Get ready to dive into the world of financial wellness where we break down the secrets to securing your bag and living your best life. From budgeting like a boss to crushing debt, this guide will have you flexing your financial muscles in no time.

Definition of Financial Wellness

Financial wellness refers to the state of being in control of your financial situation, where you have the ability to meet your financial goals and feel secure about your financial future. It involves having a clear understanding of your financial situation, making informed financial decisions, and managing your finances effectively.

Importance of Achieving Financial Wellness

Achieving financial wellness is crucial for overall well-being as it can reduce stress, anxiety, and uncertainty related to money matters. It allows individuals to have a sense of financial security, enabling them to focus on other aspects of their lives such as health, relationships, and personal growth.

- Financial wellness empowers individuals to make informed decisions about their finances, leading to better financial outcomes in the long run.

- It helps create a stable financial foundation, providing a sense of control and confidence in managing financial challenges.

- By achieving financial wellness, individuals can reduce the risk of financial hardship and improve their overall quality of life.

Impact of Financial Wellness on Overall Well-Being

Financial wellness has a direct impact on overall well-being by influencing various aspects of an individual’s life, including physical health, mental well-being, and relationships.

When individuals are financially secure, they are less likely to experience stress-related health issues and are better able to focus on maintaining a healthy lifestyle.

- Financial wellness can improve mental health by reducing anxiety and worry related to financial stability.

- It can strengthen relationships by minimizing financial conflicts and allowing individuals to focus on building meaningful connections with others.

- Overall, achieving financial wellness contributes to a more balanced and fulfilling life, promoting a sense of security and peace of mind.

Components of Financial Wellness

Financial wellness is made up of several key components that work together to ensure financial stability and security. These components include financial literacy, budgeting, saving, investing, debt management, and planning for the future.

Financial Literacy and Financial Wellness

Financial literacy is the foundation of financial wellness. It involves understanding basic financial concepts such as budgeting, saving, investing, and managing debt. Being financially literate empowers individuals to make informed decisions about their money, leading to better financial outcomes and overall wellness.

Budgeting and Saving

Budgeting is the process of creating a plan for how you will spend your money. It helps you track your income and expenses, prioritize your spending, and identify areas where you can cut back. Saving, on the other hand, involves setting aside a portion of your income for future needs or goals. By budgeting effectively and saving consistently, individuals can build a strong financial foundation and achieve their financial goals.

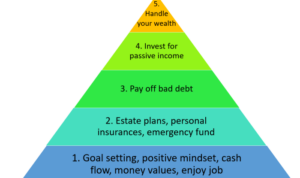

Strategies for Improving Financial Wellness

When it comes to improving financial wellness, there are several key strategies that can help individuals take control of their financial situation and work towards a more stable and secure future.

Tips for Setting Financial Goals

Setting clear and achievable financial goals is essential for improving financial wellness. Here are some tips to help you set effective financial goals:

- Start by identifying your priorities and values to determine what you truly want to achieve financially.

- Set specific, measurable, achievable, relevant, and time-bound (SMART) goals to keep you focused and motivated.

- Break down larger goals into smaller milestones to track your progress and celebrate your achievements along the way.

- Regularly review and adjust your goals as needed to reflect changes in your financial situation or priorities.

The Importance of Creating a Budget for Financial Wellness

Creating and sticking to a budget is crucial for achieving financial wellness. Here’s why having a budget is so important:

- A budget helps you track your income and expenses, allowing you to identify areas where you can save money and cut back on unnecessary spending.

- It helps you prioritize your spending, ensuring that you allocate funds towards your financial goals and necessities first.

- A budget can also help you plan for unexpected expenses, emergencies, and long-term financial objectives such as retirement or homeownership.

Ways to Reduce Debt and Improve Financial Stability

Reducing debt and improving financial stability are key components of financial wellness. Here are some strategies to help you tackle debt and build a more secure financial foundation:

- Develop a debt repayment plan by prioritizing high-interest debt and making consistent payments to reduce balances over time.

- Consider debt consolidation or negotiation with creditors to lower interest rates or settle debts for less than the full amount owed.

- Focus on increasing your income through side hustles, part-time work, or career advancement to accelerate debt repayment and improve financial stability.

- Build an emergency fund to cover unexpected expenses and avoid relying on credit cards or loans in times of financial stress.

Tools and Resources for Enhancing Financial Wellness

In today’s digital age, there are numerous tools and resources available to help individuals enhance their financial wellness. From budgeting apps to online educational platforms, these resources can make managing finances easier and more effective.

Useful Financial Management Tools

- Personal Finance Apps: Apps like Mint, YNAB, and Personal Capital help users track their spending, create budgets, and set financial goals.

- Expense Trackers: Tools like Expensify and PocketGuard allow individuals to monitor their expenses and identify areas where they can cut costs.

- Investment Platforms: Platforms such as Robinhood and Acorns make it easy for individuals to invest in stocks, ETFs, and other financial instruments.

Benefits of Using Financial Wellness Apps

- Convenience: Financial apps allow users to access their financial information anytime, anywhere, making it easier to stay on top of their finances.

- Automation: Many apps automate tasks like budgeting and saving, saving users time and effort.

- Insights: Financial apps provide valuable insights into spending habits and financial health, helping users make more informed decisions.

Leveraging Online Resources for Financial Education

- Online Courses: Platforms like Coursera and Udemy offer a wide range of courses on personal finance, investing, and budgeting.

- Financial Blogs: Following reputable financial blogs like The Balance and NerdWallet can provide valuable tips and advice on managing money.

- Webinars and Podcasts: Attending financial webinars or listening to podcasts like The Dave Ramsey Show can offer valuable insights into financial planning and wealth management.