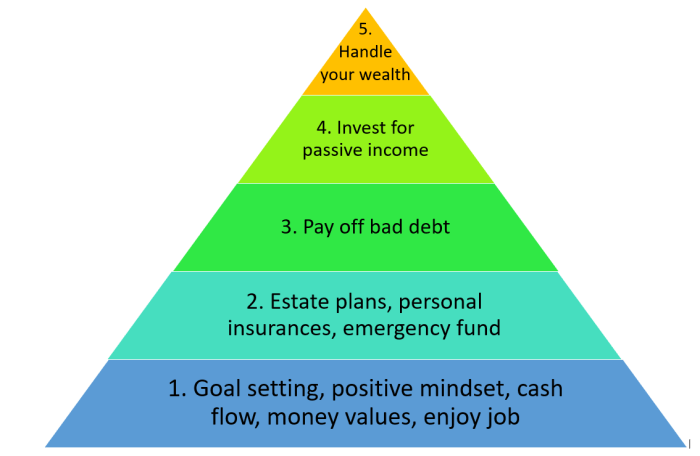

Hey there, ready to dive into the world of financial freedom? Buckle up as we explore the key steps to achieving financial independence, paving the way for a more secure and empowered future.

Let’s break down the essentials of setting financial goals, creating a budget, managing debt, saving and investing, and building multiple streams of income. Get ready to take charge of your financial destiny!

The Importance of Financial Freedom

Financial freedom is crucial for individuals as it provides a sense of security and stability in their lives. When someone achieves financial freedom, they are no longer bound by financial constraints and can make choices based on their wants and needs rather than financial limitations.

Benefits of Achieving Financial Freedom

- Ability to pursue passions and interests without worrying about money

- Reduced stress and anxiety related to financial concerns

- Opportunity to save and invest for future goals

- Flexibility to make decisions based on personal values rather than financial constraints

Financial Freedom for a Secure Future

Financial freedom can lead to a more secure future by allowing individuals to build a strong financial foundation. With the ability to save and invest wisely, individuals can create a safety net for unexpected expenses, emergencies, or retirement. This sense of security provides peace of mind and ensures a more stable future for themselves and their loved ones.

Setting Financial Goals

Setting financial goals is a crucial step in achieving financial freedom. By having clear objectives in mind, individuals can better manage their money, track their progress, and stay motivated to reach their desired financial status.

Short-term Financial Goals

- Creating an emergency fund to cover unexpected expenses.

- Reducing credit card debt by a specific amount each month.

- Setting aside a certain percentage of income for savings or investments.

Long-term Financial Goals

- Buying a house or property within a certain timeframe.

- Planning for retirement by contributing to a 401(k) or IRA consistently.

- Building a diversified investment portfolio to grow wealth over time.

Achieving Financial Freedom through Goal Setting

Setting financial goals provides a roadmap for individuals to follow on their journey towards financial freedom. It helps in prioritizing expenses, staying focused on saving and investing, and making informed financial decisions. By breaking down larger goals into smaller, achievable targets, individuals can track their progress and adjust their strategies as needed. Ultimately, setting financial goals empowers individuals to take control of their financial future and work towards a more secure and stable financial position.

Creating a Budget

Creating a budget is a crucial step in achieving financial freedom. It helps you track your expenses, prioritize your spending, and save for your financial goals.

Importance of Creating and Sticking to a Budget

- Creating a budget allows you to see where your money is going and identify areas where you can cut back on expenses.

- Sticking to a budget helps you avoid overspending and accumulating debt, leading to financial stability and peace of mind.

- A budget empowers you to make informed financial decisions and take control of your money, paving the way towards achieving your long-term financial goals.

Steps to Create an Effective Budget

- List all your sources of income to determine your total monthly income.

- Track your expenses by categorizing them into fixed expenses (e.g., rent, utilities) and variable expenses (e.g., groceries, entertainment).

- Set financial goals and allocate a portion of your income towards savings, investments, and debt repayment.

- Create a budget spreadsheet or use budgeting apps to monitor your income and expenses regularly.

- Adjust your budget as needed to align with your financial priorities and ensure that you are living within your means.

Role of Budgeting in Achieving Financial Freedom

- By creating and sticking to a budget, you are actively managing your finances and making intentional choices about how you use your money.

- A budget helps you build good financial habits, such as saving regularly and avoiding unnecessary expenses, which are essential for achieving financial freedom.

- Budgeting allows you to track your progress towards your financial goals and make adjustments to stay on course, ultimately leading to a more secure financial future.

Managing Debt

Managing debt is a crucial aspect of achieving financial freedom. By effectively managing and reducing debt, individuals can take control of their finances, alleviate financial stress, and work towards their financial goals.

The Significance of Managing and Reducing Debt

- Reducing debt can lead to lower interest payments, saving money in the long run.

- Managing debt responsibly can improve credit scores, opening up opportunities for better loan terms in the future.

- Eliminating debt provides individuals with more disposable income to invest or save for the future.

Strategies for Paying Off Debt Efficiently

- Create a repayment plan by prioritizing high-interest debts first.

- Consider debt consolidation to combine multiple debts into one with a lower interest rate.

- Increase monthly payments or make bi-weekly payments to reduce the principal balance faster.

- Avoid taking on new debt while working towards paying off existing debts.

How Managing Debt Contributes to Financial Freedom

- Reducing debt frees up financial resources for saving, investing, or pursuing other financial goals.

- Improved credit scores from responsible debt management can lead to better loan terms and opportunities for wealth-building.

- Eliminating debt reduces financial stress and provides peace of mind, allowing individuals to focus on long-term financial planning.

Saving and Investing

Saving and investing are crucial components in achieving financial freedom. By setting aside money for the future and putting it to work through investments, individuals can secure their financial well-being and work towards their long-term goals.

Importance of Saving and Investing

- Building an emergency fund: Saving money allows you to have a safety net for unexpected expenses like medical bills or car repairs.

- Generating wealth: Investing your savings in stocks, bonds, real estate, or other assets can help your money grow over time through compound interest.

- Retirement planning: Saving and investing early can help you build a nest egg for retirement, ensuring a comfortable and secure future.

- Financial independence: By saving and investing wisely, you can eventually reach a point where your investments generate enough income to cover your expenses, giving you the freedom to pursue your passions.

Tips for Saving and Investing Wisely

- Set clear financial goals: Define your objectives and establish a timeline for achieving them to stay motivated and focused.

- Automate your savings: Schedule automatic transfers from your checking account to your savings or investment accounts to ensure consistent contributions.

- Diversify your investments: Spread your money across different asset classes to reduce risk and maximize returns.

- Monitor your progress: Regularly review your savings and investment accounts to track your growth and make adjustments as needed.

Role of Saving and Investing in Long-Term Financial Goals

Saving and investing play a vital role in achieving long-term financial goals by helping individuals build wealth, secure their future, and attain financial independence.

Building Multiple Streams of Income

Building multiple streams of income is a key strategy to achieve financial freedom. By diversifying your income sources, you can create more stability, security, and opportunities for growth. Let’s explore the benefits and ideas for building multiple income streams.

The Benefits of Having Multiple Streams of Income

Having multiple streams of income provides several advantages:

- Diversification: By having income from various sources, you are less reliant on one single source, reducing the risk of financial instability.

- Increased Income Potential: With multiple streams of income, you have the opportunity to earn more money and accelerate your path to financial freedom.

- Flexibility: Different income streams can provide flexibility in terms of time commitment and work-life balance.

Ideas on How to Diversify Income Sources

- Start a Side Business: Use your skills and interests to create a small business or freelance service.

- Invest in Real Estate: Generate passive income through rental properties or real estate investments.

- Online Ventures: Explore opportunities such as affiliate marketing, e-commerce, or creating digital products.

How Multiple Income Streams Can Accelerate the Path to Financial Freedom

Multiple income streams provide a buffer against economic downturns and unexpected financial challenges, helping you achieve financial stability and independence faster.

- Compound Growth: Reinvesting income from multiple sources can compound your wealth and accelerate your journey to financial freedom.

- Risk Management: Diversifying income sources reduces the risk of relying on a single source of income, ensuring greater financial security.

- Opportunity for Growth: With multiple income streams, you have the potential to explore new opportunities, expand your skills, and increase your overall earning potential.