With Building a diversified investment portfolio at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Diving into the world of investment, understanding the importance of diversification is like discovering the secret sauce for financial success.

Importance of Diversification

Diversifying your investment portfolio is crucial in order to spread out risk and maximize potential returns. By investing in a variety of asset classes, sectors, and geographic regions, you can reduce the impact of market fluctuations on your overall portfolio.

Benefits of Diversification

- Diversification helps protect your investments from the volatility of individual stocks or sectors. If one investment underperforms, the impact on your overall portfolio is minimized.

- It can potentially increase your returns by capturing gains in different areas of the market that are performing well at any given time.

- Provides a more stable investment strategy over the long term, as different assets tend to perform differently under various market conditions.

Examples of How Diversification Can Mitigate Risks

- For example, during a market downturn, having a mix of stocks, bonds, and real estate in your portfolio can help cushion the impact of a decline in any one asset class.

- Diversifying across different industries can also protect you from sector-specific risks. If one industry experiences a downturn, other sectors may still be performing well.

- Geographic diversification can mitigate the impact of regional economic downturns or political instability in a particular country, as your investments are spread across different regions.

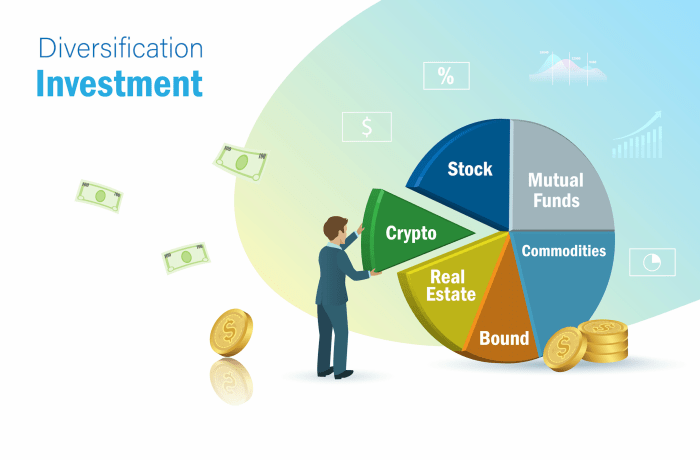

Types of Investments for Diversification

Investing in a variety of asset classes is crucial for building a diversified portfolio. Different types of investments offer varying levels of risk and return, allowing investors to spread their investments across different sectors and industries to reduce overall risk.

Stocks

Stocks represent ownership in a company and offer potential for high returns, but they also come with high volatility. Investing in a mix of large-cap, mid-cap, and small-cap stocks can help diversify the risk associated with individual companies.

Bonds

Bonds are debt securities issued by corporations or governments, offering a fixed rate of return over a specified period. They are generally considered lower risk compared to stocks and provide income through interest payments. Diversifying bond investments across different issuers and maturities can help manage risk.

Real Estate

Investing in real estate can provide both income and potential appreciation. Real estate can be diversified through different property types such as residential, commercial, or industrial properties, as well as through geographical locations to reduce risk associated with local market conditions.

Commodities

Commodities are physical assets like gold, silver, oil, or agricultural products. Investing in commodities can provide a hedge against inflation and economic uncertainty. Diversifying commodity investments across different types can help mitigate the risk of price fluctuations in any single commodity.

Alternative Investments

Alternative investments include assets such as hedge funds, private equity, venture capital, and real assets like art or collectibles. These investments have low correlation to traditional asset classes like stocks and bonds, offering additional diversification benefits to a portfolio. However, they often come with higher fees and less liquidity compared to traditional investments.

Risk Management Strategies

Diversification plays a crucial role in managing investment risks by spreading out your investments across different asset classes. This reduces the impact of a potential loss in any single investment on your overall portfolio. Let’s delve deeper into the concept of correlation among different assets and how it affects portfolio diversification.

Correlation Among Different Assets

Correlation measures how closely the price movements of two assets are related. A correlation of +1 indicates that two assets move in perfect lockstep, while a correlation of -1 means they move in opposite directions. Assets with a correlation close to zero have little to no relationship in their price movements.

- Highly correlated assets: When two assets have a high positive correlation, such as stocks in the same industry, a rise or fall in one asset’s price will likely result in a similar movement in the other asset’s price.

- Negatively correlated assets: Assets with a negative correlation, like stocks and bonds, tend to move in opposite directions. This can help offset losses in one asset class with gains in another.

- Lowly correlated assets: Investing in assets with low or negative correlations can help achieve better diversification and reduce overall portfolio risk.

Understanding the correlation among different assets is essential for building a well-diversified investment portfolio.

Building a Balanced Portfolio

Building a well-diversified investment portfolio is crucial for long-term financial success. One key aspect of this is creating a balanced portfolio that aligns with your risk tolerance and investment goals.

Importance of Asset Allocation

Asset allocation plays a significant role in achieving a balanced portfolio. By spreading your investments across different asset classes, such as stocks, bonds, real estate, and cash equivalents, you can reduce the overall risk of your portfolio while maximizing returns.

- Determine your risk tolerance: Assess how much risk you are willing to take on and adjust your asset allocation accordingly. For example, if you have a low risk tolerance, you may lean more towards conservative investments like bonds.

- Set investment goals: Define your financial objectives, whether it’s saving for retirement, buying a home, or funding your children’s education. Your asset allocation should reflect these goals and the time horizon for achieving them.

- Regularly review and rebalance: Market fluctuations can cause your portfolio to drift from its original allocation. Periodically assess your investments and make adjustments to realign your portfolio with your risk tolerance and goals.