Understanding mutual fund fees is like navigating the hallways of high school – you need to know who’s who and what’s what to come out on top. In this guide, we’ll break down the complex world of mutual fund fees in a way that’s easy to understand and totally rad.

From dissecting different fees to exploring their impact on investment returns, get ready to level up your financial knowledge game.

Importance of Understanding Mutual Fund Fees

Investors need to have a clear understanding of mutual fund fees in order to make informed decisions about their investments. These fees can have a significant impact on investment returns, affecting the overall profitability of the investment. By understanding the various types of fees associated with mutual funds, investors can better assess the true cost of their investment and determine if it aligns with their financial goals.

Types of Mutual Fund Fees

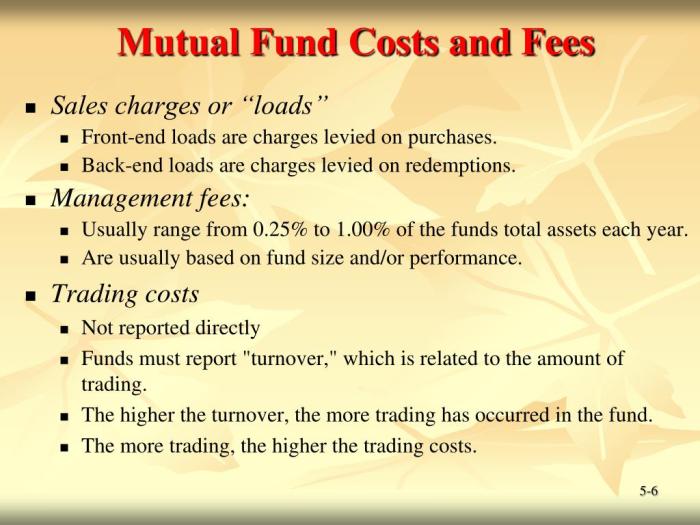

- Management Fees: These fees are charged by the fund manager for managing the fund’s portfolio. They are typically charged as a percentage of the fund’s assets under management.

- Expense Ratio: This ratio represents the total annual expenses of the fund as a percentage of the fund’s total assets. It includes management fees, administrative costs, and other operating expenses.

- Load Fees: These fees are charges applied either when purchasing (front-end load) or selling (back-end load) shares of the mutual fund. They are a commission paid to the broker or salesperson.

- 12b-1 Fees: These fees are used for marketing and distribution expenses of the fund. They are included in the expense ratio and can impact the overall cost of the investment.

Types of Mutual Fund Fees

When investing in mutual funds, it’s crucial to understand the different types of fees that may apply. These fees can impact your overall returns and vary depending on the fund you choose. Let’s take a closer look at the various types of mutual fund fees.

Expense Ratios

Expense ratios represent the annual operating expenses of a mutual fund as a percentage of its total assets. This fee covers the costs of managing the fund, including administrative fees, marketing expenses, and other operational costs. A lower expense ratio typically indicates a more cost-effective fund.

Sales Loads

Sales loads are fees charged when buying or selling mutual fund shares. Front-end loads are deducted from your initial investment, while back-end loads are charged when you sell your shares. No-load funds, on the other hand, do not have any sales charges, making them a more cost-effective option for investors.

Redemption Fees

Redemption fees are charged when investors sell their mutual fund shares within a specific timeframe. These fees are designed to discourage frequent trading and help offset the costs associated with buying and selling securities within the fund. Not all funds impose redemption fees, so it’s important to check the fund’s prospectus for details.

Fee Structures in Mutual Funds

When it comes to mutual funds, understanding the fee structures is crucial for investors. Let’s dive into how these fees are typically set up and calculated by fund managers.

Fixed Fees

Fixed fees in mutual funds are set amounts that investors pay regardless of the fund’s performance. These fees are usually charged annually and are based on a percentage of the total assets under management.

Performance-Based Fees

Performance-based fees are calculated based on the fund’s performance relative to a benchmark. Fund managers earn a percentage of the fund’s profits if they outperform the benchmark, providing an incentive for them to generate positive returns for investors.

Tiered Fee Structures

Tiered fee structures involve different fee rates based on the amount invested in the fund. Typically, larger investments receive lower fee rates compared to smaller investments. This encourages investors to invest more in the fund to benefit from reduced fees.

Impact of Fees on Investment Performance

When it comes to investing in mutual funds, understanding the impact of fees on your investment performance is crucial. Even seemingly small differences in fees can have a significant effect on your long-term returns. Investors need to be aware of how fees can eat into their returns and ultimately affect their overall investment performance.

Fee Impact Analysis

- High fees can erode your returns over time, especially in the case of actively managed funds where fees are typically higher compared to passively managed funds.

- For example, let’s consider two mutual funds with similar underlying assets and performance, but one charges a management fee of 1% while the other charges 0.5%. Over a 20-year period, the fund with the lower fee could potentially outperform the one with the higher fee by a significant margin due to the compounding effect of lower fees.

- Investors should carefully evaluate the fee structures of different mutual funds and consider the impact of fees on their investment decisions. By choosing funds with lower fees, investors can potentially increase their overall returns in the long run.