Trends in retirement savings sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From the impact of economic factors to the influence of technology, this topic dives deep into the evolving landscape of retirement savings.

As we delve into the various aspects of retirement savings trends, we uncover a world where innovation meets tradition, and where demographics and government policies play crucial roles in shaping the future of retirement security.

Overview of Retirement Savings Trends

Retirement savings trends have been evolving in recent years, influenced by various economic factors and the changing landscape of financial products and strategies. Let’s delve into some of the key aspects shaping the current scenario.

Impact of Economic Factors on Retirement Savings Trends

Economic conditions play a crucial role in determining the retirement savings behavior of individuals. In times of economic uncertainty, people tend to save more and invest cautiously to secure their financial future. On the other hand, during periods of economic growth, there is a tendency to take on more risk in pursuit of higher returns. Factors such as inflation, interest rates, and market volatility greatly impact the retirement savings landscape.

Innovative Retirement Savings Products or Strategies

In response to the changing needs and preferences of savers, the financial industry has introduced a range of innovative retirement savings products and strategies. For example, target-date funds have gained popularity for their automatic rebalancing and risk-adjustment features, making it easier for individuals to invest based on their retirement timeline. Similarly, Health Savings Accounts (HSAs) have emerged as a valuable tool for saving for healthcare expenses in retirement, offering tax advantages and investment opportunities.

Technology and Retirement Savings

Technology plays a significant role in shaping retirement savings trends today. With the advancement of digital tools and platforms, individuals now have more options to manage and grow their retirement funds efficiently.

Comparing Traditional and Modern Methods

- Traditional methods often involved physical paperwork and in-person meetings with financial advisors, which could be time-consuming and less convenient.

- Modern technological solutions, such as robo-advisors and online investment platforms, offer automated services that make it easier for individuals to track and optimize their retirement savings.

- Apps and online platforms provide real-time updates on investment performance, personalized recommendations, and easy access to financial information, empowering individuals to make informed decisions about their retirement savings.

Role of Apps and Online Platforms

- Apps and online platforms allow users to set financial goals, create personalized retirement plans, and track their progress towards retirement readiness.

- These tools often incorporate features like budgeting tools, retirement calculators, and investment tracking to help individuals make smart choices with their money.

- Moreover, some apps offer educational resources and tips to improve financial literacy, guiding users towards better retirement planning strategies.

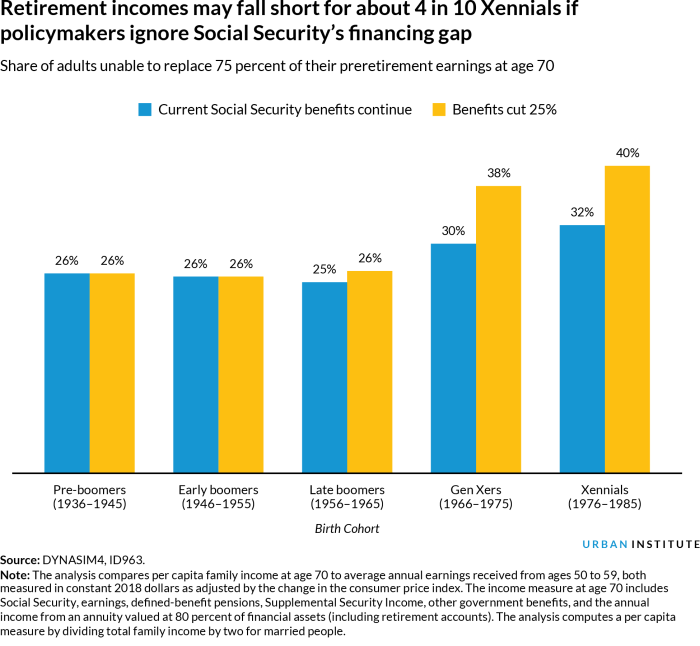

Demographic Trends in Retirement Savings

In today’s society, different age groups approach retirement savings in various ways based on their unique financial situations and priorities. Let’s explore how gender and ethnic diversity also play a role in shaping retirement savings trends, as well as the impact of changing workforce dynamics on patterns of saving for retirement.

Age Groups and Retirement Savings

- Younger individuals in their 20s and 30s often prioritize short-term financial goals over saving for retirement, focusing on paying off student loans, buying a home, or starting a family.

- Individuals in their 40s and 50s typically start to ramp up their retirement savings, realizing the importance of building a nest egg for their golden years as retirement becomes more imminent.

- Older adults in their 60s and beyond may be more focused on maximizing their retirement savings through catch-up contributions to make up for any lost time or missed opportunities earlier in their careers.

Gender and Ethnic Diversity in Retirement Savings Trends

- Research shows that women tend to have lower retirement savings compared to men due to factors such as the gender pay gap, career breaks for caregiving responsibilities, and longer life expectancy.

- Ethnic diversity also plays a role in retirement savings trends, with minority groups often facing additional financial challenges that impact their ability to save for retirement, such as lower incomes and less access to employer-sponsored retirement plans.

Changing Workforce Dynamics and Retirement Savings Patterns

- The gig economy and rise of freelance work have led to a shift in traditional employment models, impacting retirement savings as individuals may not have access to employer-sponsored retirement plans or consistent income streams for saving.

- Automation and technological advancements in the workplace may result in job displacement or changes in job requirements, affecting retirement savings as individuals may need to adapt to new skill sets or industries to remain financially secure in retirement.

Government Policies and Retirement Savings

Government policies play a crucial role in shaping retirement savings trends by providing incentives, regulations, and frameworks to encourage individuals to save for their future. These policies aim to ensure financial security for retirees and promote responsible saving habits among the population.

Impact of Government Policies

- Government-sponsored retirement plans such as 401(k) and Individual Retirement Accounts (IRAs) offer tax advantages to incentivize individuals to save for retirement.

- Legislative changes like the SECURE Act in 2019 increased the age for required minimum distributions from retirement accounts, allowing individuals to save for a longer period.

- Regulations set by the government ensure that retirement savings accounts are managed and invested responsibly to safeguard the funds for retirement.

Recent Legislative Changes

- The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 introduced provisions to expand access to workplace retirement plans and increase savings opportunities for individuals.

- The CARES Act in 2020 allowed penalty-free withdrawals from retirement accounts for individuals affected by the COVID-19 pandemic, providing relief during challenging times.

- The proposed SECURE Act 2.0 includes measures to further enhance retirement savings options and increase retirement security for Americans.

Importance of Regulations in Retirement Security

- Regulations help protect retirement savings from fraud, mismanagement, and risky investments, ensuring that individuals’ hard-earned money is secure for the future.

- Government oversight through regulatory agencies like the Department of Labor and the Securities and Exchange Commission helps monitor retirement plans and enforce compliance with established rules.

- By setting standards for plan sponsors, investment advisors, and financial institutions, regulations play a vital role in maintaining the integrity and reliability of retirement savings vehicles.