Step into the world of investment automation where cutting-edge technology meets financial savvy. Get ready to explore the realm of automated investment strategies with a twist of innovation and efficiency.

Let’s dive deeper into the realm of investment automation and discover its significance, evolution, benefits, types of tools, implementation, risks, and limitations.

Overview of Investment Automation

Investment automation is the use of technology and algorithms to make investment decisions without human intervention. It plays a significant role in the financial industry by streamlining processes, reducing human error, and increasing efficiency in managing investments.

Evolution of Investment Automation

Investment automation has evolved significantly over the years, from simple rule-based systems to complex artificial intelligence algorithms. In the past, investors relied on manual analysis and trading, but with advancements in technology, automation has become more prevalent.

- Robo-advisors: Robo-advisors are automated platforms that provide investment advice and portfolio management based on algorithms and risk profiles.

- Algorithmic trading: Algorithmic trading uses pre-defined instructions to execute trades at optimal prices and times, eliminating emotional bias in decision-making.

- Machine learning: Machine learning algorithms analyze vast amounts of data to identify patterns and make predictions about market trends and investment opportunities.

Benefits of Investment Automation

Investment automation offers numerous advantages in the financial world, streamlining processes and maximizing efficiency for investors of all levels. By utilizing automated tools and strategies, individuals and organizations can enhance their investment performance and achieve their financial goals more effectively.

Increased Efficiency

Automated investment platforms enable users to execute trades, rebalance portfolios, and monitor market conditions in real-time without constant manual supervision. This results in faster decision-making and reduced human error, ultimately leading to improved investment outcomes.

Cost-Effectiveness

Compared to traditional manual approaches, investment automation can significantly lower costs associated with trading fees, advisory services, and portfolio management. This cost savings can have a substantial impact on overall investment returns over time.

Portfolio Diversification

Automation allows investors to easily diversify their portfolios across different asset classes, regions, and industries. By spreading risk through automated allocation strategies, individuals can achieve a more balanced and resilient investment portfolio.

Success Stories

Numerous companies and individuals have successfully leveraged investment automation to grow their wealth and achieve financial independence. For example, Robo-advisors like Betterment and Wealthfront have revolutionized the investment industry by offering automated portfolio management services that have outperformed many traditional investment approaches.

Market Timing

Automation tools can help investors make informed decisions based on market trends and data analysis. By utilizing algorithms and artificial intelligence, individuals can capitalize on market opportunities and adjust their investment strategies in real-time to maximize returns.

Risk Management

Automated risk assessment tools can provide investors with valuable insights into their risk tolerance and help them create a diversified portfolio that aligns with their investment goals. This proactive risk management approach can safeguard investments against market volatility and unforeseen events.

Types of Investment Automation Tools

Investment automation tools come in various forms to cater to different needs and strategies of investors. Let’s explore some of the common types available in the market.

Robo-Advisors

Robo-advisors are automated platforms that provide algorithm-based financial planning services. They typically offer portfolio management, asset allocation, and investment recommendations based on the investor’s risk tolerance and financial goals. Robo-advisors are ideal for passive investors looking for a hands-off approach to managing their investments.

Algorithmic Trading Platforms

Algorithmic trading platforms utilize complex mathematical algorithms to execute trades automatically based on predefined criteria. These tools are popular among active traders and institutional investors looking to capitalize on market inefficiencies and arbitrage opportunities. Algorithmic trading platforms can execute trades at high speeds and volumes, which may not be feasible for individual investors.

Automated Investment Solutions

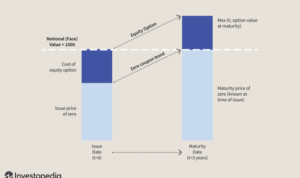

Automated investment solutions encompass a broader category of tools that automate various aspects of the investment process, including portfolio rebalancing, tax-loss harvesting, and dividend reinvestment. These tools are designed to streamline the investment management process and help investors maintain a disciplined approach to their portfolios. Automated investment solutions can be customized to suit different investment goals and risk profiles.

Each type of investment automation tool caters to specific needs and strategies. Robo-advisors are suitable for passive investors seeking a hands-off approach, while algorithmic trading platforms are more geared towards active traders looking for sophisticated trading strategies. Automated investment solutions offer a comprehensive approach to managing investments, with a focus on efficiency and customization.

Implementation of Investment Automation

Investment automation can revolutionize the way financial institutions manage their portfolios and make investment decisions. Implementing this technology involves several crucial steps to ensure a smooth transition and maximize the benefits it offers.

Steps in Implementing Investment Automation

- Assess Current Processes: Evaluate existing investment processes and identify areas that can be automated for efficiency.

- Define Objectives: Clearly Artikel the goals and objectives of implementing investment automation to align with the organization’s overall strategy.

- Choose the Right Tools: Select automation tools that are tailored to the specific needs of the organization and offer the functionalities required for effective investment management.

- Integration with Existing Systems: Ensure seamless integration of automation tools with existing systems to avoid disruptions and maximize efficiency.

- Training and Adoption: Provide comprehensive training to staff members on how to use the new automation tools effectively and encourage adoption across the organization.

- Monitoring and Evaluation: Continuously monitor the performance of the automated investment systems and evaluate their impact on investment outcomes.

Considerations for Choosing Automation Tools

- Scalability: Ensure that the automation tools can scale with the organization’s growth and increasing investment needs.

- Customization: Look for tools that can be customized to fit the unique requirements of the organization and its investment strategies.

- Security: Prioritize tools that offer robust security features to protect sensitive financial data and ensure compliance with regulations.

- Cost-Efficiency: Evaluate the cost of implementing and maintaining automation tools in relation to the expected benefits and ROI.

Challenges in Transitioning to Automated Investment Systems

- Resistance to Change: Employees may resist the adoption of automation tools due to fear of job displacement or unfamiliarity with new technology.

- Data Integration Issues: Ensuring seamless integration of data from different sources into automated systems can be a complex and time-consuming process.

- Regulatory Compliance: Meeting regulatory requirements when implementing automated investment systems poses challenges in ensuring transparency and accountability.

- Technical Challenges: Dealing with technical issues such as system compatibility, data security, and software updates can impede the smooth transition to automation.

Risks and Limitations of Investment Automation

Investment automation can offer numerous benefits, but it also comes with its own set of risks and limitations that investors need to be aware of in order to make informed decisions.

Potential Risks of Investment Automation

- Overreliance on algorithms: Relying solely on automated investment strategies without human oversight can lead to significant losses if the algorithms are not properly calibrated or if market conditions change unexpectedly.

- Technical failures: Automation tools can experience technical glitches or malfunctions, which may result in erroneous trades or missed opportunities.

- Market volatility: Automated systems may struggle to adapt to extreme market volatility or sudden changes, leading to suboptimal investment decisions.

Limitations of Investment Automation

- Complex market conditions: Automated systems may not always be equipped to handle complex or unpredictable market conditions that require human intuition and judgment.

- Emotional factors: Automation tools lack the emotional intelligence and gut instinct that human investors possess, which can be crucial in certain situations.

- Lack of customization: Automated strategies may not be able to cater to the unique preferences or risk tolerances of individual investors, leading to subpar results.

Recommendations for Mitigating Risks

- Regular monitoring: Investors should regularly monitor and review the performance of their automated strategies to ensure they are aligned with their investment goals.

- Diversification: Diversifying investment portfolios can help mitigate risks associated with automated strategies by spreading investments across different assets.

- Human oversight: Combining automated tools with human oversight can help address the limitations of automation and ensure that investment decisions are well-informed.