With Investing in international stocks taking the center stage, get ready to dive into a world of global opportunities and financial growth. This journey is about to kick off with a bang, so buckle up and let’s explore the exciting realm of international stock investments.

Understanding International Stocks

Investing in international stocks involves purchasing shares of companies that are based outside of your home country. These stocks are traded on foreign stock exchanges and can provide investors with exposure to different economies, industries, and currencies compared to domestic stocks.

Benefits of Investing in International Stocks

- Diversification: Investing in international stocks can help spread risk across different markets and industries, reducing the impact of a downturn in any one market.

- Potential for Higher Returns: Some international markets may offer higher growth potential than domestic markets, providing the opportunity for greater returns on investment.

- Currency Diversification: Holding assets denominated in different currencies can help protect against currency fluctuations and provide a hedge against inflation.

Risks Associated with Investing in International Stocks

- Foreign Exchange Risk: Fluctuations in currency exchange rates can impact the value of international investments when converted back into your home currency.

- Political and Economic Instability: Investing in countries with unstable governments or economies can expose investors to higher levels of risk and uncertainty.

- Regulatory Differences: International markets may have different regulations and disclosure requirements compared to domestic markets, leading to potential risks for investors.

How to Invest in International Stocks

Investing in international stocks can provide diversification and growth opportunities beyond domestic markets. There are different ways investors can access international stock markets, such as through American Depository Receipts (ADRs), Exchange-Traded Funds (ETFs), and mutual funds. Each of these options offers varying levels of risk and potential return.

Accessing International Stock Markets

- ADR: ADRs are certificates issued by U.S. banks that represent shares of a foreign stock. They allow investors to trade international stocks on U.S. exchanges without having to deal with foreign currencies or regulations.

- ETFs: ETFs are investment funds traded on stock exchanges that hold a basket of international stocks. They offer diversification and can be traded throughout the day like individual stocks.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of international stocks. They are managed by professional fund managers and offer convenience for investors looking to access global markets.

Opening an International Brokerage Account

Opening an international brokerage account is a crucial step for investing in international stocks. Investors can choose from online brokerage platforms that offer access to global markets. The process typically involves providing identification documents, completing account forms, and funding the account through wire transfers or other payment methods. It’s important to research and choose a reputable brokerage firm with a good track record of international trading.

Tax Implications of Investing in International Stocks

Investing in international stocks can have different tax implications compared to domestic stocks. Investors may be subject to foreign withholding taxes on dividends, capital gains, and interest income from international investments. Additionally, they may need to report foreign accounts and assets to the IRS. It’s essential for investors to understand the tax treaties between their home country and the country where they are investing to avoid double taxation and comply with reporting requirements.

Researching International Stocks

When it comes to investing in international stocks, thorough research is key to making informed decisions. By understanding the companies you are investing in, as well as the geopolitical factors that may impact their performance, you can better navigate the complexities of the global market.

Strategies for Researching International Companies

- Start by looking into the company’s financial health, including revenue growth, profitability, and debt levels.

- Consider the industry trends and competitive landscape to assess the company’s positioning in the market.

- Review the management team and their track record to gauge their ability to drive the company forward.

- Evaluate the regulatory environment and political stability of the country where the company is based.

Understanding Geopolitical Factors

- Geopolitical factors, such as trade agreements, conflicts, and economic policies, can impact international stocks.

- Stay informed about global events and how they may influence the countries or regions where your investments are located.

- Consider the currency risk and how exchange rate fluctuations can affect your returns.

Key Indicators for Evaluating International Stocks

- Look at the company’s price-to-earnings ratio (P/E ratio) to determine if the stock is undervalued or overvalued.

- Examine the company’s earnings growth rate and compare it to industry peers to assess its performance.

- Consider the dividend yield and payout ratio to understand the company’s dividend policy.

- Assess the company’s market share and competitive advantages to determine its long-term growth potential.

Diversifying with International Stocks

Investing in international stocks plays a crucial role in diversifying an investment portfolio. By including stocks from different countries and regions, investors can reduce their exposure to risks associated with a single market or economy.

Reducing Portfolio Risk

- Diversification: Investing in international stocks provides exposure to different markets, industries, and currencies, reducing the impact of a downturn in any single market.

- Geopolitical Risk: By spreading investments across various countries, investors can mitigate geopolitical risks that may affect a specific region or country.

- Market Volatility: International stocks can help balance the overall volatility of a portfolio, as global markets often do not move in sync with each other.

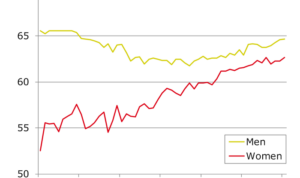

Impact of Currency Exchange Rates

- Fluctuations: Changes in currency exchange rates can impact the value of international stock investments. A strengthening or weakening of the investor’s home currency can either boost or reduce returns.

- Hedging: Some investors use currency hedging strategies to mitigate the impact of exchange rate fluctuations on their international investments.

- Diversification Benefits: Despite currency risks, investing in international stocks can still offer diversification benefits that outweigh the impact of currency fluctuations in the long run.