Yo, diving into the world of investment diversification! Get ready for a wild ride as we break down the ins and outs of spreading those funds across different assets. From stocks to real estate, we’ve got you covered.

Now, let’s dig deeper into what it means to diversify your investments and why it’s crucial in today’s ever-changing financial landscape.

What is Investment Diversification?

Investment diversification is a strategy used by investors to spread their investments across different assets to minimize risk and maximize returns. By diversifying their portfolios, investors can reduce the impact of volatility in any one asset class on their overall wealth.

Importance of Diversifying Investment Portfolios

Diversifying investment portfolios is crucial because it helps in spreading risk. If one asset underperforms, the impact on the entire portfolio is minimized because of the presence of other investments. This strategy also helps in achieving a balance between risk and return.

- Diversification helps in reducing the overall risk of the portfolio.

- It allows investors to take advantage of different market conditions.

- By diversifying, investors can protect themselves from potential losses in one particular asset class.

Examples of Different Types of Assets for Diversification

When diversifying investments, investors can consider a range of assets such as stocks, bonds, real estate, commodities, and even alternative investments like cryptocurrencies or precious metals. Each asset class has its own risk and return profile, and combining them in a portfolio can help in achieving a well-rounded investment strategy.

Remember, don’t put all your eggs in one basket. Diversification is key to a successful investment strategy.

Benefits of Investment Diversification

Diversifying your investments can offer several advantages that help you manage risks and potentially increase returns over time.

Reduced Risk

One of the key benefits of investment diversification is the reduction of overall risk in your portfolio. By spreading your investments across different asset classes, industries, and geographical regions, you can lower the impact of a single investment underperforming or facing a downturn.

Steady Returns

Investment diversification can help you achieve more consistent returns over time. Even if one sector or asset class experiences a decline, other investments in your portfolio may continue to perform well, balancing out any losses.

Opportunity for Growth

Having a diversified investment portfolio allows you to tap into various growth opportunities. By investing in different types of assets, you can benefit from the potential growth of multiple sectors or markets, maximizing your chances of achieving long-term financial goals.

Real-Life Scenario: 2008 Financial Crisis

During the 2008 financial crisis, investors who had diversified portfolios were better positioned to weather the storm. While certain sectors like real estate and banking faced significant losses, those with diversified holdings in other industries were able to mitigate the impact and recover more quickly.

Strategies for Diversifying Investments

When it comes to diversifying your investment portfolio, it’s crucial to explore different strategies to minimize risk and maximize returns. One key concept in diversification is asset allocation, which involves spreading your investments across different asset classes to reduce exposure to any single type of risk.

Asset Allocation

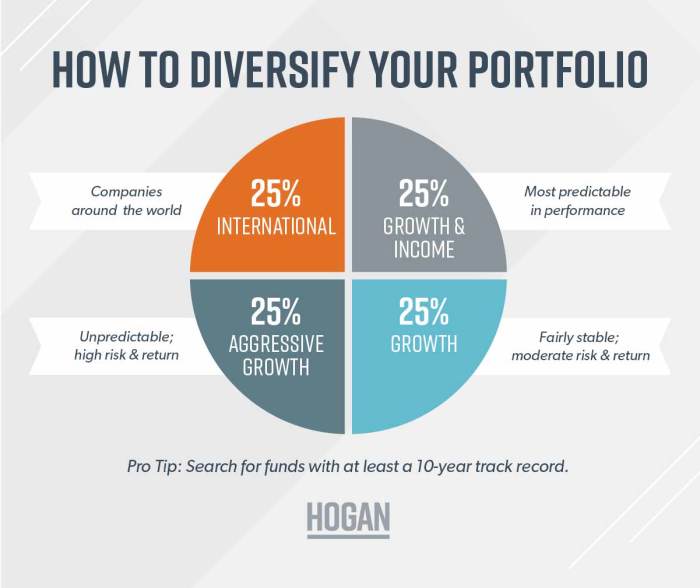

Asset allocation is a strategy that involves dividing your investments among different asset classes such as stocks, bonds, real estate, and cash equivalents. By spreading your investments across various asset classes, you can reduce the impact of market volatility on your portfolio.

For example, if the stock market experiences a downturn, having investments in bonds or real estate can help cushion the blow and minimize losses.

- Determine your investment goals and risk tolerance before deciding on the percentage allocation for each asset class.

- Regularly review and rebalance your portfolio to ensure it aligns with your financial objectives and risk tolerance.

- Consider factors like age, time horizon, and financial goals when determining the appropriate asset allocation mix.

Considerations for Effective Diversification

When it comes to diversifying your investments, there are key factors to keep in mind to ensure a balanced and effective portfolio. Market conditions play a crucial role in shaping diversification strategies, and knowing how to navigate these conditions is essential. Maintaining a diversified portfolio requires regular monitoring and adjustments to stay on track with your investment goals.

Key Factors for Diversifying Investments

- Determine your risk tolerance: Understand how much risk you are willing to take on with your investments, as this will influence the types of assets you choose to diversify.

- Asset allocation: Spread your investments across different asset classes, such as stocks, bonds, real estate, and commodities, to reduce risk and maximize returns.

- Industry diversification: Invest in a variety of industries to minimize the impact of sector-specific risks on your portfolio.

- Global diversification: Consider investing in international markets to reduce exposure to domestic market fluctuations.

- Time horizon: Align your investment choices with your financial goals and time horizon to ensure a balanced and diversified portfolio.

Impact of Market Conditions on Diversification Strategies

- Market volatility: During periods of high volatility, diversification can help cushion the impact of market fluctuations on your portfolio.

- Interest rates: Changes in interest rates can affect different asset classes differently, making it important to diversify across various investments.

- Economic indicators: Keep an eye on economic indicators and adjust your diversification strategy accordingly to mitigate risks associated with market changes.

Tips for Maintaining a Balanced Portfolio

- Regularly review your portfolio: Monitor the performance of your investments and make adjustments as needed to maintain a balanced allocation.

- Rebalance periodically: Reassess your asset allocation and rebalance your portfolio to ensure it aligns with your risk tolerance and investment goals.

- Stay informed: Keep up with market trends, economic news, and investment opportunities to make informed decisions about your portfolio diversification.