Diving deep into the world of Crowdfunding investments, get ready for a ride filled with insights and excitement. From revolutionizing the financial landscape to empowering individuals, this topic is about to take you on a wild journey.

As we explore the various types, benefits, risks, and success stories of Crowdfunding investments, prepare to be amazed by the endless possibilities this innovative funding method offers.

Introduction to Crowdfunding Investments

Crowdfunding investments have revolutionized the financial world by allowing individuals to invest in projects, businesses, or ventures through online platforms. This method of raising funds has gained popularity due to its accessibility and potential for high returns.

Basic Concept of Crowdfunding Investments

Crowdfunding investments involve a large group of individuals pooling their money together to support a project or business in exchange for equity, debt, or rewards. Unlike traditional investment methods where only a few wealthy investors have access, crowdfunding opens up opportunities for everyday people to invest in projects they believe in.

Successful Crowdfunding Investment Campaigns

- One notable example is the Pebble Time smartwatch, which raised over $20 million on Kickstarter, making it one of the most successful crowdfunding campaigns ever.

- The Oculus Rift virtual reality headset also gained traction on crowdfunding platform Kickstarter before being acquired by Facebook for $2 billion.

- Real estate platform Fundrise has successfully raised millions of dollars through crowdfunding investments, providing individuals with opportunities to invest in real estate projects.

Types of Crowdfunding Investments

Crowdfunding investments come in various forms, each with its own set of pros and cons. Let’s explore the different types and see how they compare.

Equity-Based Crowdfunding

Equity-based crowdfunding involves investors receiving shares in a company in exchange for their investment. This type allows investors to potentially earn a return if the company succeeds, but they also bear the risk of losing their investment if the company fails. Examples of successful equity-based crowdfunding projects include Oculus VR, which was later acquired by Facebook.

Reward-Based Crowdfunding

Reward-based crowdfunding offers backers rewards or products in exchange for their contribution. This type is popular for creative projects and allows backers to receive exclusive perks. However, there is no financial return on investment. A notable example is the Pebble smartwatch, which raised over $10 million through reward-based crowdfunding.

Donation-Based Crowdfunding

Donation-based crowdfunding involves contributors donating money to support a cause or project without expecting anything in return. This type is commonly used for charitable purposes or community initiatives. A successful example is the ALS Ice Bucket Challenge, which raised millions for ALS research.

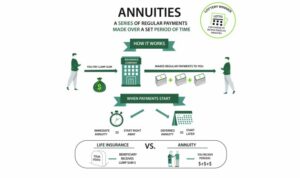

Debt-Based Crowdfunding

Debt-based crowdfunding, also known as peer-to-peer lending, allows individuals to lend money to businesses or individuals with the expectation of repayment with interest. This type provides a steady income stream for investors but carries the risk of default. An example is LendingClub, a peer-to-peer lending platform.

Benefits of Crowdfunding Investments

Crowdfunding investments offer a range of benefits for both investors and project creators. These benefits can democratize access to investment opportunities and have the potential to transform the way individuals and businesses raise funds.

Access to Diverse Investment Opportunities

- Investors can access a wide range of investment opportunities across different industries and sectors.

- Crowdfunding platforms provide a platform for investors to diversify their investment portfolios without the need for large amounts of capital.

- Project creators can tap into a global network of potential investors, increasing their chances of securing funding for their ventures.

Democratization of Investment

- Crowdfunding investments enable individuals from diverse backgrounds to participate in the investment process, leveling the playing field.

- By eliminating traditional barriers to entry, crowdfunding allows anyone to invest in projects they believe in, regardless of their financial status.

- This democratization of investment opportunities can lead to greater innovation and creativity in the business world.

Success Stories

- A small startup was able to launch a revolutionary product thanks to crowdfunding investments, bypassing traditional funding sources.

- An artist funded a passion project through a crowdfunding campaign, connecting directly with supporters who believed in their work.

- A community project raised funds through crowdfunding, bringing together a diverse group of backers who shared a common goal.

Risks and Challenges of Crowdfunding Investments

When it comes to crowdfunding investments, there are certain risks and challenges that both investors and project creators should be aware of in order to make informed decisions. Understanding these potential pitfalls is crucial to mitigating risks and maximizing the chances of a successful crowdfunding campaign or investment.

Common Risks Associated with Crowdfunding Investments

- Market Risks: Fluctuations in the market can impact the success of a project or investment.

- Lack of Regulation: Crowdfunding platforms may not be as regulated as traditional investment avenues, leading to potential fraud or misuse of funds.

- Project Failure: There is always a risk that the project being funded may not succeed, resulting in losses for investors.

- Liquidity Risks: Crowdfunding investments are often illiquid, meaning it may be difficult to sell or cash out investments quickly.

Challenges Project Creators May Face

- Meeting Funding Goals: Project creators may struggle to reach their funding targets, which can result in the project not moving forward.

- Managing Expectations: Balancing the expectations of backers with the realities of the project’s progress can be challenging.

- Legal Compliance: Ensuring compliance with regulations and laws related to crowdfunding can be complex and time-consuming.

Tips for Investors to Mitigate Risks

- Conduct Due Diligence: Research the project, the creators, and the platform before making an investment.

- Diversify Investments: Spread out investments across different projects to reduce overall risk.

- Set Realistic Expectations: Understand that not all crowdfunding projects will succeed, and be prepared for potential losses.

- Stay Informed: Keep up-to-date on market trends and changes in regulations that may affect crowdfunding investments.