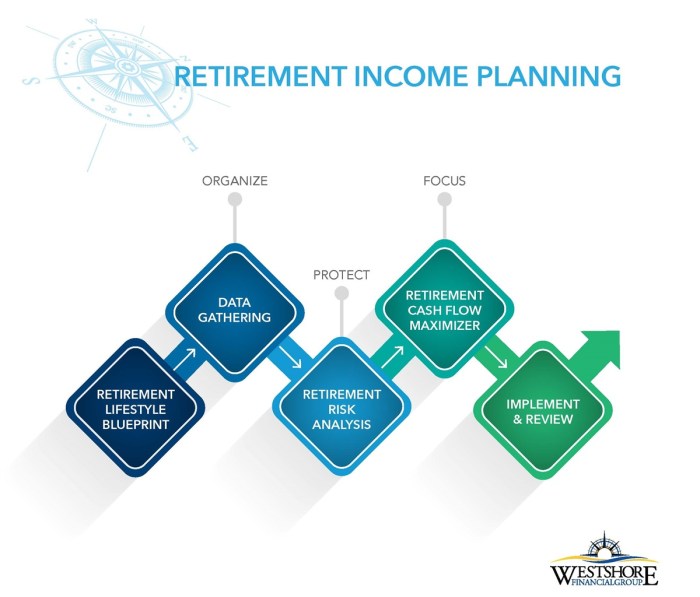

When it comes to retirement income planning, securing your financial future is key. Let’s dive into the ins and outs of this crucial topic and explore how early planning can pave the way for a comfortable retirement.

Importance of Retirement Income Planning

Retirement income planning is essential for ensuring financial security during your retirement years. It involves creating a strategy to manage your income sources, expenses, and investments to support your desired lifestyle after you stop working.

Not having a retirement income plan in place can lead to various risks, such as outliving your savings, relying solely on social security benefits, or not being able to cover unexpected expenses. Without a solid plan, you may have to compromise on your retirement goals and face financial hardships in your later years.

Early Retirement Income Planning

Starting to plan for your retirement income early can have a significant positive impact on your future financial well-being. By saving and investing wisely in your early working years, you can benefit from compound interest, grow your retirement nest egg, and have more flexibility and options for your retirement lifestyle. Taking proactive steps towards retirement income planning early on can help you achieve financial independence and peace of mind in your retirement years.

Types of Retirement Income Sources

When planning for retirement, it’s crucial to consider the different sources of income that will support you during your golden years. Let’s take a look at some common retirement income sources and discuss their benefits and drawbacks.

Pensions

Pensions are a traditional form of retirement income provided by some employers. They offer a stable and predictable stream of income during retirement, which can be reassuring for retirees. However, pensions are becoming less common in today’s workforce, and not all workers have access to this benefit.

Social Security

Social Security is a government program that provides a monthly income to eligible retirees. It serves as a reliable source of income for many retirees, offering financial stability. However, the future sustainability of Social Security has been a topic of debate, raising concerns about potential cuts or changes to the program.

Savings

Personal savings, such as 401(k) or IRA accounts, are another important source of retirement income. Saving regularly and investing wisely can help build a nest egg for retirement. The flexibility and control over your savings are key benefits, but the growth of savings is not guaranteed, and market fluctuations can impact the value of your investments.

Investments

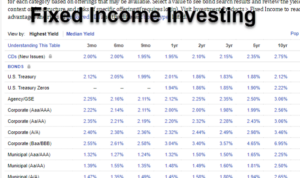

Investments, such as stocks, bonds, and real estate, can provide additional income during retirement. They offer the potential for higher returns compared to traditional savings accounts. However, investments come with risks, and the value of your investments can fluctuate based on market conditions.

Comparison of Retirement Income Sources

In comparing these retirement income sources, it’s essential to consider the reliability and sustainability of each option. Pensions and Social Security offer more stability, while savings and investments provide potential for growth. Diversifying your income sources can help mitigate risks and ensure a more secure retirement.

Strategies for Retirement Income Planning

When it comes to retirement income planning, there are several key strategies that can help you make the most of your resources and ensure a comfortable retirement. From maximizing Social Security benefits to creating a diversified income portfolio, these strategies can help you achieve financial security in your golden years.

Maximizing Social Security Benefits

- Delaying Social Security benefits can result in higher monthly payments when you do start claiming.

- Consider your full retirement age and the impact of claiming benefits early or late on your overall income.

- Spousal benefits and survivor benefits can also play a role in maximizing your Social Security income.

Creating a Diversified Retirement Income Portfolio

- Diversification is key to reducing risk and ensuring a steady income stream in retirement.

- Consider a mix of assets such as stocks, bonds, real estate, and other investments to balance risk and return.

- Regularly review and adjust your portfolio based on your risk tolerance and financial goals.

Role of Annuities in Retirement Income Planning

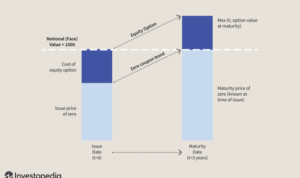

- Annuities can provide a guaranteed income stream for life, offering protection against outliving your savings.

- Fixed annuities offer a set payout amount, while variable annuities allow for investment in market-based funds.

- Consider the fees, surrender charges, and terms of the annuity before making a decision to ensure it aligns with your retirement goals.

Challenges in Retirement Income Planning

Planning for retirement income can be a daunting task, as individuals face various challenges that can impact their financial stability during retirement. These challenges often require careful consideration and strategic adjustments to ensure a comfortable retirement.

Unexpected Expenses

Unexpected expenses can significantly impact retirement income plans, as they can arise suddenly and deplete savings intended for retirement. These expenses could include medical emergencies, home repairs, or other unforeseen costs that were not accounted for in the initial retirement plan. To address this challenge, individuals should consider building an emergency fund to cover unexpected expenses without dipping into their retirement savings.

Changing Financial Circumstances

It is essential to adjust retirement income plans based on changing financial circumstances, such as fluctuations in the stock market, inflation, or changes in living expenses. Failing to adapt to these changes can lead to financial strain during retirement. By regularly reviewing and adjusting retirement income plans, individuals can ensure they are adequately prepared to meet their financial needs throughout retirement.

Tools and Resources for Retirement Income Planning

Planning for retirement can be a daunting task, but thankfully there are various tools and resources available to help you navigate the process and make informed decisions. From retirement calculators to budgeting apps, these tools can assist you in creating a solid plan for your financial future.

Retirement Calculators

- Retirement calculators are online tools that help you estimate how much money you will need to retire comfortably based on factors like your current savings, expected retirement age, and desired lifestyle.

- Popular retirement calculators include Vanguard’s Retirement Nest Egg Calculator and the AARP Retirement Calculator.

Budgeting Apps

- Budgeting apps such as Mint and Personal Capital can help you track your expenses, set savings goals, and create a budget that aligns with your retirement plans.

- These apps can provide insights into your spending habits and help you identify areas where you can cut back to save more for retirement.

Investment Platforms

- Platforms like Fidelity, Charles Schwab, and Vanguard offer a range of investment options to help you grow your retirement savings.

- Financial advisors can assist you in selecting the right investments based on your risk tolerance, time horizon, and financial goals.

Financial Advisors

- Financial advisors play a crucial role in retirement income planning by providing personalized advice and guidance tailored to your individual needs.

- They can help you create a comprehensive retirement plan, optimize your investments, and adjust your strategy as needed to ensure financial security in retirement.

Online Resources

- Reputable online resources like Investopedia, NerdWallet, and The Balance offer a wealth of information on retirement income planning, investment strategies, and retirement savings vehicles.

- These resources can help you enhance your knowledge, stay informed about market trends, and make informed decisions about your retirement finances.