Yo, listen up! We’re diving into the world of Emergency fund planning – a key element in securing your financial future. Get ready to learn how to navigate unexpected expenses and ensure peace of mind during uncertain times.

In this guide, we’ll break down the importance of having an emergency fund, strategies for setting it up, managing and growing it, and using it wisely. So buckle up and let’s roll!

Importance of Emergency Fund Planning

Having an emergency fund is crucial for financial stability. It acts as a safety net to cover unexpected expenses that may arise, helping individuals avoid going into debt or facing financial hardship.

Examples of Unexpected Expenses

- Medical emergencies: Unexpected medical bills can quickly add up, putting a strain on finances. An emergency fund can help cover these costs without having to dip into savings or rely on credit cards.

- Car repairs: When your car breaks down unexpectedly, having funds set aside in an emergency fund can prevent financial stress and ensure you can get back on the road quickly.

- Job loss: In the event of sudden unemployment, an emergency fund can provide a buffer to cover essential expenses until a new job is secured.

Peace of Mind During Uncertain Times

An emergency fund provides peace of mind during uncertain times by offering financial security and stability. Knowing that you have funds set aside for unexpected events can reduce stress and anxiety, allowing you to focus on other aspects of your life without worrying about finances.

Setting Up an Emergency Fund

When it comes to setting up an emergency fund, there are a few key steps to consider to ensure you are prepared for unexpected financial challenges.

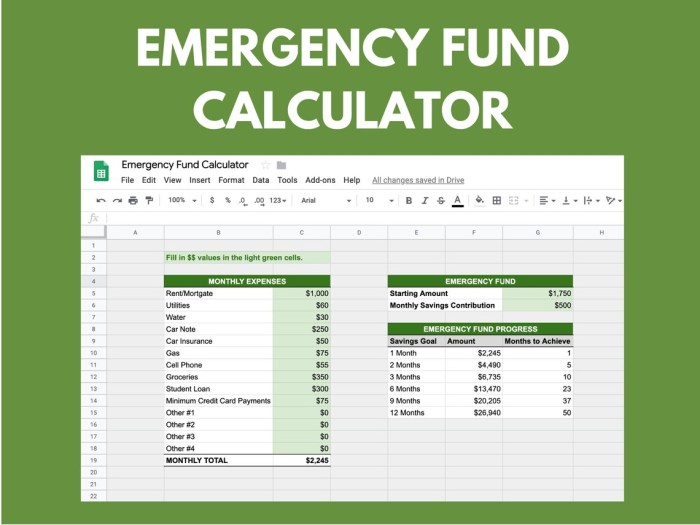

To calculate the ideal amount for an emergency fund based on monthly expenses, it is recommended to have at least 3 to 6 months’ worth of living expenses saved up. Start by adding up all your essential monthly expenses, including rent or mortgage, utilities, groceries, and any other necessary bills. Multiply this total by the number of months you want to cover to determine your target emergency fund amount.

Strategies for Saving Towards an Emergency Fund

- Automate your savings: Set up automatic transfers from your checking account to your savings account each month. This way, you won’t even have to think about saving – it will happen automatically.

- Cut expenses: Look for areas where you can reduce your spending to free up more money for your emergency fund. This could include eating out less, canceling subscription services you don’t use, or finding ways to lower your utility bills.

- Side hustle: Consider taking on a side job or freelance work to increase your income and boost your emergency fund savings faster.

Choosing the Right Type of Account for Your Emergency Fund

- Savings account: A high-yield savings account is a popular choice for an emergency fund, as it offers easy access to your money and typically earns more interest than a traditional savings account.

- Money market account: Another option is a money market account, which combines the benefits of a savings account with some of the features of an investment account, providing liquidity and potentially higher interest rates.

- Certificate of Deposit (CD): If you want to earn a higher interest rate and are willing to lock up your money for a set period, a CD could be a good choice for your emergency fund.

Managing and Growing Your Emergency Fund

Having an emergency fund is crucial, but it’s equally important to manage and grow it over time to ensure financial stability in times of need.

Periodically Reviewing and Adjusting the Emergency Fund Amount

It’s essential to review your emergency fund regularly to ensure it aligns with your current financial situation. Life changes, such as a job loss or unexpected expenses, may require adjusting the fund amount.

- Consider increasing the fund if your expenses have risen or if you have new financial responsibilities.

- Reevaluate your fund if you have paid off debts or increased your income to determine if adjustments are needed.

- Set a schedule to review and adjust your emergency fund at least once a year to keep it in line with your financial goals.

Tips on Resisting the Temptation to Dip into the Emergency Fund

It can be tempting to use your emergency fund for non-emergencies, but it’s crucial to maintain its integrity for unforeseen circumstances.

- Establish a separate savings account for non-emergency expenses to avoid dipping into your emergency fund.

- Think twice before using the fund and consider alternative solutions like budgeting or finding additional income sources.

- Remind yourself of the fund’s purpose and the peace of mind it provides in times of crisis.

Strategies for Increasing the Size of the Emergency Fund Over Time

Growing your emergency fund ensures you have enough financial cushion to handle any unexpected events that may arise.

- Set a specific savings goal to increase the fund gradually, whether it’s adding a certain amount each month or allocating windfalls to the fund.

- Automate your savings by setting up automatic transfers to your emergency fund from your paycheck or checking account.

- Cut back on unnecessary expenses and allocate those savings directly to the emergency fund to accelerate its growth.

Using the Emergency Fund Wisely

In times of financial crisis, it’s crucial to use your emergency fund wisely to avoid further financial strain. Here are some tips on how to make the most of your emergency fund:

Types of Situations to Use Emergency Funds

- Medical emergencies: Unexpected medical bills can quickly drain your savings, so using your emergency fund to cover these expenses can prevent debt accumulation.

- Job loss: If you suddenly lose your job, having an emergency fund in place can help cover your living expenses until you find a new source of income.

- Car or home repairs: When faced with unexpected repairs, tapping into your emergency fund can prevent you from going into debt to fix essential items.

Examples of Preventing Financial Hardship

When Sarah’s car broke down unexpectedly, she was able to use her emergency fund to cover the repair costs, avoiding having to take out a loan and adding to her debt.

Tips for Replenishing Your Emergency Fund

- Set a budget and prioritize saving: Allocate a portion of your income to replenishing your emergency fund after it has been used.

- Automate savings: Set up automatic transfers to your emergency fund account to ensure consistent contributions.

- Look for additional sources of income: Consider taking on a side hustle or selling unused items to boost your savings.