Diving into the world of Annuities explained, get ready to unravel the mysteries behind this financial concept. From understanding the different types available to exploring the benefits and drawbacks, this overview will equip you with the knowledge you need to navigate the annuities landscape with confidence.

Annuities Overview

Annuities are financial products that provide a steady stream of income over a specified period of time, often used as a way to secure retirement income. They are typically sold by insurance companies and can offer a guaranteed income for life.

Types of Annuities

- Fixed Annuities: These provide a guaranteed interest rate for a specific period.

- Variable Annuities: Offer the opportunity to invest in various sub-accounts, with the potential for higher returns but also higher risks.

- Indexed Annuities: Linked to a stock market index, allowing for potential growth based on market performance.

Key Features of Annuities

- Guaranteed Income: Annuities can provide a reliable income stream, either for a set number of years or for life.

- Tax Deferral: Earnings within an annuity grow tax-deferred until withdrawals are made.

- Death Benefits: Some annuities offer death benefits, ensuring that beneficiaries receive a certain amount upon the annuitant’s death.

- Flexibility: Annuities can be customized to meet individual needs, with options for lump-sum payments or periodic payouts.

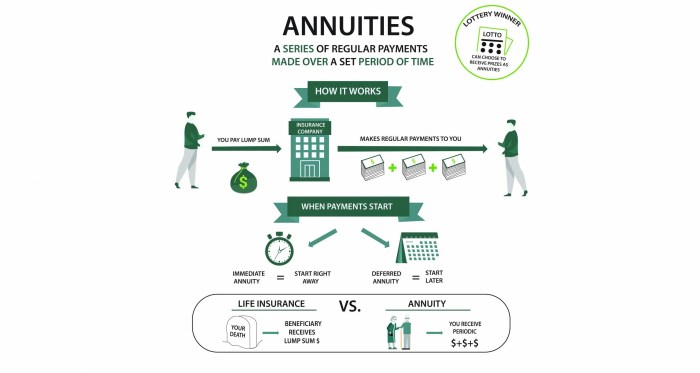

How Annuities Work

Annuities work by individuals making a lump sum payment or a series of payments to an insurance company. In return, the insurance company provides regular payouts to the individual, either immediately or at a later date. These payouts can be for a specific period or for the rest of the individual’s life.

Annuity Mechanics

Annuities operate on the principle of accumulating funds over time through premium payments and then distributing those funds back to the individual in the form of regular payments. The insurance company invests the premiums, and the growth of these investments determines the amount of the payouts.

- Premiums: These are the payments made by the individual to the insurance company. They can be made as a lump sum or in installments.

- Payouts: These are the regular payments made to the individual by the insurance company. The frequency and amount of these payments depend on the type of annuity and the terms of the contract.

- Annuitization: This is the process by which the accumulated funds in the annuity are converted into a stream of income payments. Once annuitization occurs, the individual starts receiving regular payouts according to the terms of the annuity contract.

Benefits of Annuities

Investing in annuities comes with several advantages that make them an attractive option for individuals looking to secure their financial future. One of the key benefits of annuities is the ability to provide a steady income stream during retirement, ensuring financial stability and peace of mind for the annuitant.

Steady Income Stream

Annuities are designed to provide a guaranteed income for a specified period or even for life, depending on the type of annuity chosen. This steady stream of income can help retirees cover their living expenses, medical bills, or any other financial needs without the worry of outliving their savings. It offers a sense of security and predictability in an individual’s financial planning.

Tax-Deferred Growth

Another significant benefit of annuities is the tax-deferred growth feature they offer. This means that the earnings on the investment within an annuity are not taxed until they are withdrawn. As a result, annuitants can benefit from compounded growth over time without being subject to annual taxes on the gains. This tax advantage can help maximize the growth potential of the investment and increase the overall value of the annuity.

Drawbacks of Annuities

When considering investing in annuities, it’s essential to be aware of the potential downsides that come with them. These drawbacks can impact your financial planning and overall investment strategy.

Fees and Charges Associated with Annuities

One of the main drawbacks of annuities is the fees and charges that are typically associated with them. These fees can include sales charges, administrative fees, and management fees, which can eat into your overall returns. It’s crucial to understand the fee structure of the annuity you are considering before making a decision.

Liquidity and Surrender Charges Related to Annuities

Another significant drawback of annuities is the lack of liquidity and surrender charges. Annuities are long-term investments, and accessing your funds before the agreed-upon term can result in surrender charges. This lack of liquidity can be a drawback for individuals who may need access to their funds in case of emergencies or unforeseen circumstances.