Yo, check it out! Financial markets basics are like the foundation of the money game, and we’re about to drop some knowledge bombs that’ll have you seeing dollar signs. Get ready to dive into the world of stocks, bonds, and all that jazz with a fresh perspective that’s gonna make your wallet thank you.

So, let’s break it down for you – from the players in the game to the instruments they trade, we’re here to give you the lowdown on everything you need to know about financial markets basics.

Overview of Financial Markets Basics

Financial markets are platforms where individuals and entities can trade financial securities, commodities, and other fungible items at prices determined by market forces. These markets play a crucial role in facilitating the flow of capital throughout the economy, allowing for efficient allocation of resources and risk management.

Types of Financial Markets

- The stock market: A marketplace where shares of publicly traded companies are bought and sold. Investors can participate in the growth of companies and earn returns through capital gains and dividends.

- The bond market: Also known as the debt market, where governments, corporations, and other entities issue bonds to raise capital. Investors purchase bonds as a form of fixed-income investment, receiving periodic interest payments and the return of the principal amount at maturity.

- The money market: A segment of the financial market where short-term debt securities with high liquidity and low risk are traded. Participants in the money market include banks, financial institutions, and government entities seeking to manage their short-term cash needs.

Participants in Financial Markets

Financial markets involve a variety of key players who play different roles in the buying and selling of financial assets. These participants include investors, financial institutions, and corporations. Each group has its own objectives and impacts the market in different ways.

Investors

Investors are individuals or entities that provide capital to financial markets with the expectation of receiving a return on their investment. They can be classified into different categories such as retail investors, institutional investors, and foreign investors. Retail investors are individual investors who trade on their own behalf, while institutional investors manage large pools of money on behalf of clients. Foreign investors are individuals or institutions from other countries who invest in domestic financial markets.

- Investors play a crucial role in determining the demand and supply of financial assets in the market.

- They influence market prices through their buying and selling activities.

- Investors also contribute to market efficiency by providing liquidity and capital.

Financial Institutions

Financial institutions include banks, insurance companies, investment firms, and other entities that provide financial services. These institutions facilitate the flow of funds between investors and borrowers, manage risk, and offer various financial products and services to clients.

- Financial institutions act as intermediaries in the financial markets by connecting borrowers with lenders.

- They help investors diversify their portfolios and manage their investments effectively.

- Financial institutions also play a role in market regulation and compliance to ensure the stability and integrity of the financial system.

Corporations

Corporations are businesses that issue stocks and bonds to raise capital for their operations and expansion. They participate in financial markets by issuing securities, investing excess funds, and managing financial risks.

- Corporations rely on financial markets to raise capital through initial public offerings (IPOs) and bond issuances.

- They engage in activities such as mergers and acquisitions, stock buybacks, and dividend payments that affect their stock prices and market dynamics.

- Corporations are also subject to regulations that govern their financial reporting, disclosure requirements, and corporate governance practices.

Instruments Traded in Financial Markets

In financial markets, various types of instruments are traded by investors to achieve different financial objectives. These instruments can range from traditional stocks and bonds to more complex derivatives.

Stocks:

Stocks represent ownership in a company and are one of the most common financial instruments traded in the stock market. Investors buy shares of a company’s stock in the hope that the value of the stock will increase over time, allowing them to profit from capital appreciation.

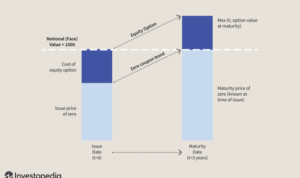

Bonds:

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When an investor buys a bond, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are typically seen as lower-risk investments compared to stocks.

Derivatives:

Derivatives are financial instruments whose value is derived from an underlying asset or index. This can include options, futures, swaps, and forwards. Derivatives are often used for hedging risk, speculation, or to gain leverage in the market. They can be highly complex and may involve significant risks.

Comparison of Characteristics:

– Stocks offer ownership in a company and potential for high returns but come with higher volatility.

– Bonds provide fixed income and lower risk compared to stocks but offer lower potential returns.

– Derivatives offer flexibility, leverage, and the ability to hedge risk but can be highly risky and complex.

Examples of Use:

– Investors may buy stocks of growing companies for long-term capital appreciation.

– Conservative investors may invest in bonds for steady income and capital preservation.

– Traders may use derivatives like options to hedge their stock positions against market volatility.

Market Structure and Functionality

When it comes to financial markets, understanding the structure and functionality is key to successful trading. Let’s dive into the primary vs. secondary markets, exchanges vs. over-the-counter markets, and how market price is determined.

Primary vs. Secondary Markets

In the primary market, new securities are issued and sold by companies or governments directly to investors. This is where initial public offerings (IPOs) take place. On the other hand, the secondary market is where existing securities are bought and sold among investors, with no involvement from the issuing company or government.

Exchanges vs. Over-the-Counter Markets

Exchanges are centralized marketplaces where buyers and sellers come together to trade securities. Examples include the New York Stock Exchange (NYSE) and the Nasdaq. On the contrary, over-the-counter (OTC) markets are decentralized and do not have a physical location. Trading is done directly between parties, facilitated by dealers or brokers.

Market Price Determination

Market price is determined by the forces of supply and demand. When there is high demand for a security and limited supply, prices tend to rise. Conversely, if supply exceeds demand, prices will fall. Factors influencing market price include economic indicators, company performance, geopolitical events, and investor sentiment.

Market Liquidity

Market liquidity refers to how easily and quickly an asset can be bought or sold without significantly impacting its price. High liquidity means there are many buyers and sellers in the market, making it easier to execute trades. Liquidity is crucial for ensuring smooth trading and minimizing transaction costs for investors.

Market Analysis and Investment Strategies

In the world of financial markets, analyzing market trends and developing investment strategies are crucial for investors to make informed decisions and maximize returns on their investments. Let’s dive into the key concepts of market analysis and investment strategies.

Fundamental and Technical Analysis

Fundamental analysis involves evaluating the intrinsic value of an asset by examining financial statements, economic indicators, and market trends. Investors using fundamental analysis focus on factors such as revenue, earnings, and industry trends to determine whether an asset is undervalued or overvalued.

Technical analysis, on the other hand, relies on historical price data and market statistics to forecast future price movements. Traders using technical analysis analyze charts, patterns, and indicators to identify trends and make buy or sell decisions based on past price movements.

Common Investment Strategies

- Value Investing: Value investors seek to buy undervalued assets that have the potential to increase in price over time. They focus on finding bargains in the market and holding onto these assets for the long term.

- Growth Investing: Growth investors look for assets with high growth potential, even if they may be trading at a premium. They are willing to pay a higher price for assets expected to grow rapidly in the future.

- Diversification: Diversification involves spreading investments across different asset classes, sectors, and geographic regions to reduce risk. By diversifying their portfolios, investors can minimize the impact of market volatility on their overall returns.

Market Trends and Sentiment Impact

Market trends and sentiment play a significant role in shaping investment decisions. Positive market trends and sentiment can lead to increased investor confidence and higher asset prices, while negative trends and sentiment can trigger sell-offs and market downturns. It’s essential for investors to stay informed about market developments and sentiment to adjust their strategies accordingly.

Risk Management in Financial Markets

When it comes to financial markets, managing risks is crucial for investors and financial institutions. By understanding and mitigating various types of risks, they can protect their investments and assets.

Types of Risks in Financial Markets

- Market Risk: This type of risk arises from the uncertainty of market movements, such as changes in interest rates, inflation, or economic conditions.

- Credit Risk: Credit risk refers to the potential loss that may occur if a borrower fails to repay a loan or debt obligation.

- Liquidity Risk: Liquidity risk involves the inability to quickly buy or sell an asset without causing a significant change in its price.

Risk Management Strategies

- Diversification: Investors can reduce their exposure to risk by spreading their investments across different asset classes, sectors, or geographic regions.

- Asset Allocation: By strategically allocating assets based on risk tolerance and investment goals, investors can balance risk and return.

- Stop-Loss Orders: Setting stop-loss orders helps investors limit potential losses by automatically selling an asset if it reaches a predetermined price.

Role of Financial Derivatives

Financial derivatives, such as options and futures contracts, are essential tools for hedging against risks in financial markets. These instruments allow investors to protect themselves from adverse market movements by locking in prices or rates for future transactions.

Using financial derivatives can help investors manage risk exposure and minimize potential losses in volatile market conditions.

Market Efficiency and Behavioral Finance

In the world of finance, the concept of market efficiency and the study of behavioral finance play crucial roles in understanding how financial markets operate and how investors behave.

Market Efficiency and the Efficient Market Hypothesis:

Market efficiency refers to the degree to which stock prices reflect all available information in the market. The Efficient Market Hypothesis (EMH) asserts that it is impossible to consistently outperform the market because stock prices already incorporate and reflect all relevant information.

Anomalies in Financial Markets:

Despite the EMH, anomalies exist in financial markets that challenge the notion of market efficiency. These anomalies include phenomena like market bubbles, where asset prices soar to unsustainable levels, and market crashes, where prices plummet unexpectedly. These events suggest that markets are not always efficient and can be influenced by irrational behavior.

Principles of Behavioral Finance:

Behavioral finance explores how psychological factors and cognitive biases affect investor decision-making. Investors often deviate from rationality due to emotions like fear and greed, leading to suboptimal choices and market inefficiencies. Behavioral finance seeks to understand these deviations and their impact on market dynamics.

Biases in Investor Behavior

- Overconfidence Bias: Investors tend to overestimate their abilities and make riskier investment decisions.

- Loss Aversion Bias: Investors fear losses more than they value gains, leading to conservative investment choices.

- Herding Behavior: Investors follow the actions of others without independent analysis, leading to market bubbles and crashes.

Implications for Financial Markets

- Market Inefficiencies: Behavioral biases can cause mispricing of assets and create trading opportunities for informed investors.

- Volatility and Momentum: Investor sentiment can drive market volatility and create momentum effects that deviate from rational expectations.

- Risk Management: Understanding behavioral finance principles is essential for effective risk management and decision-making in financial markets.