Get ready to dive into the world of financial goals, where setting the stage for success is key. From short-term wins to long-term victories, we’ve got you covered with tips and tricks to make your money work for you.

Let’s explore the different types of financial goals, strategies to achieve them, and how to overcome challenges along the way. Buckle up and let’s hit the road to financial freedom together!

Why Set Financial Goals?

Setting financial goals is crucial for achieving financial stability and success. It helps individuals to have a clear direction, prioritize their spending, and work towards a secure financial future.

Importance of Setting Financial Goals

- Establishing financial goals provides a roadmap for your financial journey, guiding you on how to allocate your resources efficiently.

- It helps in controlling impulsive spending by giving you a clear purpose for your money, ensuring that you are working towards something meaningful.

- Setting financial goals encourages saving and investing, as you are motivated to reach specific milestones and objectives.

Examples of Short-term and Long-term Financial Goals

- Short-term: Saving up for a vacation, paying off credit card debt, or building an emergency fund within a year.

- Long-term: Buying a house, retiring comfortably, saving for your children’s education, or achieving financial independence in the next 10-20 years.

How Setting Financial Goals Can Help with Budgeting and Saving

- Creating specific financial goals allows you to tailor your budget to meet those objectives, ensuring that you allocate the right amount of money towards each goal.

- Tracking your progress towards your financial goals helps you stay motivated and disciplined in your spending and saving habits.

- Financial goals act as a benchmark for your financial health, enabling you to make adjustments to your budget and lifestyle to achieve your desired outcomes.

Types of Financial Goals

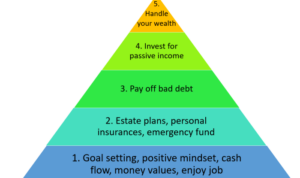

When it comes to setting financial goals, there are various categories to consider. These categories can help you prioritize your objectives and create a roadmap for your financial journey.

Savings Goals

- Setting aside a certain amount of money each month for emergencies or future expenses.

- Building an emergency fund to cover unexpected costs without going into debt.

Investment Goals

- Growing your wealth by investing in stocks, bonds, real estate, or other assets.

- Planning for retirement by contributing to a 401(k) or IRA account.

Debt Reduction Goals

- Paying off high-interest debt like credit cards to avoid accumulating more interest over time.

- Consolidating multiple debts into a single payment to make it more manageable and affordable.

Needs-based vs. Wants-based Goals

Financial goals can be categorized as needs-based or wants-based. Needs-based goals are essential for your well-being and survival, such as paying for housing, food, and healthcare. On the other hand, wants-based goals are desires or luxuries that enhance your quality of life but are not necessary for survival, like vacations or luxury items.

Importance of SMART Financial Goals

Setting SMART financial goals is crucial for success in achieving your objectives. These goals are:

Specific, Measurable, Achievable, Relevant, and Time-bound.

By defining your goals clearly, measuring your progress, ensuring they are realistic, relevant to your financial situation, and setting a deadline, you increase your chances of reaching them effectively.

Strategies to Achieve Financial Goals

Setting financial goals is just the first step in your journey towards financial success. To actually achieve these goals, you need to have a solid action plan in place and be diligent in tracking your progress. Here are some strategies to help you reach your financial goals:

Create a Detailed Action Plan

- Break down your financial goals into smaller, manageable tasks.

- Assign deadlines to each task to keep yourself accountable.

- Identify potential obstacles and come up with solutions to overcome them.

Importance of Tracking Progress

Tracking your progress towards your financial goals is crucial to stay on course and make necessary adjustments along the way. It helps you stay motivated and focused on your objectives. Remember, what gets measured gets managed.

Tools for Goal Tracking and Financial Planning

- Personal finance apps like Mint or YNAB can help you track your spending, set budgets, and monitor your progress towards financial goals.

- Online tools like Personal Capital can provide a comprehensive view of your financial situation and help you plan for the future.

- Consider using spreadsheets or simple pen and paper to track your progress if you prefer a more hands-on approach.

Overcoming Challenges in Achieving Financial Goals

Achieving financial goals can be challenging due to various obstacles that may arise along the way. It’s important to stay motivated and focused on long-term goals to overcome these challenges effectively.

Identifying Common Obstacles

- Lack of proper budgeting and financial planning

- Unexpected expenses or emergencies

- Difficulty in controlling spending habits

- Procrastination and lack of discipline

- Inadequate financial knowledge and skills

Strategies for Staying Motivated

- Set specific and achievable short-term goals

- Reward yourself for reaching milestones

- Track your progress regularly

- Find an accountability partner or join a support group

- Visualize the benefits of achieving your financial goals

The Role of Discipline and Resilience

Discipline is essential for sticking to a financial plan and making necessary sacrifices to achieve long-term goals.

Resilience helps in bouncing back from setbacks and staying committed to the financial journey despite challenges.

Having a positive mindset and learning from past mistakes are key aspects of building financial resilience.