got you covered. So, buckle up and get ready to take control of your finances!

When it comes to navigating the complex landscape of loan interest rates, knowledge truly is power. Let’s empower you with the tools and strategies needed to secure the best possible rates for your financial future.

Understanding Loan Interest Rates

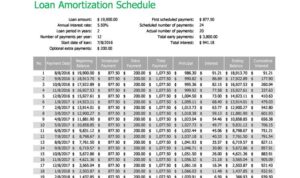

When it comes to loan interest rates, there are several key factors that influence how much you’ll end up paying over the life of the loan. Understanding these factors can help you make informed decisions when borrowing money.

Factors Influencing Loan Interest Rates

- The borrower’s credit score plays a significant role in determining the interest rate offered by lenders. A higher credit score typically leads to lower interest rates, as it signals to lenders that the borrower is less risky.

- The type of loan you choose can also impact the interest rate. For example, secured loans, which are backed by collateral, tend to have lower interest rates compared to unsecured loans.

- Economic conditions and market trends can affect interest rates as well. Lenders may adjust their rates based on factors like inflation, the Federal Reserve’s monetary policy, and overall demand for loans.

Difference Between Fixed and Variable Interest Rates

- Fixed interest rates remain the same throughout the life of the loan, providing predictability in monthly payments. On the other hand, variable interest rates can fluctuate based on market conditions, potentially leading to higher or lower payments over time.

- Borrowers who prefer stability and want to know exactly how much they’ll pay each month may opt for a fixed interest rate. Those who are comfortable with some level of risk and potential savings might choose a variable rate.

Credit Scores Impact on Interest Rates

- A borrower’s credit score is a significant factor in determining the interest rate offered by lenders. Higher credit scores generally result in lower interest rates, while lower scores may lead to higher rates or difficulty in securing a loan.

- Lenders use credit scores to assess the risk of lending to a borrower. Those with higher scores are seen as more likely to repay the loan on time, making them eligible for better interest rates.

Ways to Lower Loan Interest Rates

When it comes to lowering your loan interest rates, there are a few key strategies you can consider. Improving your credit score, exploring refinancing options, and negotiating with lenders based on your financial stability are all effective ways to secure lower interest rates on your loans.

Improve Credit Scores for Better Interest Rates

Improving your credit score is one of the most impactful ways to lower your loan interest rates. Lenders use credit scores to assess your creditworthiness, and a higher score typically results in lower interest rates. To boost your credit score, make sure to pay your bills on time, keep your credit card balances low, and avoid opening multiple new credit accounts.

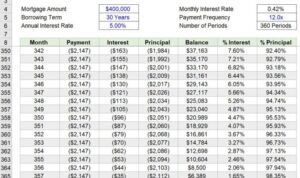

Explore Refinancing to Secure Lower Interest Rates

Refinancing your loan is another option to consider if you want to lower your interest rates. By refinancing, you can replace your current loan with a new one that has more favorable terms, including a lower interest rate. Keep in mind that refinancing may come with closing costs, so be sure to weigh the potential savings against any fees involved.

Negotiate with Lenders for Lower Interest Rates

Don’t be afraid to negotiate with your lenders for lower interest rates, especially if you have a strong financial position. Lenders may be willing to lower your interest rates if you demonstrate financial stability, a history of on-time payments, or if you have multiple accounts with them. It never hurts to ask, so be proactive in reaching out to discuss your options for lowering your loan interest rates.

Financial Management Techniques

Effective financial management is key to qualifying for lower loan interest rates. By implementing smart strategies and maintaining a healthy financial profile, you can increase your chances of securing favorable terms on your loans. One crucial aspect to focus on is your debt-to-income ratio, as it plays a significant role in lenders’ decisions. Timely payments also contribute to reducing interest rates over time, showcasing your reliability as a borrower.

Importance of Debt-to-Income Ratio

Maintaining a low debt-to-income ratio is essential when aiming for lower loan interest rates. This ratio compares your monthly debt payments to your gross monthly income. Lenders use this metric to assess your ability to manage additional debt responsibly. To improve your debt-to-income ratio, consider paying off existing debts, increasing your income, or avoiding taking on new debts.

Role of Timely Payments

Making timely payments on your loans is crucial for reducing interest rates over time. Late payments can negatively impact your credit score and signal to lenders that you may be a risky borrower. By consistently paying on time, you not only improve your creditworthiness but also demonstrate financial responsibility. This can lead to better loan terms and lower interest rates in the future.

Seeking Professional Advice

When it comes to lowering loan interest rates, seeking professional advice can be a game-changer. Financial advisors are equipped with the knowledge and expertise to provide guidance on the best strategies to reduce interest rates on your loans.

Benefits of Consulting Financial Advisors

- Financial advisors can help analyze your current financial situation and recommend personalized solutions to lower your loan interest rates.

- They can provide expert advice on refinancing options, debt consolidation, and other financial management techniques that can lead to lower interest rates.

- By working with a financial advisor, you can gain a better understanding of your financial goals and develop a plan to achieve them while minimizing interest costs.

Role of Loan Officers

- Loan officers play a crucial role in assisting borrowers with interest rate reduction strategies.

- They can provide information on available loan products, terms, and conditions that may help lower your interest rates.

- Loan officers can guide you through the loan application process and negotiate on your behalf to secure favorable interest rates.

Navigating Economic Conditions

- Professional financial advisors can help you navigate changing economic conditions that impact loan interest rates.

- They can monitor market trends, interest rate fluctuations, and economic indicators to advise you on the best course of action to lower your interest rates.

- By staying informed and proactive, with the help of financial professionals, you can make strategic decisions to minimize the impact of economic conditions on your loan interest rates.